Get the free Preferred Risk Policy - fema

Show details

This document provides a detailed outline of the Preferred Risk Policy (PRP) for flood insurance, including eligibility requirements, coverage limits, exclusions, and documentation needed for applications.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign preferred risk policy

Edit your preferred risk policy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your preferred risk policy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing preferred risk policy online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit preferred risk policy. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out preferred risk policy

How to fill out Preferred Risk Policy

01

Obtain the Preferred Risk Policy application form from the insurance provider.

02

Fill in your personal details, including name, address, and contact information.

03

Provide information about your property, such as its location, size, and the type of construction.

04

Disclose any previous insurance claims or losses related to the property.

05

Indicate any relevant safety features or upgrades that may lower risk, like smoke detectors or security systems.

06

Review the coverage options and select the ones that best meet your needs.

07

Sign and date the application to confirm accuracy and understanding.

08

Submit the completed application form along with any required documentation to the insurance provider.

Who needs Preferred Risk Policy?

01

Homeowners in areas prone to flooding or disaster-related risks.

02

Property owners looking for comprehensive insurance coverage.

03

Individuals who seek to protect their assets with a policy that offers preferred rates.

Fill

form

: Try Risk Free

People Also Ask about

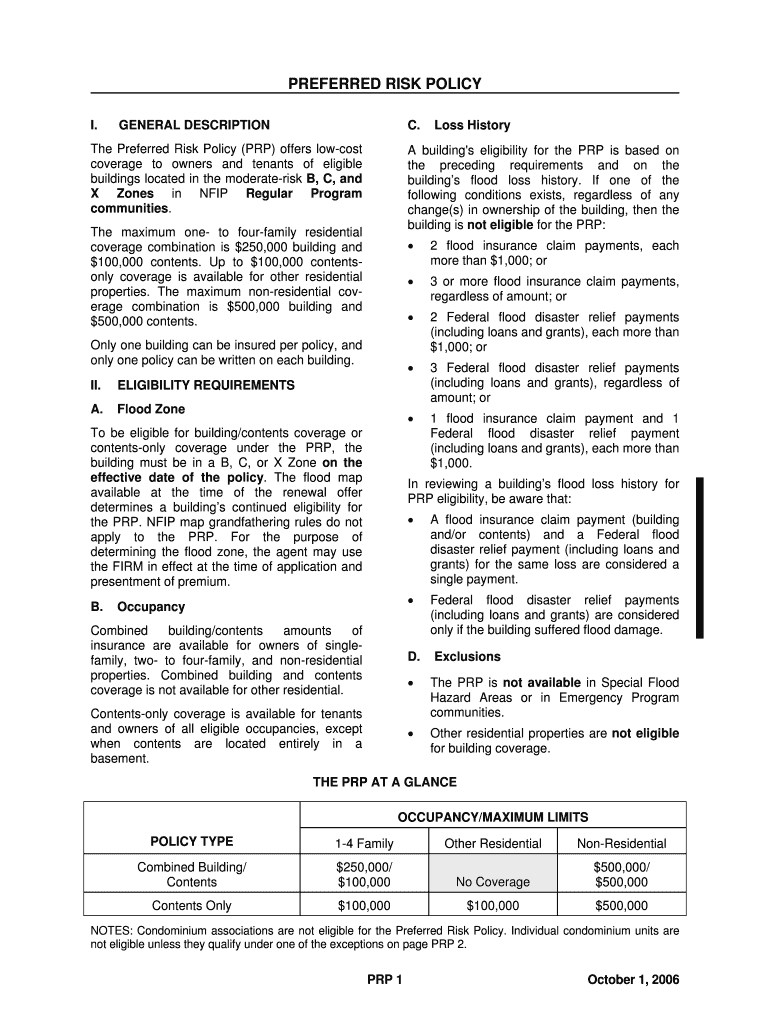

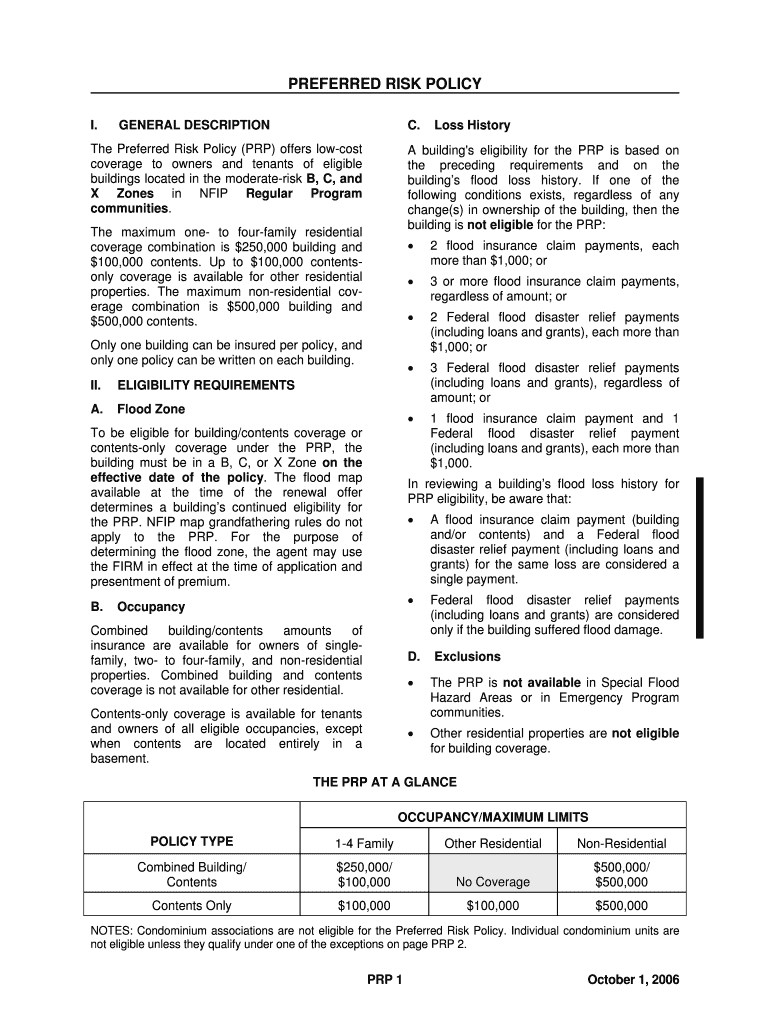

What is a preferred risk in an insurance policy?

: an insured that an insurer deems has a lower than average chance of loss and that usually may pay a lower premium.

What is the deductible under a Nfip preferred risk policy?

The standard deductible for PRPs is $1,000 each for building and contents, applied separately. Optional deductibles are not available for PRPs.

What is a preferred risk life insurance policy?

Preferred Risk These are individuals who offer a lower risk for the insurer than a standard risk and are rewarded with generally lower premium rates. High personal characteristics contribute to a preferred risk rating such as nonsmoking and overall good health.

What is an example of a preferred risk?

Definition of preferred risk insured, or an applicant for insurance, with lower expectation of incurring a loss than the standard applicant. For example, an applicant for life insurance who does not smoke can usually obtain a reduced premium rate to reflect greater life expectancy.

What is a preferred policy?

Preferred Risk Policies provide you with flood insurance protection that is the same as a standard policy, but at significant savings. Preferred Risk Policies are only available in areas of low or moderate flood risk.

What is a preferred risk policy for flood insurance?

The Preferred Risk Policy (PRP) is a lower-cost Standard Flood Insurance Policy (SFIP), written under the Dwelling Form or General Property Form. It offers fixed combinations of building/contents coverage limits or contents-only coverage.

What is a preferred policy?

Preferred Risk Policies provide you with flood insurance protection that is the same as a standard policy, but at significant savings. Preferred Risk Policies are only available in areas of low or moderate flood risk.

What is the deductible for NFIP insurance?

NFIP flood insurance deductibles can range from $1,000 to $10,000 for both the building and contents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Preferred Risk Policy?

Preferred Risk Policy is a type of insurance policy designed for properties or individuals that meet certain low-risk criteria, typically offering lower premiums due to reduced likelihood of claims.

Who is required to file Preferred Risk Policy?

Individuals or entities owning properties that qualify as low risk, typically defined by geographical location, flood zones, or other risk assessment criteria, are required to file for Preferred Risk Policy.

How to fill out Preferred Risk Policy?

To fill out a Preferred Risk Policy, applicants need to provide personal information, property details, and any relevant risk factors, often requiring the completion of a specific application form provided by the insurer.

What is the purpose of Preferred Risk Policy?

The purpose of Preferred Risk Policy is to provide affordable insurance coverage to property owners deemed to be at a lower risk of loss or damage, thus promoting financial security in insurance markets.

What information must be reported on Preferred Risk Policy?

Information that must be reported on a Preferred Risk Policy includes property address, owner details, property value, risk factors, and a description of the property and its usage.

Fill out your preferred risk policy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Preferred Risk Policy is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.