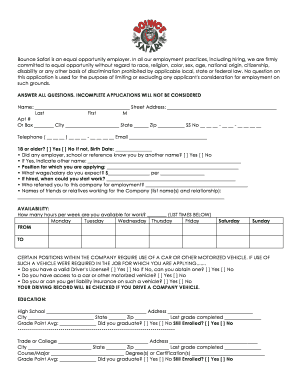

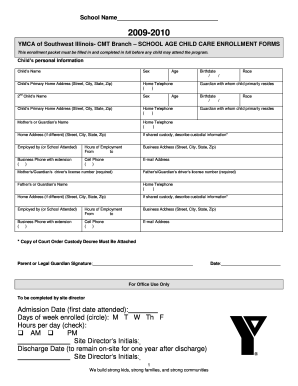

Get the free Receipt for Donated Goods

Show details

Este documento es un recibo para bienes donados a la Clínica Médica Gratuita de San Lucas, confirmando la donación de artículos o bienes sin que se proporcionen servicios o bienes a cambio. Los

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign receipt for donated goods

Edit your receipt for donated goods form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your receipt for donated goods form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing receipt for donated goods online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit receipt for donated goods. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out receipt for donated goods

How to fill out Receipt for Donated Goods

01

Obtain a blank receipt template for donated goods.

02

Write the name of the organization receiving the donation at the top.

03

Include the date of the donation.

04

Describe the items donated, including quantity and condition.

05

Assign a total estimated value for the donated goods.

06

Include the donor's full name and contact information.

07

Add a statement declaring that no goods were received in return for the donation.

08

Sign and date the receipt at the bottom.

Who needs Receipt for Donated Goods?

01

Individuals who wish to claim tax deductions for their charitable donations.

02

Non-profit organizations that require proof of donation for their records.

03

Donors seeking confirmation of their contributions for personal or organizational accounting.

Fill

form

: Try Risk Free

People Also Ask about

How do I write a donation acknowledgement?

What To Include in Donor Acknowledgement Letters Donor's name. Address the donor by name. Organization's name. Clearly state your nonprofit's name to make the letter official and avoid confusion. Donation amount and date. Type of donation. Tax information. Mission impact. Closing with gratitude. Clear Subject Line.

What is an example of a letter of receipt of donation?

Example 2: Individual Acknowledgment Letter Hi [donor name], We're super grateful for your contribution of $250 to [nonprofit's name] on [date received]. As a thank you, we sent you a T-shirt with an estimated fair market value of $25 in exchange for your contribution.

How to write a donation letter receipt?

How to create tax-compliant donation receipts Name of the organization. Donor's name. Date of the donation. Amount of cash contribution or fair market value of in-kind goods and services. Organization's 501(c)(3) status. Acknowledgment that donors didn't receive any goods or services for the donation (when applicable)

How to write a donation receipt for goods?

What's the best format for your donation receipt? The name of the organization. A statement confirming that the organization is a registered 501(c)(3) organization, along with its federal tax identification number. The date the donation was made. The donor's name. The type of contribution made (cash, goods, services)

How to write a donation acceptance letter?

What To Include in Donor Acknowledgement Letters Donor's name. Address the donor by name. Organization's name. Clearly state your nonprofit's name to make the letter official and avoid confusion. Donation amount and date. Type of donation. Tax information. Mission impact. Closing with gratitude. Clear Subject Line.

What is an example of a donor acknowledgement letter?

Dear [Donor's Name], Thank you so much for your generous donation of $[amount] on [date]. This letter is to officially acknowledge the receipt of your donation, which we have designated to support our [specific program]. Your support is vital to our efforts and makes a significant impact.

What is an example of a good donation letter?

I'm writing to ask you to support me and my [cause/project/etc.]. Just a small donation of [amount] can help me [accomplish task/reach a goal/etc.]. Your donation will go toward [describe exactly what the contribution will be used for]. [When possible, add a personal connection to tie the donor to the cause.

How do I acknowledge receipt of a donation?

What do you need to include in your donation acknowledgment letter? The donor's name. The full legal name of your organization. A declaration of your organization's tax-exempt status. Your organization's employer identification number. The date the gift was received. A description of the gift and the amount received.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

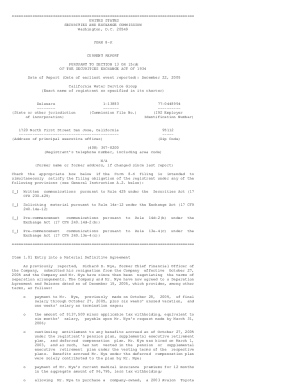

What is Receipt for Donated Goods?

A Receipt for Donated Goods is a document provided by a charity or non-profit organization to acknowledge the receipt of goods donated by an individual or entity.

Who is required to file Receipt for Donated Goods?

Typically, the donor who wishes to claim a tax deduction for their charitable contribution is required to obtain and keep a Receipt for Donated Goods.

How to fill out Receipt for Donated Goods?

To fill out a Receipt for Donated Goods, the donor should include their name, the date of the donation, a description of the goods donated, and the value of the items, while the receiving organization should provide their name and tax identification.

What is the purpose of Receipt for Donated Goods?

The purpose of a Receipt for Donated Goods is to provide verifiable proof of the donation for both the donor and the receiving organization, especially for tax reporting and auditing purposes.

What information must be reported on Receipt for Donated Goods?

The Receipt for Donated Goods must report the donor's name, the date of the donation, a detailed description of the donated items, their estimated value, and the name and tax ID of the charitable organization.

Fill out your receipt for donated goods online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Receipt For Donated Goods is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.