Get the free Notice SURE-23 - fsa usda

Show details

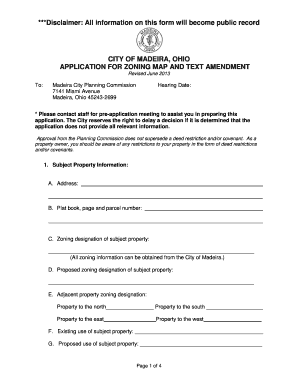

This notice provides information on the closing process for the 2008 SURE program, including final RMA download dates, actions required by State and County Offices, and guidelines for handling discrepancies

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign notice sure-23 - fsa

Edit your notice sure-23 - fsa form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your notice sure-23 - fsa form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing notice sure-23 - fsa online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit notice sure-23 - fsa. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out notice sure-23 - fsa

How to fill out Notice SURE-23

01

Gather relevant personal information such as your name, address, and contact details.

02

Ensure you have your tax identification number (TIN) or Social Security Number (SSN) available.

03

Review the instructions provided with the SURE-23 form to understand the requirements.

04

Complete each section of the form, providing accurate information as requested.

05

If applicable, attach any necessary documentation or evidence to support your claim.

06

Double-check all entries for accuracy and completeness.

07

Sign and date the form before submission.

08

Submit the form electronically or by mail, depending on the guidelines provided.

Who needs Notice SURE-23?

01

Individuals or businesses seeking relief under the specific program associated with Notice SURE-23.

02

Taxpayers who need to claim certain benefits or exemptions as outlined in the notice.

Fill

form

: Try Risk Free

People Also Ask about

What is the Surah 23 in the Quran?

Al-Muʼminun (Arabic: المؤمنون, al-muʼminūn; meaning: "The Believers") is the 23rd chapter (sūrah) of the Qur'an with 118 verses (āyāt).

What is 23 1 in the Quran?

Success is really attained by the believers - 23:1. The word falah (translated above as 'success' ) has been used in the Qur'an and Sunnah on numerous occasions. The call to prayers invites every Muslim towards falah five times a day.

What is the 23 Juz of the Quran?

The 23rd Juz covers the last 55 verses of Surah Yaseen, Surah As-Saffat, Surah Saad and first 31 verses of Surah- Az-Zumar. This Juz reflects on the beauty, depth and sheer awe the Quran presents to a point that staunch enemies of Islam secretly listening were enamored by it.

What does Quran 24 23 says?

Therefore, it is obvious that this verse (24:23) is aimed at those who were involved in slandering Sayyidah ` A'ishah ؓ and did not repent, so much so that even after the revelation of her exoneration in the Qur'an they adhered to their malicious accusation and kept on propagating it.

What is the meaning of Al Mu Minun?

Al-Muʼminun (Arabic: المؤمنون, al-muʼminūn; meaning: "The Believers") is the 23rd chapter (sūrah) of the Qur'an with 118 verses (āyāt).

What is the verse 23 of surah Al Mu Minun?

(23:23) We sent Noah to his people,24 and he said: "My people! Serve Allah; you have no deity other than He. Do you have no fear?"25 (23:24) But the notables among his people had refused to believe, and said: "This is none other than a mortal like yourselves26 who desires to attain superiority over you.

What is the Quran verse 23 111?

(23:111) Lo! I have rewarded them this Day for their steadfastness, so that they, and they alone, are triumphant.”

What is the meaning of Surah Mu minun Ayat 6?

The verse emphasizes the importance of humility, sincerity, and steadfastness in prayer. Allah says, "Except those who are humble in their prayers." This indicates that those who approach prayer with humility, reverence, and sincerity will be granted success and acceptance in their supplications.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Notice SURE-23?

Notice SURE-23 is a notification form used to report specific information regarding certain tax credits and incentives to the relevant tax authorities.

Who is required to file Notice SURE-23?

Individuals or businesses that are claiming specific tax credits or incentives as per the guidelines outlined by the tax authority are required to file Notice SURE-23.

How to fill out Notice SURE-23?

To fill out Notice SURE-23, gather all necessary documentation regarding the tax credits being claimed, complete the form with accurate information, and submit it to the appropriate tax authority as instructed.

What is the purpose of Notice SURE-23?

The purpose of Notice SURE-23 is to ensure compliance with tax regulations by allowing the tax authority to track claims for specific tax incentives and verify the information provided by taxpayers.

What information must be reported on Notice SURE-23?

The information required on Notice SURE-23 typically includes taxpayer identification details, the specific tax credits being claimed, relevant financial data, and any supporting documentation that substantiates the claims.

Fill out your notice sure-23 - fsa online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Notice Sure-23 - Fsa is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.