IRS 720 2011 free printable template

Instructions and Help about IRS 720

How to edit IRS 720

How to fill out IRS 720

About IRS previous version

What is IRS 720?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 720

How can I manage my [SKS] directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your [SKS] and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I send [SKS] to be eSigned by others?

When your [SKS] is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I create an electronic signature for the [SKS] in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your [SKS] in minutes.

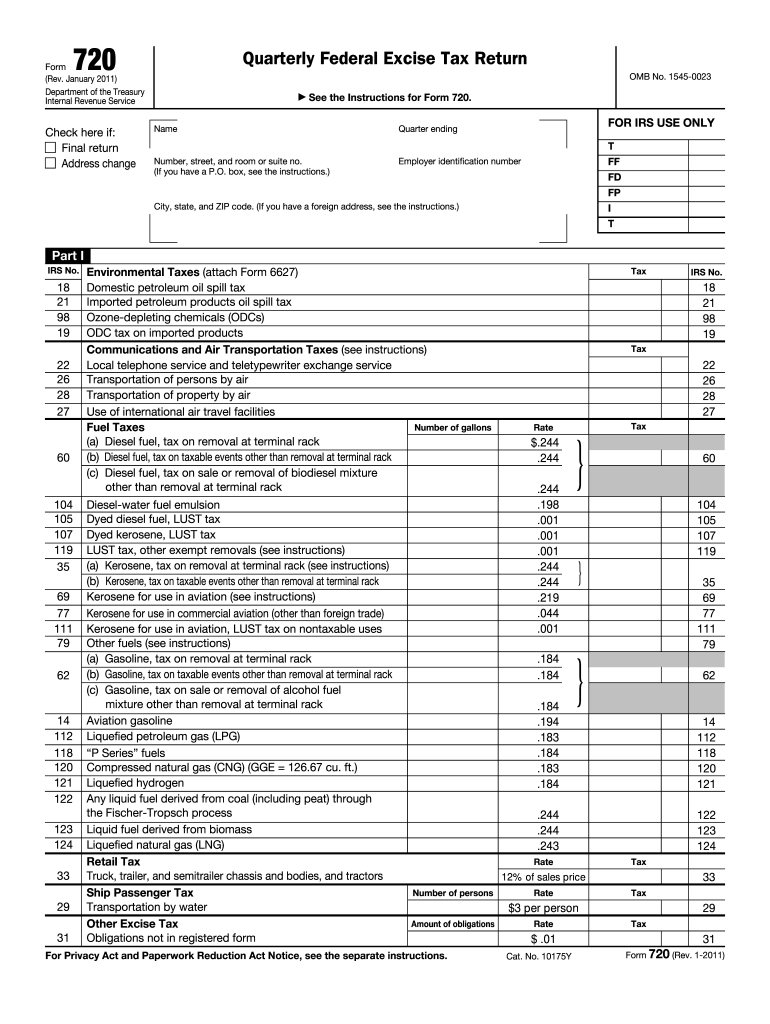

What is IRS 720?

IRS Form 720 is a quarterly federal excise tax return used to report and pay excise taxes imposed by the Internal Revenue Service (IRS) on certain goods, services, and activities.

Who is required to file IRS 720?

Businesses and individuals who are liable for federal excise taxes on specific items or services, such as fuel, air transportation, or environmental taxes, are required to file IRS Form 720.

How to fill out IRS 720?

To fill out IRS Form 720, taxpayers should gather their financial information related to excise taxes, complete the appropriate sections of the form based on the applicable tax categories, calculate the total taxes owed, and then sign and date the form before filing it with the IRS.

What is the purpose of IRS 720?

The purpose of IRS Form 720 is to report and pay federal excise taxes to the IRS, ensuring compliance with tax regulations related to specific goods and services.

What information must be reported on IRS 720?

IRS Form 720 requires information about the taxpayer's identification, the types of excise taxes being reported, total amounts of taxable goods or services, and the calculation of the total excise taxes owed.

See what our users say