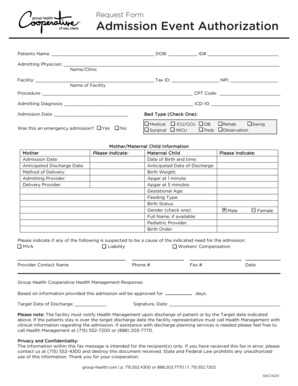

Get the free Form 8596-A

Show details

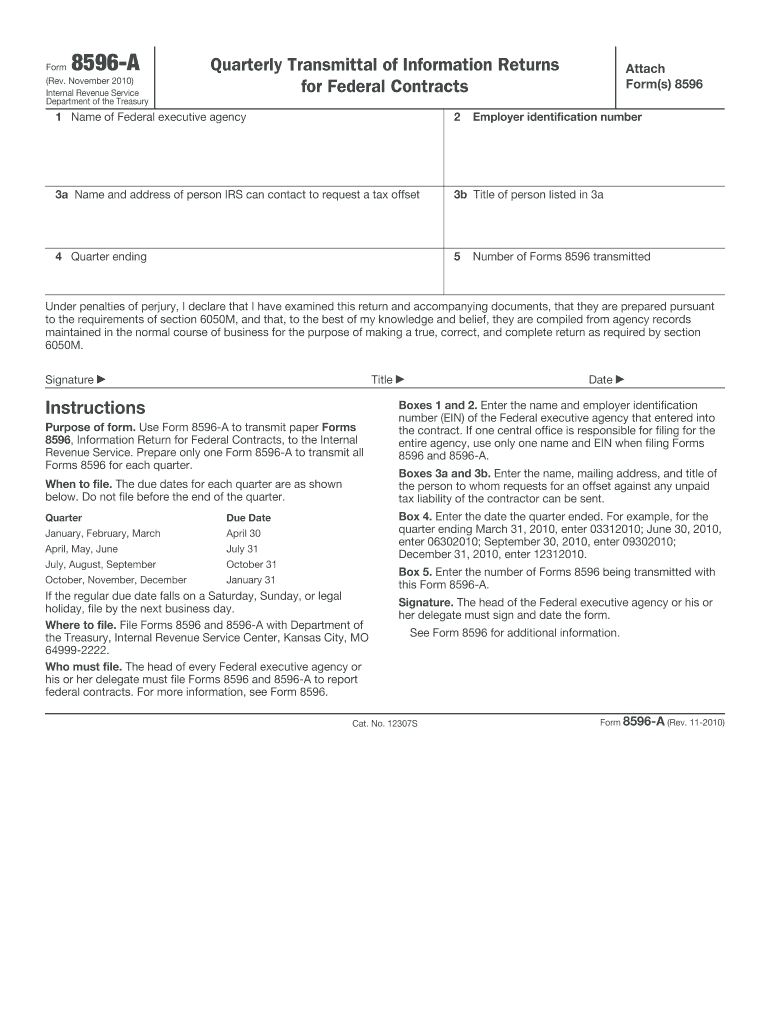

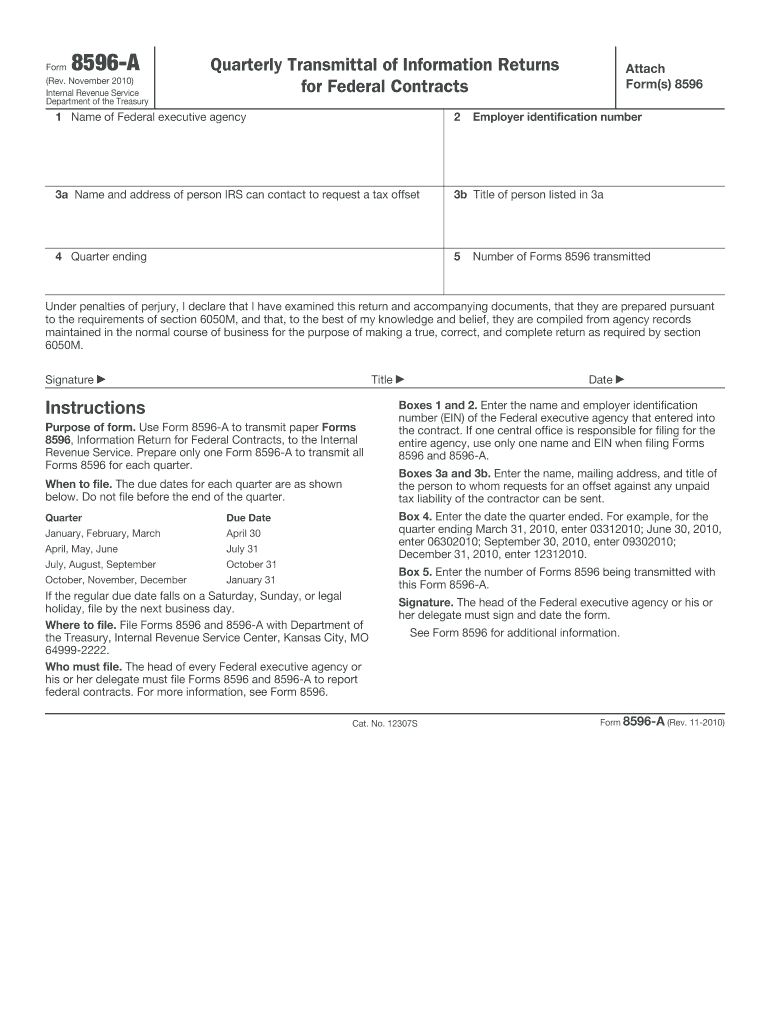

使用Form 8596-A传输纸质Forms 8596,联邦合同的信息返回给内部收入署。每个季度只准备一份Form 8596-A来传输所有Forms 8596。

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 8596-a

Edit your form 8596-a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 8596-a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 8596-a online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form 8596-a. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 8596-a

How to fill out Form 8596-A

01

Obtain a copy of Form 8596-A, which is available on the IRS website.

02

Begin by entering your personal information, including your name, address, and taxpayer identification number at the top of the form.

03

Follow the instructions specific to each section of the form, providing necessary details as prompted.

04

Carefully complete sections related to transactions and computations as required.

05

Review the form for accuracy and completeness.

06

Sign and date the form at the bottom where indicated.

07

Submit the completed form according to the IRS guidelines, either electronically or by mail.

Who needs Form 8596-A?

01

Form 8596-A is needed by individuals or entities that are involved in certain types of transactions that require reporting to the IRS.

02

Typically, it is used by taxpayers who need to report specific information about their investment activities.

Fill

form

: Try Risk Free

People Also Ask about

How do you write verb forms?

Main verbs have three basic forms: the base form, the past form and the -ed form (sometimes called the '-ed participle'): base form: used as the infinitive form, with to or without to (Do you want to come with us? I can't leave now.) and for the present simple (I always read before I go to sleep every night.)

What are the 4 types of verb forms?

V1, V2, V3, V4, and V5 refer to the five different verb forms. V1 is the base form of the verb; V2 is the simple past form; V3 is the past participle form; V4 is the third-person singular present form; and V5 is the present participle form.

How do you write verb forms in English?

For many verbs, the past simple form (V2) is created by adding "-ed" to the base form, but irregular verbs change completely, like "eat" becoming "ate." The past participle (V3) is essential for forming perfect tenses and passive voice; for example, "write" becomes "written" in the past participle.

What are the 5 verb forms?

There are five verb forms in the English language. Those are root (or an infinitive), third-person singular, present participle, past, and past participle.

Do I need to mail form 8453 to the IRS?

If you are an electronic return originator (ERO), you must mail Form 8453 to the IRS within 3 business days after receiving acknowledgement that the IRS has accepted the electronically filed tax return.

What is an example of a verb form in a sentence?

Example: Jennifer walked to the store. In this sentence, walked is the verb that shows an action. It happened in the past, so it is a past-tense verb.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

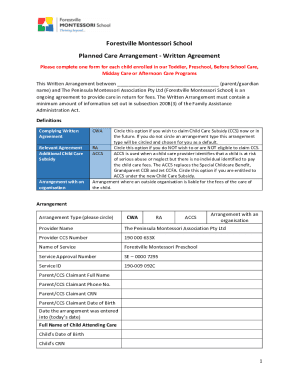

What is Form 8596-A?

Form 8596-A is a tax form used by certain businesses to report specific financial and operational information to the Internal Revenue Service (IRS).

Who is required to file Form 8596-A?

Entities that meet specific criteria set by the IRS, typically involving income thresholds, property types, or business operations, are required to file Form 8596-A.

How to fill out Form 8596-A?

To fill out Form 8596-A, the filer must provide accurate financial data, including business income, expenses, and other relevant information as specified in the form's instructions.

What is the purpose of Form 8596-A?

The purpose of Form 8596-A is to collect detailed information about certain forms of business income and expenses, which helps the IRS in tax assessment and compliance.

What information must be reported on Form 8596-A?

Form 8596-A must report information including gross income, operational expenses, and specific financial metrics relevant to the business activities of the filer.

Fill out your form 8596-a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 8596-A is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.