Get the free Suspicious Activity Report (SAR) Revised - ffiec

Show details

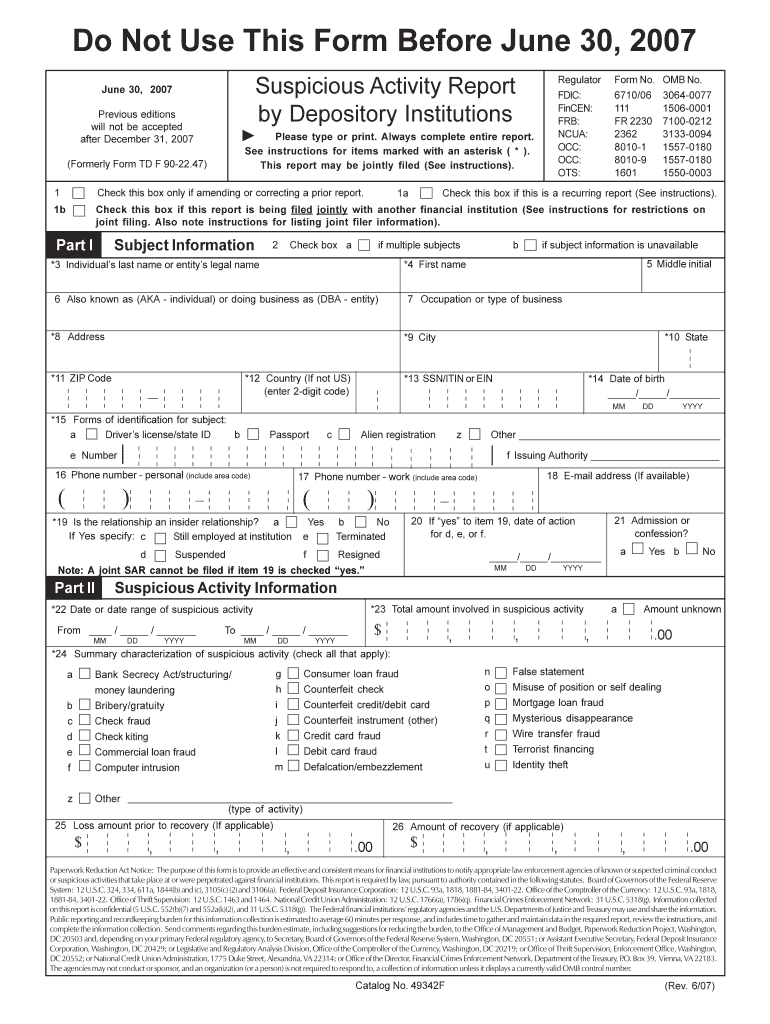

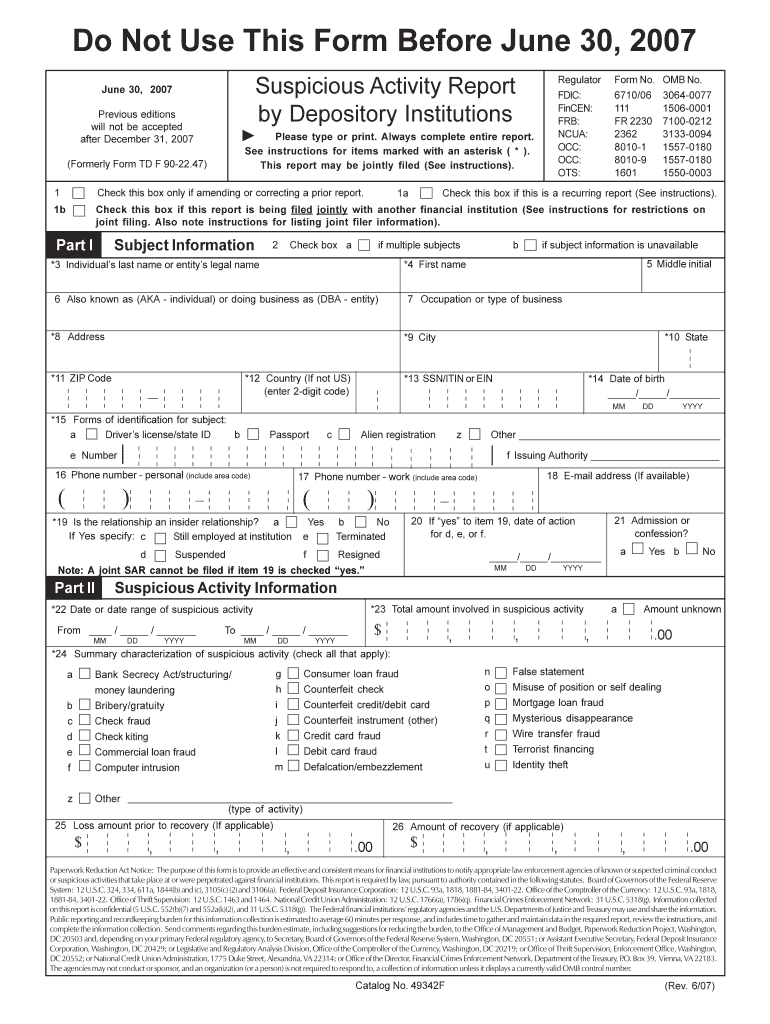

This document serves as a revised format for the Suspicious Activity Report by Depository Institutions (SAR-DI) to support a new joint filing initiative aimed at reducing duplicate SARs for single

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign suspicious activity report sar

Edit your suspicious activity report sar form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your suspicious activity report sar form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit suspicious activity report sar online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit suspicious activity report sar. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out suspicious activity report sar

How to fill out Suspicious Activity Report (SAR) Revised

01

Gather necessary information about the suspicious activity.

02

Complete the SAR form with accurate details, including the date, time, and location of the incident.

03

Provide a description of the suspicious activity, including any individuals or entities involved.

04

Include any relevant supporting documentation or evidence.

05

Review the completed SAR for accuracy and completeness.

06

Submit the SAR to the appropriate authority or financial institution as per the guidelines.

Who needs Suspicious Activity Report (SAR) Revised?

01

Financial institutions such as banks and credit unions.

02

Certain non-bank financial institutions, like money services businesses.

03

Insurance companies that detect suspicious claims activities.

04

Investment firms and broker-dealers.

Fill

form

: Try Risk Free

People Also Ask about

How to make a SAR report?

How to File a Suspicious Activity Report (SAR) Step 1: Complete a SAR Form for Each Incident of Suspicious Activity. Step 2: Submit SARs to FinCEN. Step 3: Keep Records for a Period of Time.

How do you write a SAR report?

A Suspicious Activity Report (SAR) is a document that financial institutions, and those associated with their business, must file with the Financial Crimes Enforcement Network (FinCEN) whenever there is a suspected case of money laundering or fraud.

What triggers a bank to file a SAR?

If a customer does something obviously criminal – such as offering a bribe or even admitting to a crime – the law requires you to file a SAR if it involves or aggregates funds or other assets of $2,000 or more.

What does a good SAR look like?

A well-structured SAR should include: Subject type: clearly classify the subject as a suspect, victim or unknown, to provide context and avoid confusion. Accurate subject details: for individuals, include full name, date of birth, addresses and key identifiers (e.g. NI number, passport number).

When should you file a SAR report?

Filing Timelines – Banks are required to file a SAR within 30 calendar days after the date of initial detection of facts constituting a basis for filing. This deadline may be extended an additional 30 days up to a total of 60 calendar days if no suspect is identified.

What is an example of a SAR?

Some examples of suspicious activities that may trigger a SAR include: Unusually large cash deposits or withdrawals. Frequent transactions just below the reporting threshold to avoid detection. Structuring transactions to avoid triggering regulatory requirements.

How do you write a SAR format?

Provide a brief statement of the SAR's purpose. Generally describe the known or suspected violation. Identify the date of any SARs previously filed on the subject & the purpose of that SAR. Indicate any internal investigative numbers used by the filing institution to maintain records of the SAR.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Suspicious Activity Report (SAR) Revised?

The Revised Suspicious Activity Report (SAR) is a document used by financial institutions to report suspected money laundering, fraud, or other suspicious activities to relevant regulatory authorities. It includes updated guidelines and formats to enhance clarity and compliance.

Who is required to file Suspicious Activity Report (SAR) Revised?

Financial institutions, including banks, credit unions, broker-dealers, money service businesses, and other entities involved in financial transactions are required to file the Revised SAR when they detect suspicious activity.

How to fill out Suspicious Activity Report (SAR) Revised?

To fill out the Revised SAR, institutions must provide specific details such as the type of suspicious activity, information about the individuals involved, transaction details, and the institution's analysis of the suspicious activity. Forms can typically be filled out electronically through designated government portals.

What is the purpose of Suspicious Activity Report (SAR) Revised?

The purpose of the SAR Revised is to assist law enforcement and regulatory bodies in identifying and investigating possible criminal activities, thereby helping to combat money laundering and other financial crimes.

What information must be reported on Suspicious Activity Report (SAR) Revised?

The SAR Revised must include information such as the nature of the suspicious activity, transaction details (dates, amounts, methods), personal identifying information of individuals involved, and the financial institution's rationale for suspicion.

Fill out your suspicious activity report sar online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Suspicious Activity Report Sar is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.