What is BIR Form 1800?

BIR Form 1800 is known as the Donor’s Tax Return. You must submit this form in triplicate. All individuals (juridical and natural, non-residents and residents) must file this return if they transfer some property in the form of the gift (both direct and indirect). No matter if it is personal or real, you still must file this document.

What is BIR Form 1800 for?

This BIR Form 1800 is designed for reporting the transfer of the applicant’s property as a gift. If you are going to do that, get ready to prepare the form with all information.

When is BIR Form 1800 Due?

All applicants must submit this form within 1 month after the day when the donation was made. If there are several gifts made on a single date, only one return must be filed. If there are many gifts made on various dates, an applicant must file an appropriate number of returns.

Is BIR Form 1800 Accompanied by Other Documents?

Yes, there is a set of documents that must be attached to this form. You must prepare the document showing the relationship between the donor and the done, tax declaration copy, title certificate of the gift property, confirmation of valuation of other personal property types, tax debit memo, and the confirmation of claimed deductions, etc.

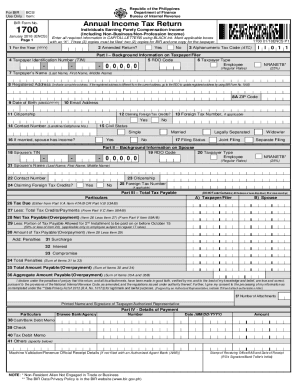

What Information do I Include in BIR Form 1800?

In the form you must indicate the date of donation, amended return, donor’MINDORO code, telephone number, donor’s name and addressdoneee’s name and address, and TIN. The form includes the part devoted to tax computation. At the bottom of the form there are payment details. There are the schedules where you must provide the description of the property. There is also a donor’s tax table.

Where do I Send BIR Form 1800?

The form must be sent to your Revenue District Office.