Get the free Application for Early Withdrawal of Pension Funds

Show details

Form to apply for an early withdrawal of funds from the pension plan for various purposes such as purchasing residential property or paying off a mortgage, including relevant requirements and acknowledgements.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for early withdrawal

Edit your application for early withdrawal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for early withdrawal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application for early withdrawal online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit application for early withdrawal. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for early withdrawal

How to fill out Application for Early Withdrawal of Pension Funds

01

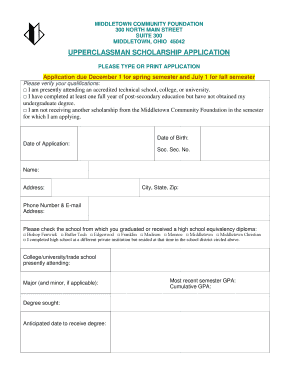

Obtain the Application for Early Withdrawal of Pension Funds form from your pension provider or their website.

02

Fill out your personal details, including your name, address, and contact information.

03

Provide your pension account number and any other identification necessary for processing.

04

Specify the amount you wish to withdraw from your pension funds.

05

Indicate the reason for the early withdrawal, such as financial hardship or medical expenses.

06

Attach any required documentation to support your reasons for the withdrawal.

07

Review the form for accuracy and completeness.

08

Sign and date the application.

09

Submit the application via the method specified by your pension provider, which may include mailing, faxing, or submitting online.

Who needs Application for Early Withdrawal of Pension Funds?

01

Individuals facing financial difficulties who need immediate access to funds.

02

Participants in a pension plan seeking to withdraw funds before retirement age.

03

Those dealing with unexpected medical expenses or emergencies.

04

People looking to consolidate debt through their pension funds.

Fill

form

: Try Risk Free

People Also Ask about

Can I take money out of my pension?

A retirement plan may, but is not required to, provide for hardship distributions. Many plans that provide for elective deferrals provide for hardship distributions. Thus, 401(k) plans, 403(b) plans, and 457(b) plans may permit hardship distributions.

Can you take an early withdrawal from a pension plan?

If your plan permits hardship withdrawals, you may be required to provide documentation to support your need for the funds. Some examples are medical bills, invoices from a college or university, and bank statements. The IRS may require that you provide proof that you don't have liquid assets to cover your expenses.

Can I withdraw my people's pension early?

Normally you can only access your pension before your normal minimum pension age if you're in ill health. Be careful if you're offered early access to your pension pot as these offers are generally scams designed to fool you into transferring your pot into bogus schemes.

What documents do I need for hardship withdrawal?

You may be able to avoid a penalty if your withdrawal is for: First-time home purchase. Some types of home purchases are eligible. Educational expenses. Disability or death. Medical expenses. Birth or adoption expenses. Health insurance. Periodic payments. Involuntary IRA distribution.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Application for Early Withdrawal of Pension Funds?

The Application for Early Withdrawal of Pension Funds is a formal request made by an individual to withdraw funds from their pension plan before reaching the designated retirement age.

Who is required to file Application for Early Withdrawal of Pension Funds?

Individuals who wish to access their pension funds before the usual retirement age are required to file the Application for Early Withdrawal of Pension Funds.

How to fill out Application for Early Withdrawal of Pension Funds?

To fill out the Application for Early Withdrawal of Pension Funds, individuals should gather necessary information such as identification, details about their pension plan, and the reason for early withdrawal, and then complete the application form with accurate and complete details.

What is the purpose of Application for Early Withdrawal of Pension Funds?

The purpose of the Application for Early Withdrawal of Pension Funds is to allow individuals access to their retirement savings for various personal or financial needs prior to reaching retirement age.

What information must be reported on Application for Early Withdrawal of Pension Funds?

The information that must be reported on the Application for Early Withdrawal of Pension Funds typically includes the applicant's personal information, pension plan details, the amount requested for withdrawal, the reason for withdrawal, and any required verification documents.

Fill out your application for early withdrawal online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Early Withdrawal is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.