Get the free Publication 918 - irs

Show details

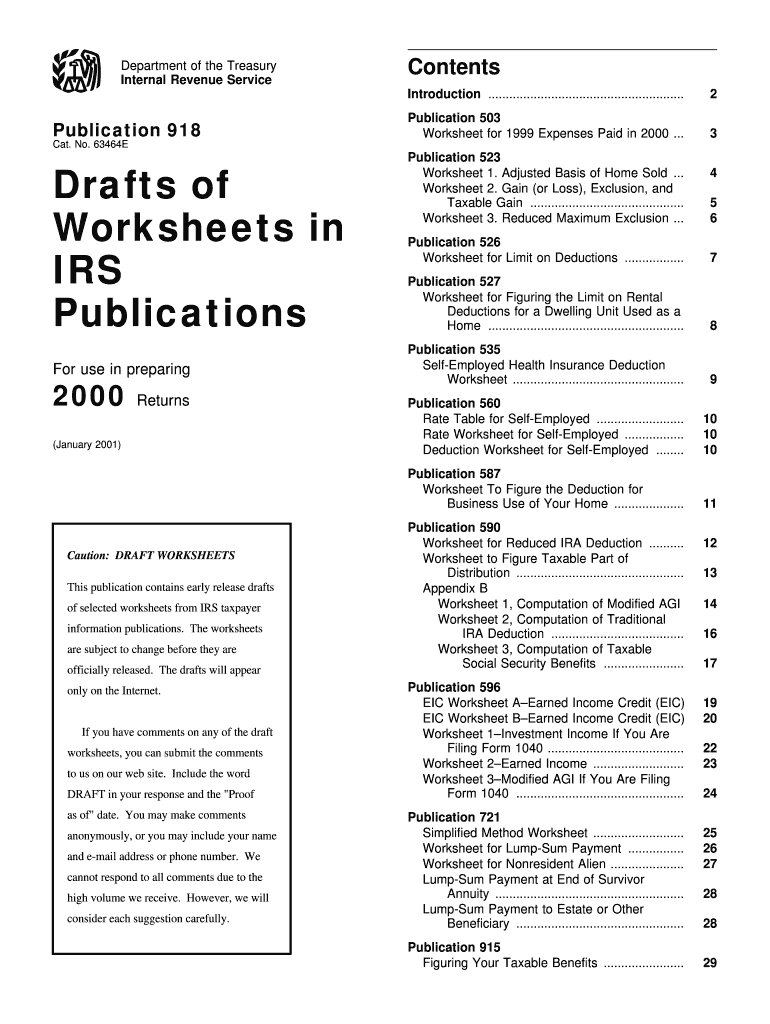

This document contains early release drafts of selected worksheets from IRS taxpayer information publications for the tax year 2000, available only on the Internet. It is intended to assist taxpayers

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign publication 918 - irs

Edit your publication 918 - irs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your publication 918 - irs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing publication 918 - irs online

To use the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit publication 918 - irs. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out publication 918 - irs

How to fill out Publication 918

01

Obtain a copy of Publication 918 from the IRS website or your local IRS office.

02

Read through the introduction to understand the purpose of the publication.

03

Gather the necessary information regarding your income and expenses as required by the publication.

04

Carefully follow the step-by-step instructions provided in each section of the publication.

05

Complete each section of the form by providing accurate information based on the guidance in the publication.

06

Review your completed form to ensure all information is accurate and complete.

07

Submit the completed Publication 918 following the instructions provided.

Who needs Publication 918?

01

Individuals or entities engaged in certain types of business activities requiring tax information.

02

Tax preparers helping clients with tax filings related to specific industries.

03

Organizations looking for guidance on accounting practices and reporting requirements.

Fill

form

: Try Risk Free

People Also Ask about

How long does it take to process I-918?

We do not charge a fee to file certain victim-based and humanitarian benefit requests, including Form I-918, and the initial Form I-765 associated with this form.

How long is the b1 b2 visa valid for?

While B-1 or B-2 visas may be valid up to 10 years, visitors on B-1 or B-2 will only be permitted to stay in the United States for a maximum of six months. For visits less than 90 days and from a participating country, you might qualify for the Visa Waiver Program.

How long is the I-918 supplement B valid?

Does the Form I-918, Supplement B, U Nonimmigrant Status Certification expire? Yes. The Form I-918, Supplement B, is valid only six months from the date of certification.

Who can fill out form I-918?

If an individual believes he or she may qualify for a U visa, then that individual or his or her representative will complete the USCIS Form I-918, Petition for U Nonimmigrant Status (Form I- 918), and submit it to U.S. Citizenship and Immigration Services (USCIS) with all relevant documentation, including Form I-918B,

How long is the EB1A green card valid for?

EB1A is Permanent The EB1A visa has no time limit to its validity, except that EB1A visa holders must apply to renew their EB1A visa every 10 years.

How long is the I 129F valid for?

The I-129F petition is valid for four months from the date of approval by USCIS. A consular officer can extend the validity of the petition if it expires before visa processing is completed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Publication 918?

Publication 918 is a document issued by the IRS that provides guidelines and information related to specific tax reporting requirements for certain taxpayers.

Who is required to file Publication 918?

Taxpayers who meet specific criteria outlined by the IRS regarding certain income types or deductions are required to file Publication 918.

How to fill out Publication 918?

To fill out Publication 918, taxpayers should follow the instructions provided in the publication itself, which typically includes providing personal information, detailing income sources, and reporting deductions if applicable.

What is the purpose of Publication 918?

The purpose of Publication 918 is to inform taxpayers about their tax obligations and provide guidance on compliance with tax reporting requirements.

What information must be reported on Publication 918?

Information that must be reported on Publication 918 includes personal identification details, income received, any applicable deductions, and other relevant tax-related details as specified in the publication.

Fill out your publication 918 - irs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Publication 918 - Irs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.