Get the free Payment Error Rate Measurement Program - cms

Show details

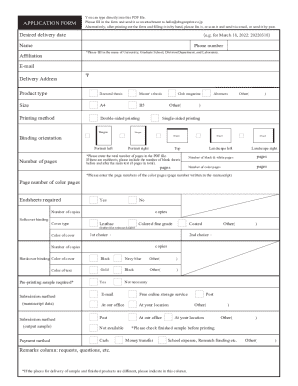

This document outlines the procedures for states to submit claims data for the Medicaid Payment Error Rate Measurement (PERM) project. It provides detailed instructions on sampling methods, data requirements,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign payment error rate measurement

Edit your payment error rate measurement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your payment error rate measurement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit payment error rate measurement online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit payment error rate measurement. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out payment error rate measurement

How to fill out Payment Error Rate Measurement Program

01

Step 1: Gather all relevant payment data for the specified period.

02

Step 2: Identify and categorize payment errors as defined by the program guidelines.

03

Step 3: Calculate the total number of payment transactions in the designated period.

04

Step 4: Calculate the total number of payment errors identified.

05

Step 5: Use the formula (Total Payment Errors / Total Payment Transactions) * 100 to determine the Payment Error Rate.

06

Step 6: Document all findings and prepare a report for submission.

Who needs Payment Error Rate Measurement Program?

01

Businesses processing payments on a regular basis.

02

Financial institutions monitoring the accuracy of transactions.

03

Compliance and audit teams within organizations.

04

Regulatory bodies requiring adherence to payment standards.

Fill

form

: Try Risk Free

People Also Ask about

Which program measures improper payments in the Medicaid program and the children's Health Insurance Program chip?

As a result, CMS developed the PERM program to comply with the PIIA and related guidance issued by OMB. The PERM program measures improper payments in Medicaid and CHIP and produces improper payment rates for each program.

Which program complements the children's Health Insurance Program chip )?

The Children's Health Insurance Program (CHIP) Each state offers CHIP coverage and works closely with its state Medicaid program.

How do you calculate payment error rate?

How to Calculate the Transaction Error Rate. To formulate the transaction error rate, add up all transaction-related errors in a reporting period and divide them by the total number of transactions completed within the same reporting period.

What is the error rate for Medicare payments?

The Medicare Fee-for-Service (FFS) estimated improper payment rate was 7.66%, or $31.70 billion, marking the eighth consecutive year this figure has been below the 10% threshold for compliance established by improper payment statutory requirements.

What was the children's health insurance program chip established in 1997 for low income children?

The Children's Health Insurance Program (CHIP) was established with bipartisan Congressional support in 1997 to provide coverage for uninsured children who are low-income, but above the cut-off for Medicaid eligibility.

What is the payment error prevention program?

Payment Error Prevention Program (PEPP) Projects. --PEPP involves issues of unacceptable claims for reimbursement. A provider may not decline interest in conforming to standards of appropriate, reasonable, and medically necessary care.

What is the agency responsible for managing Medicare Medicaid and the children's health insurance program?

CMS is the federal agency that provides health coverage to more than 160 million through Medicare, Medicaid, the Children's Health Insurance Program, and the Health Insurance Marketplace.

Which program measures improper payments in the Medicaid program and the Children's Health Insurance Program (CHIP)?

Payment Error Rate Measurement Program (PERM) The PERM program measures improper payments in Medicaid and Children's Health Insurance Program (CHIP) and produces improper payment rates for each program.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Payment Error Rate Measurement Program?

The Payment Error Rate Measurement (PERM) Program is a system used to assess the accuracy of payments made under various government programs, primarily aimed at identifying erroneous payments.

Who is required to file Payment Error Rate Measurement Program?

States that administer Medicaid and the Children's Health Insurance Program (CHIP) are required to file under the Payment Error Rate Measurement Program.

How to fill out Payment Error Rate Measurement Program?

To fill out the Payment Error Rate Measurement Program, states must collect data on payment accuracy, conduct reviews of sampled claims, and report the findings in a specified format.

What is the purpose of Payment Error Rate Measurement Program?

The purpose of the Payment Error Rate Measurement Program is to measure and improve payment accuracy, reduce improper payments, and ensure accountability in government spending.

What information must be reported on Payment Error Rate Measurement Program?

States must report information such as the number of claims reviewed, the number of errors identified, the reasons for errors, and the error rates calculated for Medicaid and CHIP.

Fill out your payment error rate measurement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Payment Error Rate Measurement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.