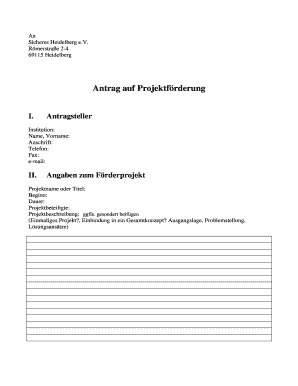

Get the free AICONS Application for Church Donation

Show details

This document outlines the terms and conditions for church organizations to qualify as donees for charitable donations from AICONS. It includes requirements for documentation, acknowledgment of donations,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign aicons application for church

Edit your aicons application for church form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your aicons application for church form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing aicons application for church online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit aicons application for church. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out aicons application for church

How to fill out AICONS Application for Church Donation

01

Gather necessary documentation, such as proof of your church's tax-exempt status.

02

Visit the AICONS website to download the application form.

03

Fill out the form with accurate and truthful information about your church.

04

Include a detailed description of the project or purpose for which you are seeking donations.

05

Provide a breakdown of the budget for the proposed project.

06

Ensure that all required signatures and endorsements are obtained before submitting.

07

Review the application for completeness and clarity.

08

Submit the application via the specified method (online submission, mail, etc.) by the deadline.

Who needs AICONS Application for Church Donation?

01

Churches seeking financial support for community projects or outreach programs.

02

Non-profit religious organizations looking for funding assistance.

03

Church leaders and administrators involved in managing donations and funding.

Fill

form

: Try Risk Free

People Also Ask about

What are the IRS rules for church donations?

The total of your church cash donations plus all other charitable contributions you make during the year typically can't exceed 60% of your adjusted gross income (AGI). However, the amounts you can't deduct this year can be deducted on one of your next five tax returns.

What is an example of a good donation letter?

I'm writing to ask you to support me and my [cause/project/etc.]. Just a small donation of [amount] can help me [accomplish task/reach a goal/etc.]. Your donation will go toward [describe exactly what the contribution will be used for]. [When possible, add a personal connection to tie the donor to the cause.

How do I write an application for donations?

How do you write a fundraising letter? Key steps Start with a personalized greeting. Explain your mission. Describe your current initiative. Outline your project's needs and what you hope to accomplish. Add meaningful photographs or infographics. Show the tangible impact associated with specific donation amounts.

How to write a donation request letter for church?

How Do You Write A Church Donation Letter? The salutation. Like any letter, start off with a greeting. The value of your congregants' support. The donation request. Call-to-action. Statement of gratitude. A closing.

What is the difference between form 8282 and 8283?

Form 8282 vs. Form 8283: What's the Difference? While Form 8283 is for donors to complete, Form 8282 is the responsibility of the “donee organization” (i.e. the charity receiving the donation). The Giving Block also helps nonprofits complete Form 8282 for accurate reporting of cryptocurrency donations.

How do I prove church donations?

For contributions of cash, check, or other monetary gift (regardless of amount), you must maintain a record of the contribution: a bank record or a written communication from the qualified organization containing the name of the organization, the amount, and the date of the contribution.

What form do you use for church donations?

If you donate $500 or more, keep a detailed listing of items and complete Form 8283. If you donate a motor vehicle, obtain Form 1098-C from the organization.

What tax form do I use for church donation?

For in-kind or other non-cash donations Donors that give in-kind or non-cash gifts can also deduct their contributions from their taxes. Donors donating a non-cash item or group of non-cash items valued over $500 must file Form 8283 with their taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is AICONS Application for Church Donation?

AICONS Application for Church Donation is a digital platform or form used by churches to manage and report donations made to them, ensuring compliance with tax regulations and facilitating a transparent record of contributions.

Who is required to file AICONS Application for Church Donation?

Churches and religious organizations that receive donations and want to maintain compliance with tax regulations are required to file the AICONS Application for Church Donation.

How to fill out AICONS Application for Church Donation?

To fill out the AICONS Application for Church Donation, users must provide details such as the church's name, address, tax identification number, and a record of all donations received, including donor information and amounts.

What is the purpose of AICONS Application for Church Donation?

The purpose of the AICONS Application for Church Donation is to provide a standardized method for churches to record and report donations, ensuring accountability and compliance with financial regulations regarding charitable contributions.

What information must be reported on AICONS Application for Church Donation?

The AICONS Application for Church Donation must report information such as the total amount of donations received, donor names and addresses, the date of the donations, and the intended purpose of the funds (if applicable).

Fill out your aicons application for church online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Aicons Application For Church is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.