Get the free APPLICATION FOR CERTIFICATE OF SUBORDINATION OF KENTUCKY DEPARTMENT OF REVENUE LIEN

Show details

This document serves as an application to request a certificate of subordination for liens held by the Kentucky Department of Revenue. It requires detailed information regarding the applicants, the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for certificate of

Edit your application for certificate of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for certificate of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for certificate of online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit application for certificate of. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for certificate of

How to fill out APPLICATION FOR CERTIFICATE OF SUBORDINATION OF KENTUCKY DEPARTMENT OF REVENUE LIEN

01

Obtain the APPLICATION FOR CERTIFICATE OF SUBORDINATION form from the Kentucky Department of Revenue website or office.

02

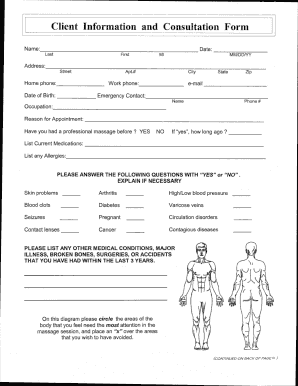

Fill in the applicant's name and contact information at the top of the form.

03

Provide details of the lien that is being subordinated, including the lienholder's name and the address of the property involved.

04

Clearly state the reasons for requesting the subordination of the lien.

05

Include any supporting documentation that may be required, such as financial statements or agreements.

06

Sign and date the application form.

07

Submit the completed application along with any required fees to the appropriate department.

Who needs APPLICATION FOR CERTIFICATE OF SUBORDINATION OF KENTUCKY DEPARTMENT OF REVENUE LIEN?

01

Individuals or businesses looking to refinance their existing debts.

02

Anyone needing to subordinate a lien for property transactions.

03

Creditors or lenders requiring the subordination to approve new financing.

Fill

form

: Try Risk Free

People Also Ask about

What is application for lien subordination?

Overview. The Notice of Federal Tax Lien (NFTL) can stop or delay refinancing of home mortgages, other loans, or third-party collection of business accounts receivable. Applying for a Certificate of Subordination of the NFTL can move a bank's claim to property ahead of the IRS's claim.

Can you subordinate a tax lien?

Are you selling, refinancing, or using your property as collateral for a loan that will not fully pay your tax debt? If so, you can apply for a lien subordination.

What is a lien subordination?

Lien subordination refers to the order in which claims on collateral are prioritized. This takes place most often among senior secured lenders and does not imply that one tranche of senior debt has payment preference over another.

How do I get around a tax lien?

You can avoid a federal tax lien by simply filing and paying all your taxes in full and on time. If you can't file or pay on time, don't ignore the letters or correspondence you get from the IRS. If you can't pay the full amount you owe, payment options are available to help you settle your tax debt over time.

Can IRS liens be negotiated?

An offer in compromise allows you to settle your tax debt for less than the full amount you owe. It may be a legitimate option if you can't pay your full tax liability or doing so creates a financial hardship. We consider your unique set of facts and circumstances: Ability to pay.

What is a certificate of subordination?

Certificate of Subordination of Federal Tax Lien. A Certificate of Subordination under Internal Revenue Code Section 6325(d)(1) and 6325(d)(2) allows a named creditor to move their junior creditor position ahead of the United States' position for the property named in the certificate.

How long do tax liens last in Colorado?

All tax lien certificates expire 15 years after the date of sale. No deed can be issued after the certificate has expired. A Treasurer's Deed may be applied for three years after the date of the auction, if the property remains unredeemed.

What is a lien subordination?

Lien subordination refers to the order in which claims on collateral are prioritized. This takes place most often among senior secured lenders and does not imply that one tranche of senior debt has payment preference over another.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APPLICATION FOR CERTIFICATE OF SUBORDINATION OF KENTUCKY DEPARTMENT OF REVENUE LIEN?

The APPLICATION FOR CERTIFICATE OF SUBORDINATION OF KENTUCKY DEPARTMENT OF REVENUE LIEN is a legal document that requests the subordination of a tax lien held by the Kentucky Department of Revenue to allow for other entities, such as lenders, to take priority in claims against a property.

Who is required to file APPLICATION FOR CERTIFICATE OF SUBORDINATION OF KENTUCKY DEPARTMENT OF REVENUE LIEN?

The application must be filed by individuals or entities who hold a mortgage or other lien against a property on which there is an existing Kentucky Department of Revenue tax lien and seek to establish their lien as having priority over the tax lien.

How to fill out APPLICATION FOR CERTIFICATE OF SUBORDINATION OF KENTUCKY DEPARTMENT OF REVENUE LIEN?

To fill out the application, gather all pertinent details including the property description, the amount of the debt secured by your lien, the nature of your lien, and the specific reasons for seeking subordination. Complete the form accurately and provide any required documentation before submission.

What is the purpose of APPLICATION FOR CERTIFICATE OF SUBORDINATION OF KENTUCKY DEPARTMENT OF REVENUE LIEN?

The purpose of the application is to facilitate financing or refinancing of properties by allowing other liens to take precedence over existing tax liens, thereby enabling property owners to secure loans or investments.

What information must be reported on APPLICATION FOR CERTIFICATE OF SUBORDINATION OF KENTUCKY DEPARTMENT OF REVENUE LIEN?

The application requires information such as the applicant's name, contact information, details of the existing lien, the legal description of the property, the amount of the debt secured, and any supporting documents that demonstrate the necessity for subordination.

Fill out your application for certificate of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Certificate Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.