Get the free Third Party Limited Trading Authorization and Indemnification Form

Show details

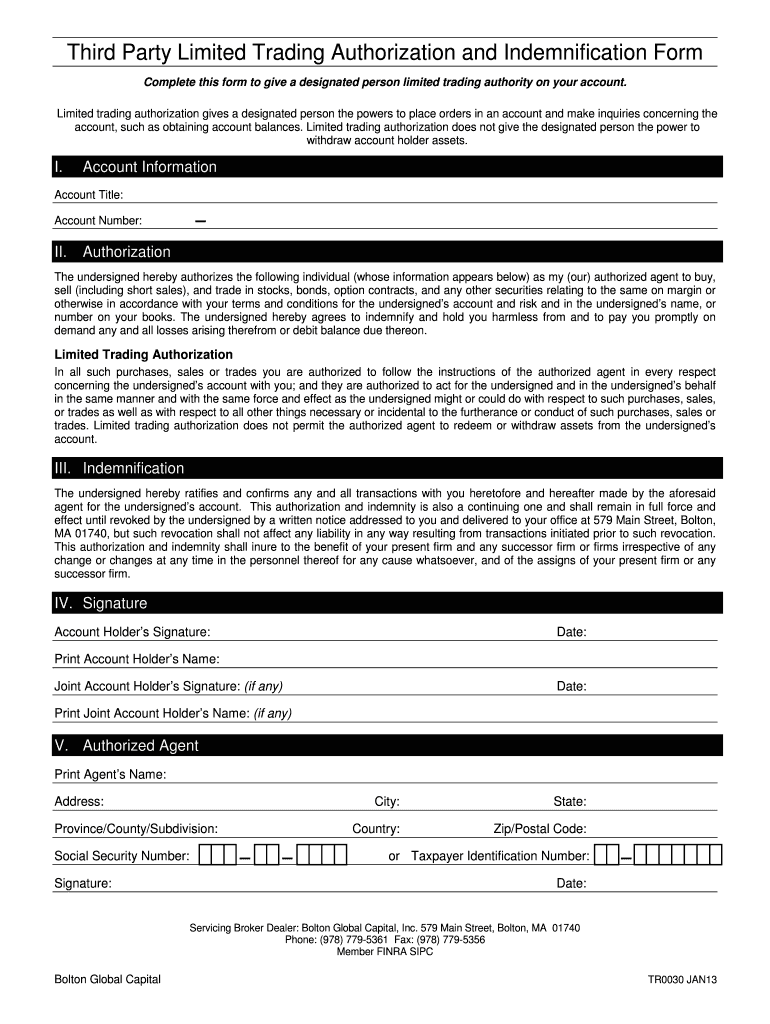

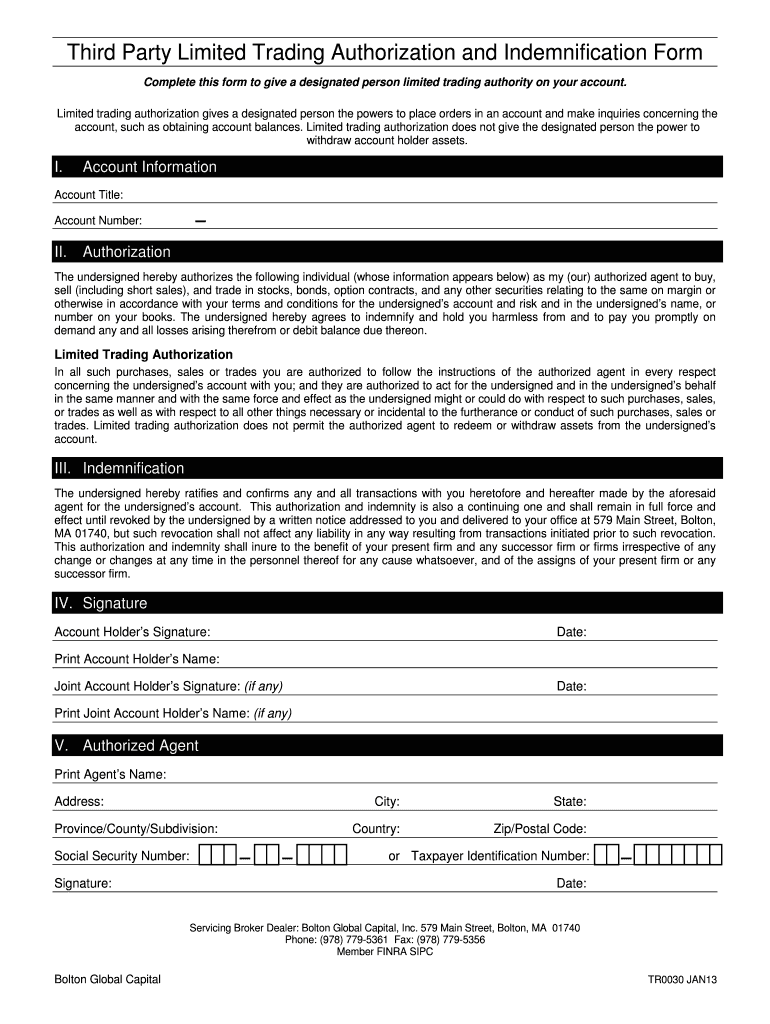

Complete this form to give a designated person limited trading authority on your account. This allows the designated individual to place orders and inquire about the account but does not permit them

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign third party limited trading

Edit your third party limited trading form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your third party limited trading form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing third party limited trading online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit third party limited trading. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out third party limited trading

How to fill out Third Party Limited Trading Authorization and Indemnification Form

01

Obtain the Third Party Limited Trading Authorization and Indemnification Form from your brokerage.

02

Fill in your personal information including name, address, and account number.

03

Provide the name and details of the third party you wish to authorize.

04

Specify the scope of the authority being granted to the third party.

05

Review the indemnification clause and ensure you understand your responsibilities.

06

Sign and date the form to validate your consent.

07

Submit the completed form to your brokerage for processing.

Who needs Third Party Limited Trading Authorization and Indemnification Form?

01

Investors who want to grant trading authority to another individual or entity.

02

Individuals who wish to allow a financial advisor or broker to trade on their behalf.

03

Account holders who are unable to manage their trading activities directly.

Fill

form

: Try Risk Free

People Also Ask about

What is third party authorization and indemnity?

Third Party Authorization and Indemnity. This form is used for an Account Owner (“I” or “We”) to grant certain authorities to another person or entity (“Agent”) specific to a brokerage account (“Account”). Agent's Relationship to Account Owner. Reason for Agent's Appointment.

What is the difference between a power of attorney and a trading authority?

How is a TA different from a Power of Attorney (POA)? A TA gives someone you choose the authority to act on your behalf in your investment account only. A General or Irrevocable Power of Attorney, on the other hand, is broader in scope.

What is the difference between full trading authority and limited trading authority?

There are two levels of trading authorizations: (1) limited trading authorization, which allows the agent to act on profitable trading opportunities but limits withdrawals, and (2) full trading authorization, which permits the agent to carry out all the account's activities available to the client.

What does trading authority authorize an individual to do?

Limited trade authorization is a level of discretionary trading authorization that gives an agent or broker the power to place orders or make inquiries concerning a client's account. Limited trading authorization allows the agent to act on behalf of an investor, but does not allow for the disbursement of account funds.

What are the four types of power of attorney?

In California, there are four main types of POAs, each offering a specific scope of decision-making power: general, durable, limited, and medical.

What can a trading authority do?

A TD Direct Investing Trading Authority (TA) is someone who has been designated to conduct trades on behalf of the account holder for the named account(s). The designated TA is only permitted to execute trades on the account; they cannot direct the movement of money in to or out of the account.

What three decisions cannot be made by a legal power of attorney?

When someone makes you the agent in their power of attorney, you cannot: Write a will for them, nor can you edit their current will. Take money directly from their bank accounts. Make decisions after the person you are representing dies. Give away your role as agent in the power of attorney.

What is a trading authorization form?

Trading authorization levels allow an investor to give certain types of access to a third party for the purpose of trading on a designated account. Trading authorization typically becomes a consideration when an individual chooses to engage with a financial professional for financial advisory services.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Third Party Limited Trading Authorization and Indemnification Form?

The Third Party Limited Trading Authorization and Indemnification Form is a document that allows an individual or entity to authorize a third party to make trading decisions on their behalf while also providing indemnification against potential losses.

Who is required to file Third Party Limited Trading Authorization and Indemnification Form?

Typically, clients or account holders who wish to allow a third party to trade on their accounts are required to file this form.

How to fill out Third Party Limited Trading Authorization and Indemnification Form?

To fill out the form, individuals need to provide their personal information, details about the third party being authorized, the scope of trading authority granted, and they may need to include signatures from both parties.

What is the purpose of Third Party Limited Trading Authorization and Indemnification Form?

The purpose of the form is to legally permit a third party to execute trades on behalf of the account holder, while also clarifying the liabilities and risks involved for both parties.

What information must be reported on Third Party Limited Trading Authorization and Indemnification Form?

The form typically requires information such as the account holder's name and account details, the name of the third party, the extent of the trading authority granted, and any specific limitations or conditions related to trading.

Fill out your third party limited trading online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Third Party Limited Trading is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.