Get the free Environmental Taxes - irs

Show details

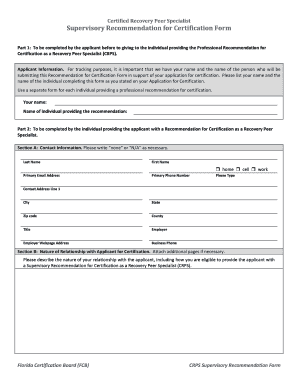

Form used to figure the environmental tax on ozone-depleting chemicals (ODCs), imported products using ODCs, and the floor stocks tax on ODCs.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign environmental taxes - irs

Edit your environmental taxes - irs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your environmental taxes - irs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing environmental taxes - irs online

To use the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit environmental taxes - irs. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out environmental taxes - irs

How to fill out Environmental Taxes

01

Obtain the necessary forms from the relevant environmental agency or department.

02

Gather all required documentation related to your environmental impact, such as emissions reports and energy usage.

03

Carefully read the instructions provided with the forms to understand the specific requirements.

04

Fill out the forms accurately, providing all requested information and calculations regarding your environmental footprint.

05

Review your entries to ensure there are no errors or omissions.

06

Submit the completed forms by the specified deadline to the appropriate agency.

Who needs Environmental Taxes?

01

Businesses that produce emissions or have a significant environmental impact.

02

Manufacturers and industrial operations.

03

Companies operating in sectors such as energy, waste management, or transportation.

04

Individuals or households that exceed certain environmental thresholds set by local laws.

Fill

form

: Try Risk Free

People Also Ask about

What is an example of a pollution charge?

For example, the federal government and many state governments impose taxes on gasoline. We can view this tax as a charge on the air pollution that cars generate as well as a source of funding for maintaining roads.

What are the disadvantages of environmental taxes?

Green taxes can increase the cost of manufacturing and lead to higher overall product costs. If a company is saddled with taxes because it uses fossil fuels, then it will pass on those increases to customers.

What are the disadvantages of environmental taxes?

Green taxes can increase the cost of manufacturing and lead to higher overall product costs. If a company is saddled with taxes because it uses fossil fuels, then it will pass on those increases to customers.

How do environmental taxes work?

An environmental tax, ecotax (short for ecological taxation), or green tax is a tax levied on activities which are considered to be harmful to the environment and is intended to promote environmentally friendly alternatives via economic incentives. One notable example is a carbon tax.

What is an example of a consumer tax?

Examples of consumption taxes include retail sales taxes, excise taxes, value-added taxes, use taxes, taxes on gross business receipts, and import duties. These taxes are borne by consumers, who pay a higher retail price for the good or service.

What is a real life example of pollution tax?

An example of a common transport tax is the tax placed on vehicle registration. This tax is levied on registrations based on factors such as weight, fuel efficiency, or emissions, and it is used to both generate revenue, and to promote the ownership and usage of cleaner, and more fuel efficient vehicles.

What is the meaning of environmental tax?

An environmental tax is a tax on something that has a proven, specific negative impact on the environment. The tax base can be a physical unit, for example litres of gasoline, or a proxy of a physical unit, for example taxes on nuclear power stations.

What is an example of a pollution tax?

Common examples of a Pigovian tax include carbon taxes to offset the environmental pollution from using gasoline, or tobacco taxes to address the strain on public healthcare systems caused by consuming tobacco products.

What are examples of green taxes?

The purpose of green taxes is to encourage individuals and businesses to reduce their environmental footprint and promote sustainable practices. One example of a green tax is the carbon tax, which is imposed on the burning of fossil fuels.

What is an example of a Pigouvian tax?

A Pigouvian tax, named after 1920 British economist Arthur C. Pigou, is a tax on a market transaction that creates a negative externality, or an additional cost, borne by individuals not directly involved in the transaction. Examples include tobacco taxes, sugar taxes, and carbon taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Environmental Taxes?

Environmental taxes are levies imposed on activities that harm the environment, encouraging individuals and businesses to reduce their ecological footprint.

Who is required to file Environmental Taxes?

Businesses and individuals engaged in activities that contribute to environmental degradation, such as carbon emissions, waste generation, or pollution, are usually required to file environmental taxes.

How to fill out Environmental Taxes?

To fill out environmental taxes, individuals or businesses must complete the designated tax forms which typically require information on their environmental impact, calculations of taxes owed, and payment details.

What is the purpose of Environmental Taxes?

The purpose of environmental taxes is to incentivize reduced environmental harm, fund environmental protection initiatives, and promote sustainable practices.

What information must be reported on Environmental Taxes?

Information reported on environmental taxes often includes the type and amount of pollutants or emissions, activities conducted, applicable tax rates, and total taxes owed.

Fill out your environmental taxes - irs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Environmental Taxes - Irs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.