Get the free bank account form

Show details

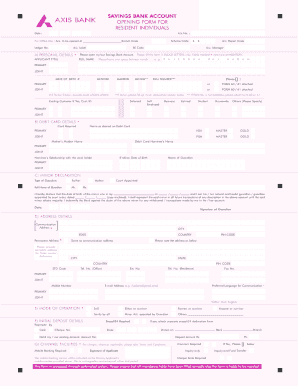

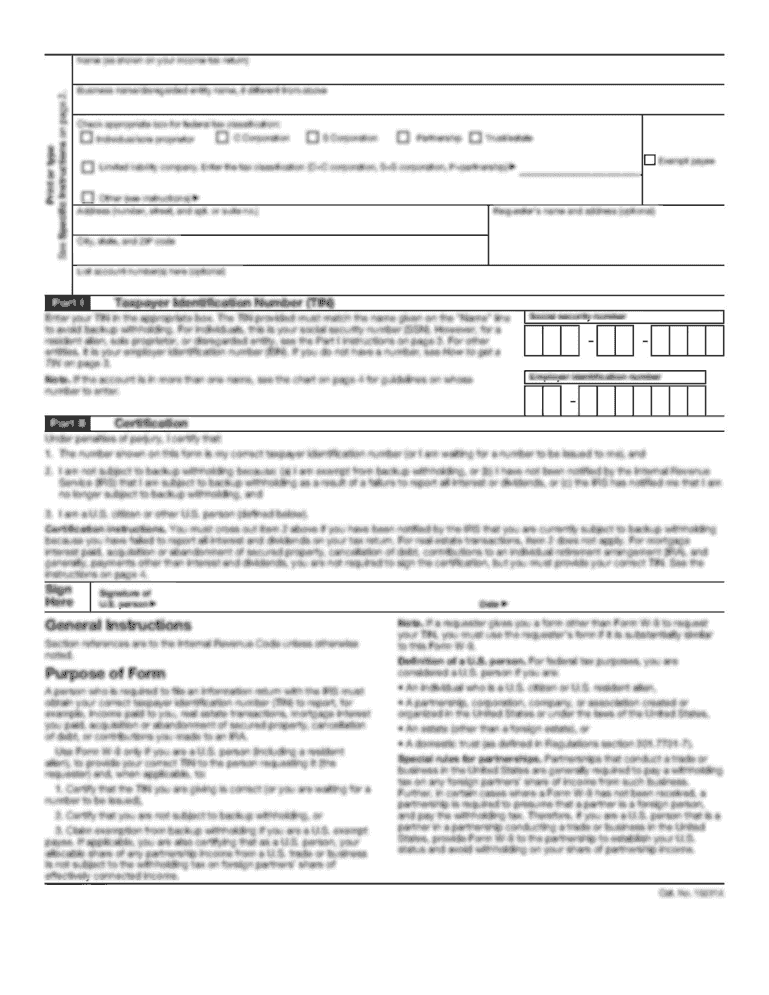

SAVINGS BANK ACCOUNT OPENING FORM Small/FI/No Frill/Normal Individual Accounts (For Bank Use Only) Name of Branch IGA Affix Passport size Photo CBS an Eco-friendly Bank Must ID A/C No. 1. Name in

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your bank account form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bank account form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit bank account form online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit bank account application form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out bank account form

To fill out a bank account form, follow these steps:

01

Gather your personal identification documents such as your passport, driver's license, or ID card.

02

Visit your chosen bank's website or go to a nearby branch to obtain the account opening form.

03

Fill in your personal information accurately, including your full name, address, date of birth, and contact details.

04

Provide your Social Security number or equivalent identification number if required.

05

Select the type of account you wish to open, whether it's a checking account, savings account, or any other specific account offered by the bank.

06

If there are any additional services or features you want to add to your account, indicate them on the form. For example, you might want an ATM card or online banking access.

07

Review the form to ensure all information is correctly entered and that you haven't missed any required fields.

08

If necessary, have a bank representative or employee assist you in completing the form or clarifying any doubts you may have.

09

Once you are satisfied with the accuracy of the information, sign and date the form.

9.1

The bank account form is required by individuals who wish to open a new bank account. This includes:

10

Individuals who do not have an existing bank account and want to establish a banking relationship.

11

Those who want to open a joint account with another person, such as a spouse or family member.

12

Students who are starting college and need a student bank account.

13

Business owners or entrepreneurs who want to open a business bank account for their company.

14

Individuals who have moved to a new country or city and need to open a local bank account for managing their finances.

15

Anyone who wants to switch banks and needs to open a new account with a different financial institution.

It is essential to have a bank account for various reasons, such as receiving salaries, making payments, saving money, and accessing financial services provided by the bank.

Fill savings bank account opening form : Try Risk Free

People Also Ask about bank account form

How do I make a bank account document?

Why do we need bank account forms?

Can I create a bank account online?

What is a bank account form?

What is an account form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is bank account form?

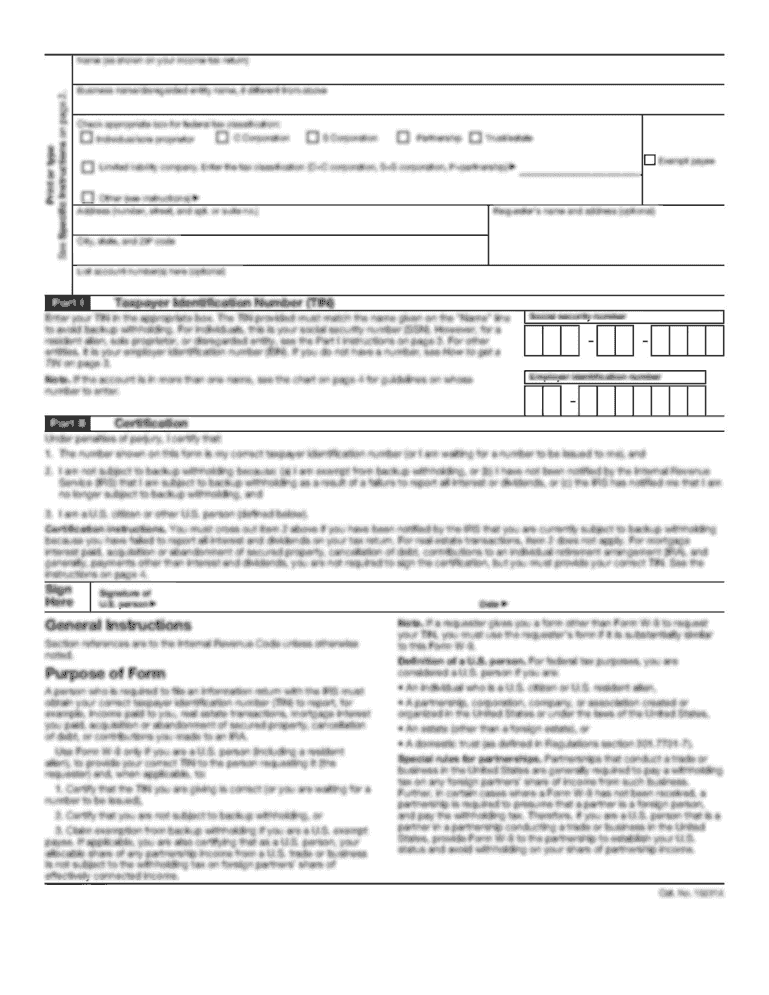

A bank account form is a document or application provided by a bank that individuals need to fill out in order to open a new bank account. It typically requires personal information such as name, contact details, date of birth, social security number or tax identification number, and proof of identity and address. The form may also ask for specific details about the type of account being opened, such as checking or savings, and may require a signature for consent to the bank's terms and conditions.

Who is required to file bank account form?

The individuals or entities required to file a bank account form may vary depending on the specific jurisdiction and the purpose of the form. In general, it is typically required for the following:

1. Individuals or businesses opening a new bank account: When opening a new bank account, individuals or businesses are often required to fill out a bank account form provided by the bank. This form collects information such as the account holder's name, address, contact details, Social Security number (or equivalent), and other relevant identifying information.

2. Individuals or businesses applying for a loan or credit: Lenders or financial institutions may require individuals or businesses seeking a loan or credit to fill out a bank account form. This form typically requests details about the applicant's bank account(s) to assess their financial stability and ability to repay the loan or credit.

3. Government agencies or tax authorities: Government agencies or tax authorities may require individuals or businesses to file bank account forms for various reasons. These forms can help authorities monitor financial transactions, assess tax liability, prevent money laundering, track illegal activities, etc.

It is important to consult the specific regulations and requirements of the relevant jurisdiction to determine who exactly is obligated to file a bank account form in a particular context.

How to fill out bank account form?

Filling out a bank account form is relatively straightforward. Here are the steps you can follow:

1. Obtain the bank account form: Typically, you'll find these forms on the bank's website or at the banking branch. You may also request a form from a bank representative.

2. Personal Information: Begin by entering your personal information, including your full name, date of birth, residential address, phone number, and email address. Some forms may also require you to provide your nationality, social security number, or passport details.

3. Account Type: Select the type of bank account you wish to open, such as checking account, savings account, or a combination of both. Ensure you understand the features and requirements of each type before making a decision.

4. Joint Account or Individual Account: Indicate whether you are opening an individual account or a joint account. Joint accounts are typically opened with a spouse, family member, or business partner.

5. Identification Information: In this section, you will need to provide proof of identification. Commonly accepted forms of identification include a driver's license, passport, social security card, or national ID.

6. Initial Deposit: Specify the amount you wish to deposit when opening the account. Some banks may have minimum deposit requirements, while others may not require any initial deposit.

7. Maintenance Fees and Service Options: Review the fees and services associated with the account type you selected. Many banks offer various account options, each with its own fee structure and additional services. Choose the options that align with your banking needs.

8. Signature: Sign and date the application form. Your signature verifies that all the information provided is true and accurate.

9. Attach Supporting Documents: If required, attach any supporting documents requested by the bank. This may include income verification, proof of address, or employment information. Make sure to include copies of the original documents, not the originals themselves.

10. Submitting the Form: Once you have completed the form, double-check that all the information is accurate and complete. Submit the form to the bank, either by visiting the branch in person, mailing it to a specified address, or submitting it online if available.

It's always a good idea to contact the bank for any specific guidance or requirements they may have while filling out the form.

What is the purpose of bank account form?

The purpose of a bank account form is to provide a structured format for individuals or businesses to open a bank account. It collects essential information from the account holder, such as their name, contact details, identification, social security number (or equivalent), and other necessary details required by the bank. The form serves as an application for a new bank account and helps the bank verify and authenticate the identity of the account holder, as well as comply with legal and regulatory requirements.

What information must be reported on bank account form?

The information that must be reported on a bank account form typically includes:

1. Personal Information: This includes the full name, date of birth, social security number, and contact information (address, phone number, and email) of the account holder.

2. Identification Documents: Usually, a copy of a valid government-issued ID, such as a passport or driver's license, is required.

3. Employment Information: This includes the current employer's name, address, and contact details.

4. Financial Information: This may include details about the source of funds and the purpose of the account, such as whether it is for personal or business use, or if it is for saving or checking purposes.

5. Previous Banking History: Some forms may require information about the account holder's previous banking relationship, including banking history, account numbers, and any outstanding debts or loans.

6. Beneficiary Information: If applicable, the form may ask for the name, address, and contact details of any beneficiary or joint account holder.

7. Signature: The account holder is usually required to sign the form to confirm the accuracy of the provided information and consent to the bank's terms and conditions.

It is important to note that the specific requirements may vary between different banks and countries, so it is advisable to consult the bank or financial institution's official website or contact their customer service for the exact information needed on their account form.

What is the penalty for the late filing of bank account form?

The penalty for the late filing of a bank account form may vary depending on the jurisdiction and specific regulations in place. In some cases, it could involve monetary fines or penalties, while in others, it may result in legal repercussions or additional reporting requirements. It is recommended to refer to the relevant banking and financial authorities or consult with a legal professional to determine the specific penalty for late filing in a particular context.

How can I get bank account form?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the bank account application form in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I fill out the bank account opening form form on my smartphone?

Use the pdfFiller mobile app to fill out and sign saving account form. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How do I fill out new bank account form on an Android device?

On Android, use the pdfFiller mobile app to finish your bank account form. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

Fill out your bank account form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bank Account Opening Form is not the form you're looking for?Search for another form here.

Keywords relevant to application for opening savings bank account form

Related to bank account form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.