Get the free Form WH-226 - gao

Show details

The document outlines suggested changes to Form WH-226 to improve the accuracy of information collected by the Department of Labor regarding employers and workers with disabilities employed at special

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form wh-226 - gao

Edit your form wh-226 - gao form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form wh-226 - gao form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form wh-226 - gao online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form wh-226 - gao. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form wh-226 - gao

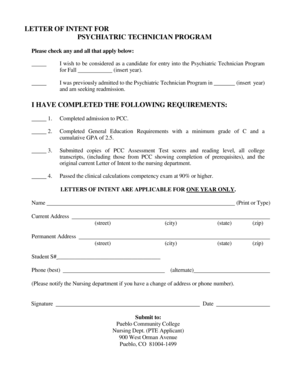

How to fill out Form WH-226

01

Obtain Form WH-226 from the official Department of Labor website or from your local office.

02

Fill out the applicant's information in section 1, including name, address, and contact details.

03

In section 2, provide the employer's information, including company name and address.

04

Complete section 3 by detailing the nature of the complaint or issue being reported.

05

Attach any supporting documents or evidence to strengthen your case.

06

Review the completed form for accuracy before submission.

07

Submit the form either by mailing it to the appropriate address or by submitting it online if applicable.

Who needs Form WH-226?

01

Form WH-226 is needed by employees who wish to report violations of wage and hour laws under the Fair Labor Standards Act (FLSA).

02

Employers who need to respond to employee complaints also may need to reference this form.

Fill

form

: Try Risk Free

People Also Ask about

What is a WH 58 form?

The WH-58 form serves as an official document employed by the United States Department of Labor for the purpose of recording the settlement of claims under the Fair Labor Standards Act.

What is the full form of WHD?

A wage is payment made by an employer to an employee for work done in a specific period of time. Some examples of wage payments include compensatory payments such as minimum wage, prevailing wage, and yearly bonuses, and remunerative payments such as prizes and tip payouts.

What is a payment for work done called?

These workers are commonly found in industries like construction, agriculture, manufacturing, and informal sectors. For example: A construction laborer who earns $100 per day worked, but only gets paid for days they actually work, without compensation for holidays or sick days.

What is an example of a wage worker?

In business and in accounting, wages and salary are two different types of expenses. Wages are hourly rates paid to workers, and they may vary seasonally along with business demand for labor. Salary is considered an annual expense of doing business.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form WH-226?

Form WH-226 is a wage deduction form used by employers in the United States to report wages subject to certain deductions.

Who is required to file Form WH-226?

Employers who have employees subject to specific wage deductions mandated by federal or state law are required to file Form WH-226.

How to fill out Form WH-226?

To fill out Form WH-226, employers must provide information such as employee details, wages, and the specific deductions being reported. Ensure that all fields are accurately completed according to the guidelines provided by the relevant regulatory agency.

What is the purpose of Form WH-226?

The purpose of Form WH-226 is to ensure compliance with wage deduction regulations and to provide a record of deductions taken from employee wages for reporting purposes.

What information must be reported on Form WH-226?

Form WH-226 must report information including employee name, Social Security number, total wages paid, the amount of deductions taken, and the reason for each deduction.

Fill out your form wh-226 - gao online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Wh-226 - Gao is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.