USAA 105314 2011-2025 free printable template

Show details

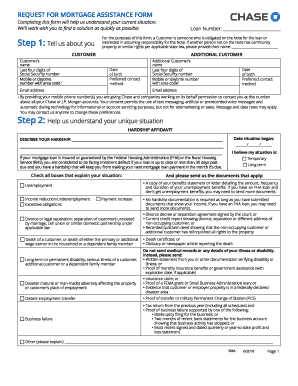

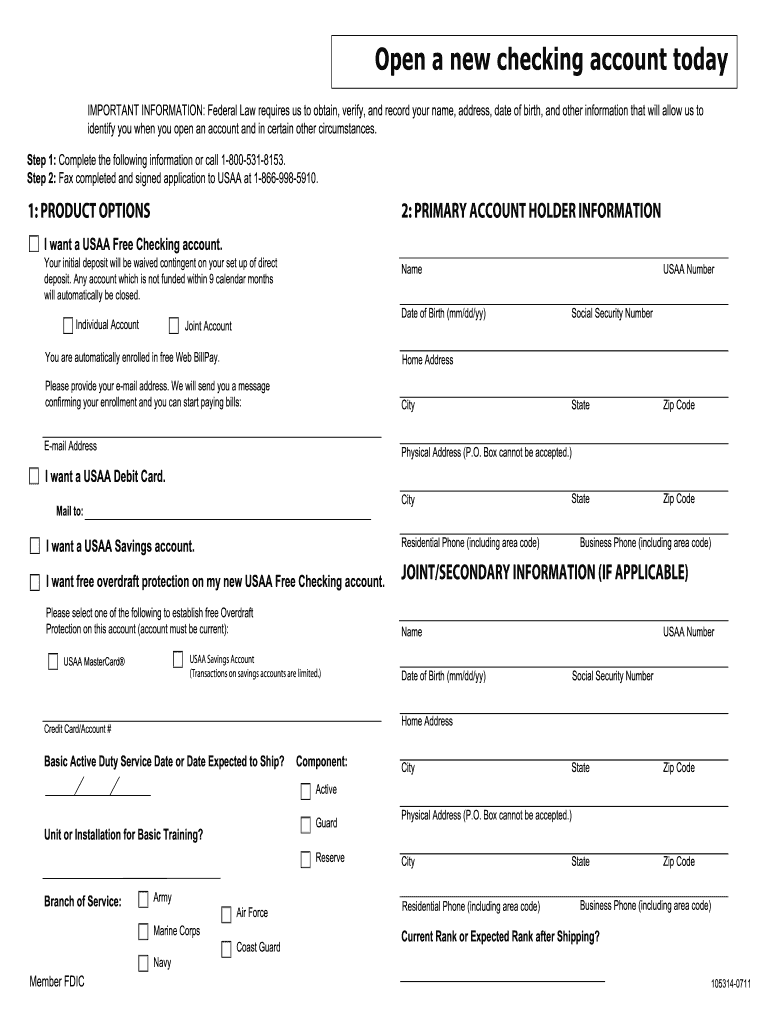

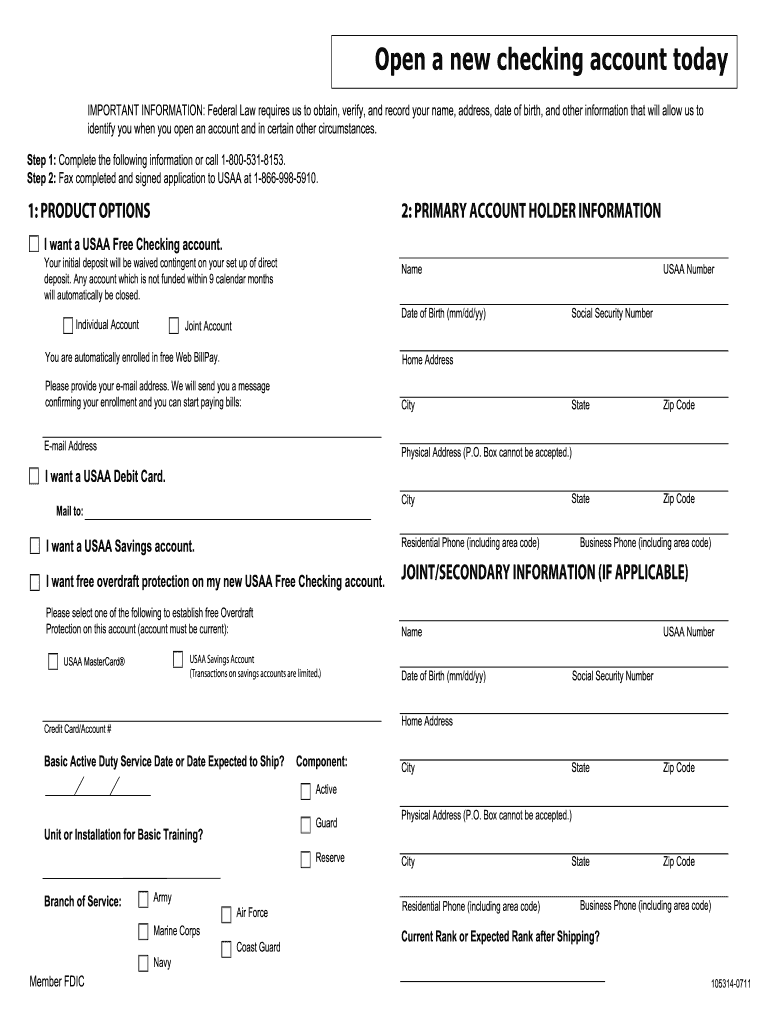

Open a new checking account today IMPORTANT INFORMATION: Federal Law requires us to obtain, verify, and record your name, address, date of birth, and other information that will allow us to identify

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign sample bank application

Edit your sample bank application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sample bank application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sample bank application online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit sample bank application. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

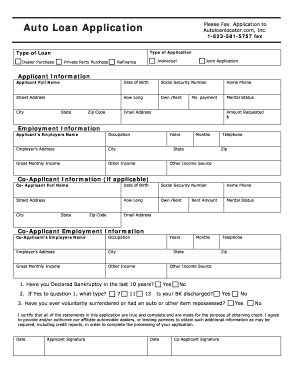

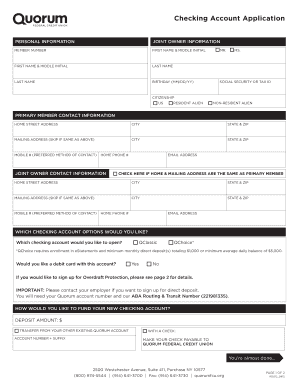

How to fill out sample bank application

How to fill out a checking account application form:

01

Start by carefully reading all instructions and information provided on the form.

02

Fill in your personal information accurately, including your full name, date of birth, address, and contact details.

03

Provide your social security number or taxpayer identification number as required.

04

Indicate the type of account you want to open, such as individual or joint account.

05

Select the features you desire for your account, such as overdraft protection or online banking services.

06

Enter your employment status, including your current employer's name, address, and contact information.

07

If applicable, provide information about any other account(s) you have with the same bank or any previous banking history.

08

Review the terms and conditions carefully. If you have any questions, seek clarification from a bank representative.

09

Sign and date the application form, certifying that all the information provided is true and accurate.

10

Submit the completed application form along with any necessary identification documents, such as a driver's license or passport.

Who needs a checking account application form:

01

Individuals who do not currently have a checking account and wish to open one.

02

People who want to switch to a new bank and need to open a checking account with that bank.

03

Those who require a joint checking account with another person, such as a spouse or business partner.

04

Individuals who want to take advantage of the various benefits and services offered by a checking account, such as direct deposit or online bill payments.

05

Students or young adults who are looking to establish their own banking relationship and learn financial management skills.

06

People who intend to use a checking account for everyday financial transactions, such as depositing paychecks and making payments.

Fill

form

: Try Risk Free

People Also Ask about

Do you need a completed application to open a checking account?

Opening a bank account is a straightforward process that requires you to complete an application, verify your identity, provide some basic information about yourself and fund your account. In most cases you can apply for a checking account either online or at one of your financial institution's local branches.

How do I open a checking account at a bank?

What you need to open a bank account A valid, government-issued photo ID, such as a driver's license or a passport. Other basic information, such as your birthdate, Social Security number or Taxpayer Identification Number, or phone number. An initial deposit is required by some banks, too.

What are the 4 types of checking accounts?

Types of checking accounts Traditional checking account. These normally offer checks, a debit or ATM card and online bill pay options. Student checking account. Senior checking account. Interest-bearing account. Business checking account. Checkless checking. Rewards checking. Private bank checking.

What are the 4 types of accounts?

4 Most Common Types of Bank Accounts Checking Account. The most basic type of bank account is the checking account. Savings Account. A checking account and savings account go together like Batman and Robin. Money Market Deposit Account. Certificate of Deposit (CD)

What do I need to open a checking account?

What you need to open a checking account Your Social Security number. A valid, government-issued photo ID like a driver's license, passport or state or military ID. A minimum opening deposit of $25 to activate your account (once you've been approved).

What are the 4 checking accounts?

What are the different types of checking accounts? Some of the different types of checking accounts are regular (basic) checking accounts, premium checking accounts, student checking accounts, senior checking accounts, interest-bearing accounts, business checking accounts, and rewards checking accounts.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in sample bank application?

With pdfFiller, it's easy to make changes. Open your sample bank application in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How can I edit sample bank application on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing sample bank application.

How do I complete sample bank application on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your sample bank application. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is USAA 105314?

USAA 105314 is a specific form used by USAA (United Services Automobile Association) to process certain types of requests or claims, primarily related to insurance and financial services for military members and their families.

Who is required to file USAA 105314?

Individuals who are USAA members and need to submit a claim or request related to their insurance or financial products are typically required to file USAA 105314.

How to fill out USAA 105314?

To fill out USAA 105314, gather all necessary information related to your claim or request, carefully read the instructions provided on the form, and provide accurate details in each designated field before submitting it to USAA.

What is the purpose of USAA 105314?

The purpose of USAA 105314 is to allow members to formally submit requests or claims for benefits, ensuring that necessary information is collected to process claims efficiently.

What information must be reported on USAA 105314?

On USAA 105314, members must report personal identification information, details about the claim or request, and any relevant supporting documentation that pertains to the claim.

Fill out your sample bank application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sample Bank Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.