Get the free Rev. Proc. 2007-54 - irs

Show details

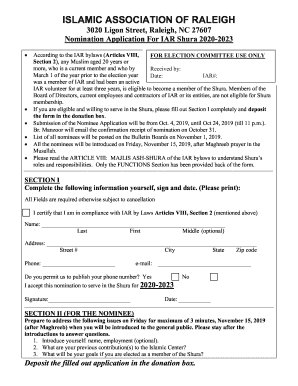

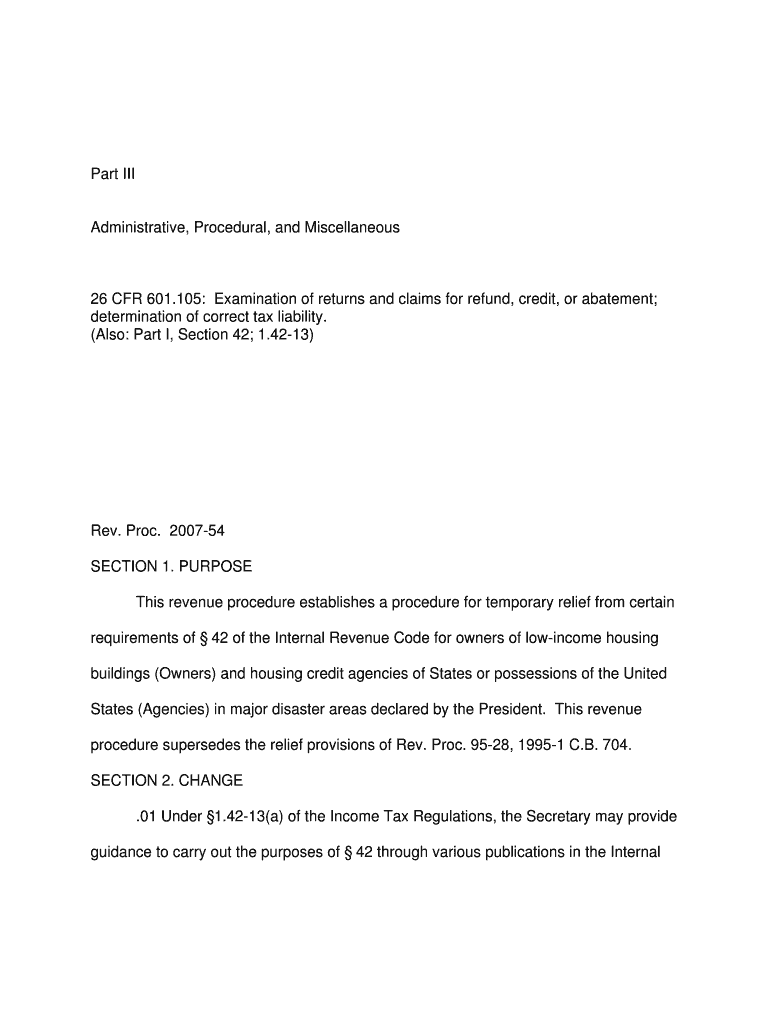

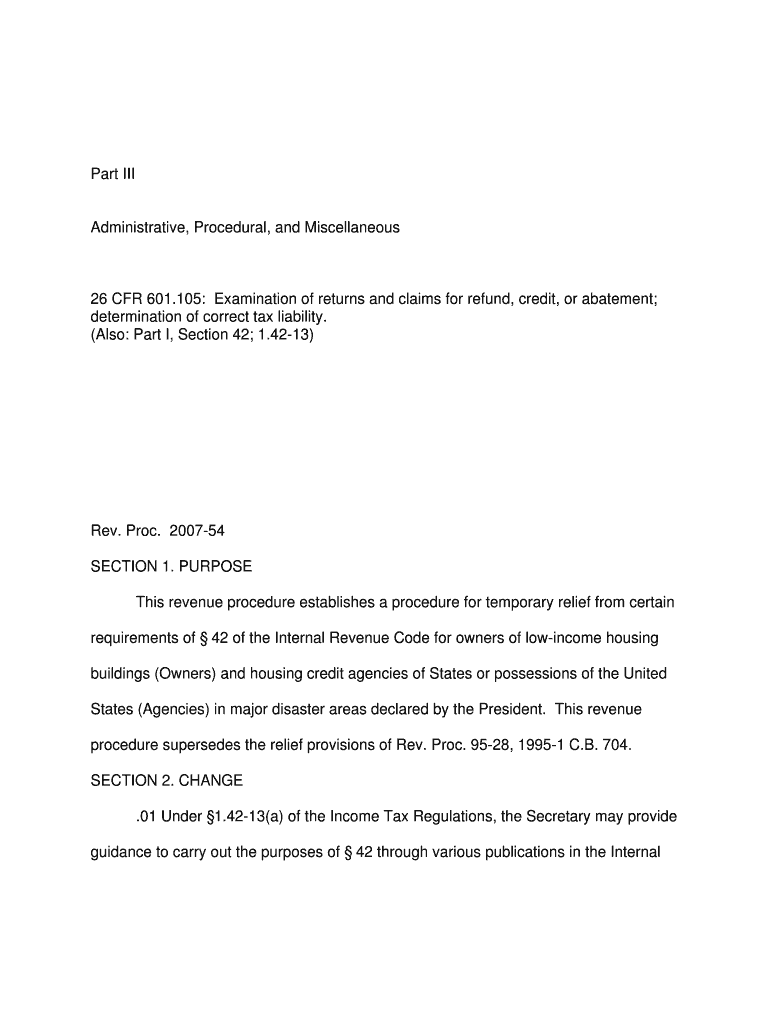

This revenue procedure establishes a procedure for temporary relief from certain requirements of § 42 of the Internal Revenue Code for owners of low-income housing buildings and housing credit agencies

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rev proc 2007-54

Edit your rev proc 2007-54 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rev proc 2007-54 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing rev proc 2007-54 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit rev proc 2007-54. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rev proc 2007-54

How to fill out Rev. Proc. 2007-54

01

Obtain the Rev. Proc. 2007-54 document from the IRS website.

02

Review the purpose of the procedure to understand its context.

03

Gather all necessary financial records and documentation relevant to your submission.

04

Carefully read the instructions provided in the Rev. Proc. 2007-54 for specific requirements.

05

Complete the applicable forms mentioned in the procedure.

06

Calculate any required amounts or values as specified.

07

Double-check all entries for accuracy.

08

Submit the completed forms and documentation to the appropriate IRS address.

Who needs Rev. Proc. 2007-54?

01

Individuals or businesses seeking to obtain relief for certain tax liabilities.

02

Taxpayers who have experienced defined circumstances that meet the criteria outlined.

03

Accountants and tax professionals assisting clients with compliance under the procedure.

Fill

form

: Try Risk Free

People Also Ask about

What is rev proc 2004 48 and rev proc 2007 62?

Rev. Proc. 2004-48 and Rev. Proc 2007-62 provide simplified methods for taxpayers to request relief for a late S corporation election and a late corporate classification election intended to be effective on the same date as the S corporation election.

What is the rev procedure?

The REV procedure [2–8] is a surgical technique used to treat transposition of the great arteries with ventricular septal defect (VSD) and pulmonary stenosis and malpositions similar to transposition of the great arteries (TGA), as an alternative to the classic Rastelli repair [9] .

What is rev proc 2025 15?

Rev. Proc. 2025-15 provides that the discount factors for losses incurred in accident year 2024 are determined by using the applicable interest rate for 2024 under section 846(c), which is 3.18% compounded semiannually.

What does tax refund proc mean?

"RFND DISB" seems like an abbreviation for "refund disbursement", and "TAX REFUND PROC" is "tax refund proceeds". Were you getting your refund directly from the IRS, or did you agree to have a tax company hold their fees out of your refund; could that be a factor here?

What is the revenue procedure statement?

Revenue Procedures deal with the internal practice and procedures of the IRS in the administration of the tax laws. They are official statements of procedures relating to sections of the Internal Revenue Code, related statutes, tax treaties, and regulations.

What is rev proc?

A revenue procedure is an official statement of a procedure published in the Bulletin that either affects the rights or duties of taxpayers or other members of the public under the Internal Revenue Code and related statutes, treaties, and regulations or, although not necessarily affecting the rights and duties of the

What is rev proc 2006 45?

03 Rev. Proc. 2006-45 provides the exclusive procedures for certain corporations to obtain automatic approval of the Commissioner to change their annual accounting periods.

What does rev proc stand for?

Definition: REV. PROC. is an abbreviation for REVENUE PROCEDURE. REVENUE PROCEDURE is a set of guidelines issued by the Internal Revenue Service (IRS) that provides instructions and procedures for taxpayers to follow when complying with tax laws.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Rev. Proc. 2007-54?

Rev. Proc. 2007-54 is a revenue procedure issued by the Internal Revenue Service (IRS) that provides guidance on the circumstances under which a taxpayer may obtain relief from the consequences of failing to meet certain requirements of the Internal Revenue Code.

Who is required to file Rev. Proc. 2007-54?

Taxpayers who have failed to meet certain requirements for tax benefits under specified sections of the Internal Revenue Code may be required to file under Rev. Proc. 2007-54 to seek relief.

How to fill out Rev. Proc. 2007-54?

To fill out Rev. Proc. 2007-54, taxpayers must complete the necessary forms as specified in the procedure, providing accurate information regarding their situation and the specific reasons for seeking relief.

What is the purpose of Rev. Proc. 2007-54?

The purpose of Rev. Proc. 2007-54 is to outline the process for taxpayers to request relief from penalties and other consequences resulting from noncompliance with certain tax-related requirements.

What information must be reported on Rev. Proc. 2007-54?

Taxpayers must report specific information related to their compliance issues, including details about the failed requirements, the circumstances leading to noncompliance, and any actions taken to rectify the situation.

Fill out your rev proc 2007-54 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rev Proc 2007-54 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.