Get the free Certificate of Foreign Person’s Claim for Exemption From Withholding on Income Effec...

Show details

Este formulario se utiliza para reclamar una exención del impuesto de retención sobre ingresos que están efectivamente conectados con la realización de un comercio o negocio en los Estados Unidos.

We are not affiliated with any brand or entity on this form

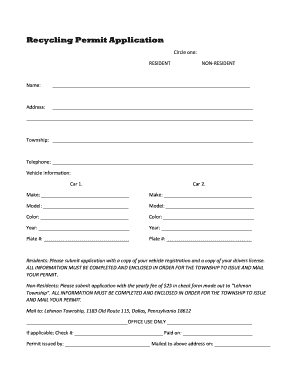

Get, Create, Make and Sign certificate of foreign persons

Edit your certificate of foreign persons form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your certificate of foreign persons form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing certificate of foreign persons online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit certificate of foreign persons. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out certificate of foreign persons

How to fill out Certificate of Foreign Person’s Claim for Exemption From Withholding on Income Effectively Connected With the Conduct of a Trade or Business in the United States

01

Obtain the Certificate of Foreign Person’s Claim for Exemption From Withholding on Income Effectively Connected With the Conduct of a Trade or Business in the United States form (IRS Form 8233).

02

Provide your name and identifying information in the personal details section.

03

Describe the type of income you are claiming exemption for in the designated section.

04

Include your foreign tax identifying number or TIN if applicable.

05

Declare your residency status and provide supporting documents if required.

06

Sign and date the form where indicated to certify the accuracy of the information provided.

07

Submit the completed form to the appropriate withholding agent or payor before the income payment is made.

Who needs Certificate of Foreign Person’s Claim for Exemption From Withholding on Income Effectively Connected With the Conduct of a Trade or Business in the United States?

01

Foreign individuals or entities who receive income connected to a trade or business in the U.S.

02

Non-residents seeking to claim exemption from U.S. tax withholding on certain types of income.

03

Those earning income from U.S. sources related to business activities.

Fill

form

: Try Risk Free

People Also Ask about

What is a certificate of exemption for?

A sales tax exemption certificate is an official document that allows a business to make purchases without paying the standard sales tax. This certificate is proof that the purchases are not subject to sales tax due to specific exemptions that apply to the business.

What does foreign person's US source income subject to withholding mean?

What is a 1042-S? A non-citizen is, in most cases, subject to U.S. tax on income from U.S. sources. Form 1042-S, Foreign Person's U.S. Source Income Subject to Withholding, is used to report amounts paid to foreign persons (including those presumed to be foreign) by a United States based institution or business.

What does certificate of exemption from withholding mean?

If an employee qualifies for exemption from withholding, the employee can use Form W-4 to tell the employer not to deduct any federal income tax from wages. This applies only to income tax, not to Social Security or Medicare tax.

Is it better to be tax-exempt or not?

Is It Good to Be Tax Exempt? There's no downside to being tax-exempt since it means that you're able to avoid paying tax on some or all of your income. For example, if you're investing in municipal bonds for passive income, you might appreciate not having to pay tax on the interest payments you receive from them.

Why did I receive a W-8BEN?

The W-8BEN is an Internal Revenue Service (IRS) mandated form to collect correct Nonresident Alien (NRA) taxpayer information for individuals for reporting purposes and to document their status for tax reporting purposes. (The form for entities is the W-8BEN-E.)

Is it good to claim exemption from withholding?

Claiming exempt is bad if you are going to owe taxes. Federal tax withholding is used to pay your taxes. If your are underwithheld pay you pay when you file, it you over withold you get a refund.

Why would someone be exempt from federal taxes?

Who Does Not Have to Pay Taxes? You generally don't have to pay taxes if your income is less than the standard deduction or the total of your itemized deductions, if you have a certain number of dependents, if you work abroad and are below the required thresholds, or if you're a qualifying non-profit organization.

Who needs to fill out W-8BEN E?

Who Must Provide Form W-8BEN-E. You must give Form W-8BEN-E to the withholding agent or payer if you are a foreign entity receiving a withholdable payment from a withholding agent, receiving a payment subject to chapter 3 withholding, or if you are an entity maintaining an account with an FFI requesting this form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Certificate of Foreign Person’s Claim for Exemption From Withholding on Income Effectively Connected With the Conduct of a Trade or Business in the United States?

The Certificate of Foreign Person’s Claim for Exemption From Withholding on Income Effectively Connected With the Conduct of a Trade or Business in the United States is a form used by foreign entities and individuals to inform payers that they are exempt from certain withholding taxes on income that is effectively connected with a trade or business they conduct within the U.S.

Who is required to file Certificate of Foreign Person’s Claim for Exemption From Withholding on Income Effectively Connected With the Conduct of a Trade or Business in the United States?

Foreign individuals or entities that receive income effectively connected with a U.S. trade or business and seek exemption from withholding taxes are required to file this certificate.

How to fill out Certificate of Foreign Person’s Claim for Exemption From Withholding on Income Effectively Connected With the Conduct of a Trade or Business in the United States?

To fill out the certificate, the applicant must provide their name, address, taxpayer identification number, the type of income, and details about the trade or business. It's important to ensure that all information matches IRS records to avoid issues.

What is the purpose of Certificate of Foreign Person’s Claim for Exemption From Withholding on Income Effectively Connected With the Conduct of a Trade or Business in the United States?

The purpose of the certificate is to establish a foreign person's or entity's eligibility for exemption from U.S. tax withholding on income that is effectively connected with their trade or business activities within the United States.

What information must be reported on Certificate of Foreign Person’s Claim for Exemption From Withholding on Income Effectively Connected With the Conduct of a Trade or Business in the United States?

The information required includes the name and address of the foreign person or entity, the U.S. taxpayer identification number (if applicable), the type of income that is being claimed for exemption, and a declaration of effective connection to a U.S. trade or business.

Fill out your certificate of foreign persons online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Certificate Of Foreign Persons is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.