Get the free Form 8835 - irs

Show details

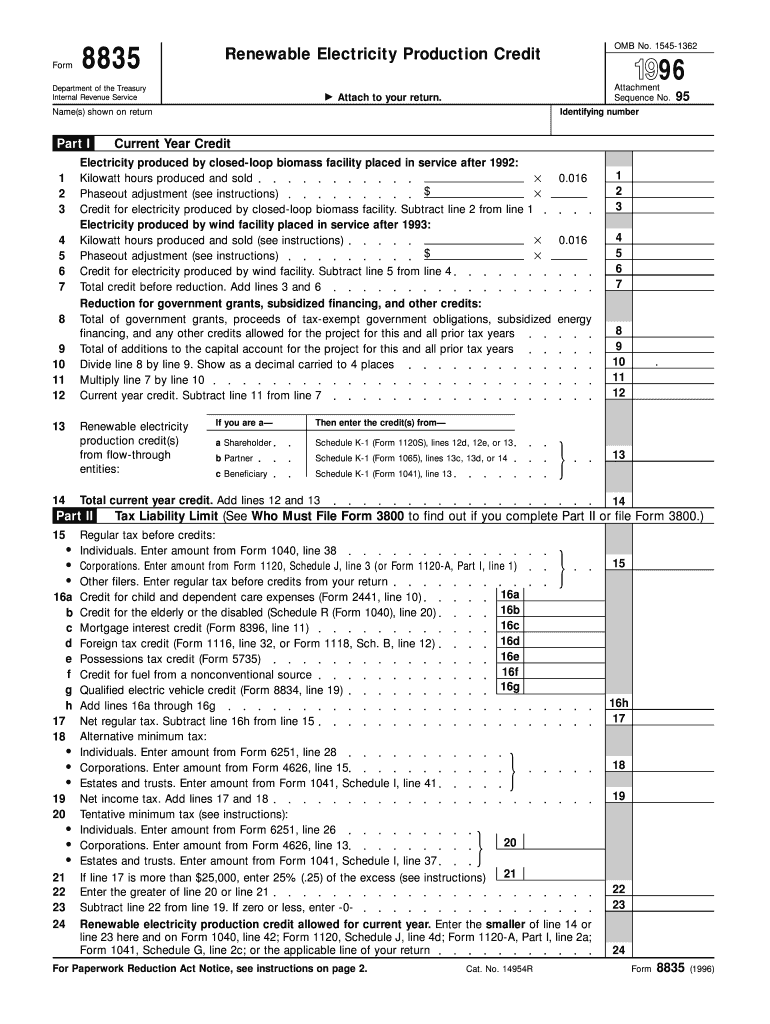

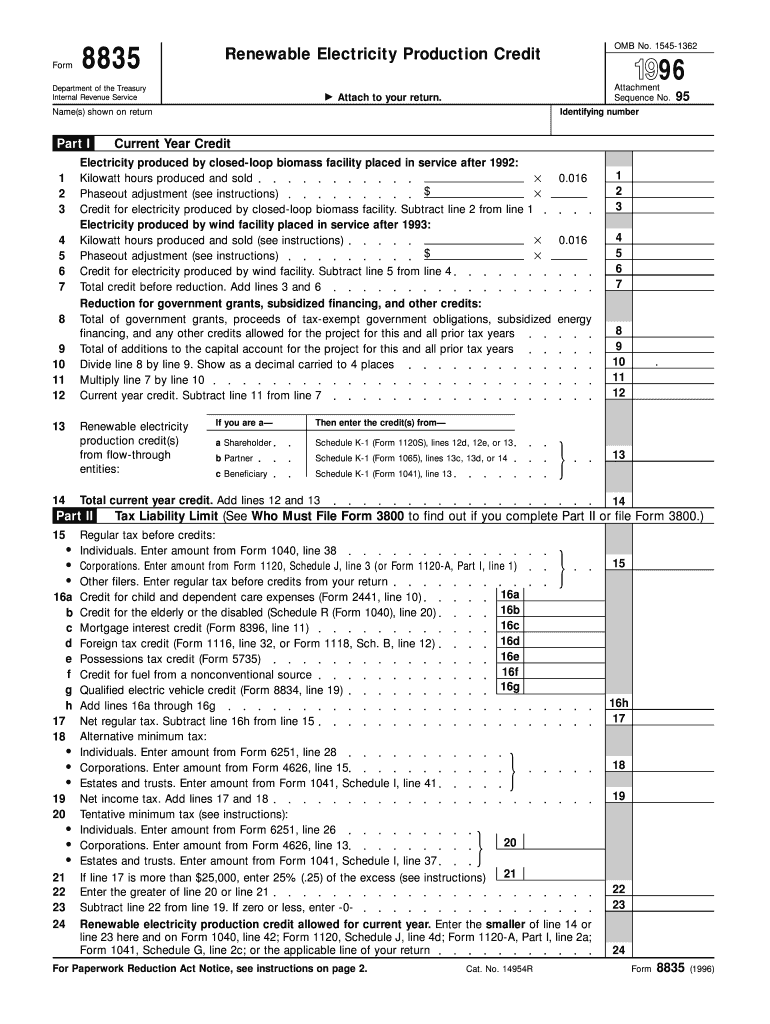

This form is used to claim the renewable electricity production credit for the sale of electricity produced from qualified energy resources in the United States.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 8835 - irs

Edit your form 8835 - irs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 8835 - irs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 8835 - irs online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form 8835 - irs. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 8835 - irs

How to fill out Form 8835

01

Gather all necessary information regarding the qualified fuel property.

02

Obtain the relevant tax year for which you are filing the form.

03

Complete Part I of Form 8835 by providing your name, address, and taxpayer identification number.

04

Fill out Part II, where you will calculate the credit based on the qualified fuel used during the tax year.

05

Complete Part III, which involves listing the amounts of qualified alternative fuel used.

06

Review and double-check all entries for accuracy.

07

Sign and date the form before submitting it to the appropriate IRS office.

Who needs Form 8835?

01

Taxpayers who are eligible for the alternative fuel vehicle refueling property credit.

02

Businesses that have installed qualified alternative fuel vehicle refueling property.

03

Individuals or entities who have made investments in alternative fuel properties and wish to claim a tax credit.

Fill

form

: Try Risk Free

People Also Ask about

What is the renewable electricity production tax credit?

For facilities placed in service after December 31, 2021, the PTC provides a corporate tax credit of up to 1.5 cents/kWh for electricity generated from landfill gas (LFG), open-loop biomass, municipal solid waste resources, and small irrigation power facilities, or up to 2.75 cents/kWh for electricity generated from

What is the clean electricity production tax credit?

The Clean Electricity Production Credit is a newly established, tech-neutral production tax credit that replaces the Energy Production Tax Credit once it phases out at the end of 2024. This is an emissions-based incentive that is neutral and flexible between clean electricity technologies.

What is the inflation adjustment factor for the production tax credit?

The PTC originally allowed taxpayers to claim a credit equal to $1.5 cents (adjusted annually for inflation) per kilowatt hour of renewable electricity produced at a qualified facility. The inflation adjustment factor for calendar-year 2024 is 1.9499.

What is the tax credit for landfill gas?

For facilities placed in service after December 31, 2021, the PTC provides a corporate tax credit of up to 1.5 cents/kWh for electricity generated from landfill gas (LFG), open-loop biomass, municipal solid waste resources, and small irrigation power facilities, or up to 2.75 cents/kWh for electricity generated from

What is the purpose of the 8825 form?

Partnerships and S corporations use Form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental real estate activities that flow through from partnerships, estates, or trusts.

What is the inflation adjustment factor for the production tax credit?

The PTC originally allowed taxpayers to claim a credit equal to $1.5 cents (adjusted annually for inflation) per kilowatt hour of renewable electricity produced at a qualified facility. The inflation adjustment factor for calendar-year 2024 is 1.9499.

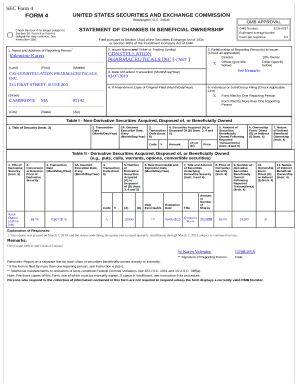

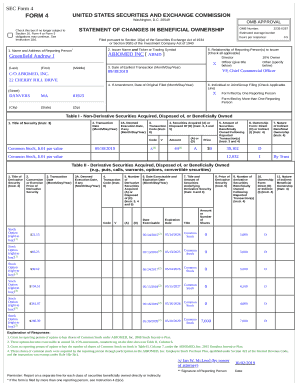

What is form 8835 used for?

Use Form 8835 to claim the renewable electricity production credit. The credit is allowed only for the sale of electricity produced in the United States or U.S. territories from qualified energy resources at a qualified facility.

Who files form 8908?

Eligible contractors use Form 8908 to claim a credit for each qualified energy efficient home sold or leased to another person during the tax year for use as a residence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 8835?

Form 8835 is a tax form used by certain taxpayers to claim the credit for the production of renewable electricity from wind, solar, geothermal, and other renewable sources.

Who is required to file Form 8835?

Taxpayers who have produced electricity from renewable sources and wish to claim the Renewable Electricity Production Credit are required to file Form 8835.

How to fill out Form 8835?

To fill out Form 8835, you need to gather information about your renewable electricity production, including the type of energy generated, the date the facility was placed in service, and the amount of electricity produced during the tax year. Follow the instructions provided with the form to complete it accurately.

What is the purpose of Form 8835?

The purpose of Form 8835 is to allow eligible entities to claim tax credits for the production of renewable electricity as part of the efforts to encourage sustainable energy practices.

What information must be reported on Form 8835?

Information that must be reported on Form 8835 includes the total kilowatt-hours of electricity produced, the type of renewable energy, the facility’s location, and the period during which the electricity was produced.

Fill out your form 8835 - irs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 8835 - Irs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.