Who needs a form 8821?

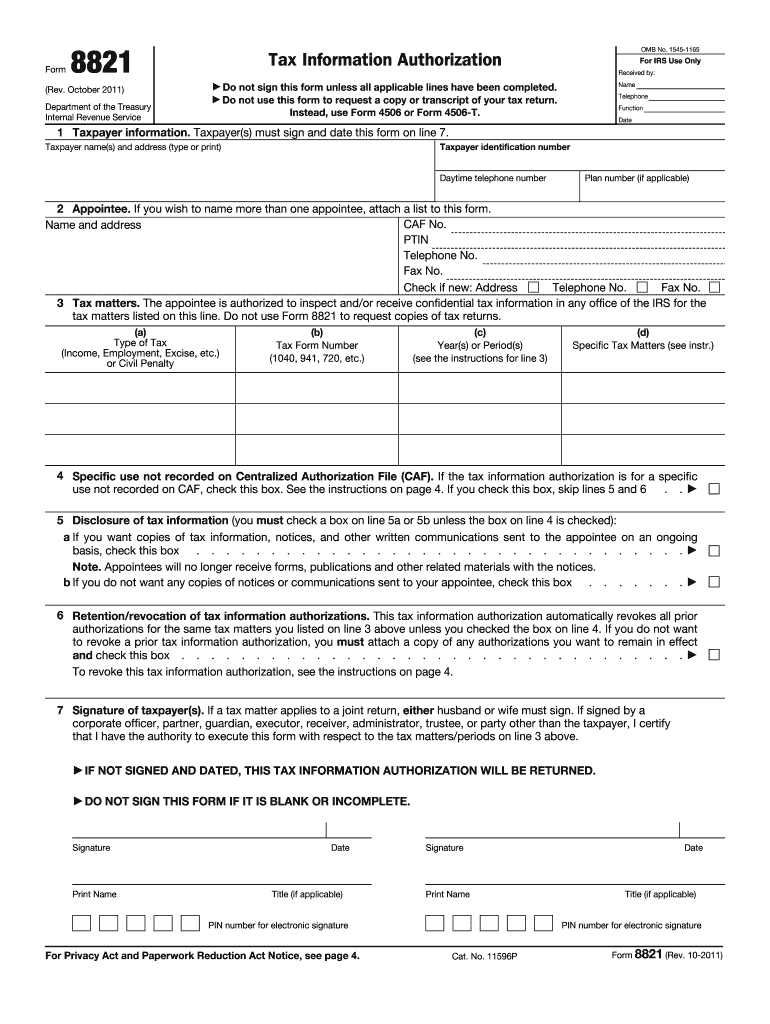

This form is called Tax Information Authorization. It can be used by any taxpayer who designated an individual, corporation, firm, organization or partnership that offers professional advice in dealing with personal or business taxes.

What is form 8821 for?

With form 8821 a taxpayer provides a right to receive and inspect information about designated tax during a certain period of time to a third party. Both the type of tax and the period of using the service must be indicated on the form 8821. Please, keep in mind that form 8821 does not give the right to speak on your behalf in any IRS case, file tax forms or make payments, represent you in court regarding a tax issue or execute any agreements on your behalf. You must use form 2848, Power of Attorney and Declaration of Representative, for these purposes.

Is it accompanied by other forms?

You can use form 56 to inform IRS of fiduciary relationship, if you have established that kind of relationship with a trustee. It means that a designated person can act as a taxpayer and stands in the position of a taxpayer, not a representative.

When is form 8821 due?

If the purpose of this form is receiving consultancy on any particular tax matter, the IRS must receive a copy of 8821 within 120 days since the signature date on the related form. Otherwise, there is no due date for filing form 8821.

How do I fill out a form 8821?

Follow the instructions on the IRS official webpage and fill out form 8821 using filler’s convenient editing tools and digital signature technology.

Where do I send it?

You can find the correct address for your state in this table.