Get the free Internal Revenue Service Letter - irs

Show details

This document details the IRS's denial of a taxpayer's request to change the accounting method for coal transportation and material handling costs related to electricity production.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign internal revenue service letter

Edit your internal revenue service letter form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your internal revenue service letter form via URL. You can also download, print, or export forms to your preferred cloud storage service.

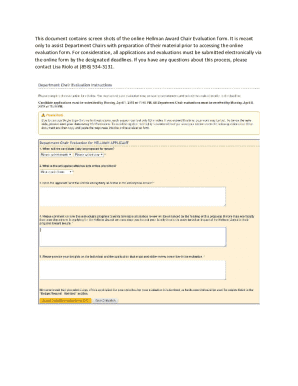

Editing internal revenue service letter online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit internal revenue service letter. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out internal revenue service letter

How to fill out Internal Revenue Service Letter

01

Gather all necessary personal information including your name, address, and Social Security number.

02

Review the IRS letter to understand what specific information is required.

03

If applicable, prepare any supporting documents requested by the IRS.

04

Clearly and concisely answer any questions or requests made in the letter.

05

Double-check for accuracy in your responses and documents to avoid errors.

06

Sign and date the letter as instructed.

07

Mail the completed letter and any supporting documents to the address provided in the IRS communication.

Who needs Internal Revenue Service Letter?

01

Individuals or entities who have received correspondence from the IRS requiring additional information or clarification.

02

Taxpayers who need to respond to a notice regarding their tax returns or accounts.

03

Anyone undergoing an audit or review by the IRS.

Fill

form

: Try Risk Free

People Also Ask about

How do I write a reasonable cause letter to the IRS?

When requesting abatement of penalties for reasonable cause, your statement should include supporting documentation and address the following items: The reason the penalty was charged. The daily delinquency penalty may be charged for either a late filed return, an incomplete return, or both.

How do I write a response letter to the IRS?

Reference the IRS Notice or Issue: Clearly mention why you're writing the letter. Include the notice number (found on the top of the IRS letter you received) and briefly describe the issue, like an unfilled tax return or a correction to your tax return.

Why is the internal revenue service sending me a letter?

If you receive an IRS notice or letter We may send you a notice or letter if: You have a balance due. Your refund has changed. We have a question about your return.

What does an official IRS letter look like?

The letter's formatting and language should be professional, with no typos, grammatical errors, or strange fonts. It should address you by name and refer to details specific to your tax situation, such as your Social Security number and tax years. IRS scammers won't have access to this kind of information.

How do I write a letter to the Internal Revenue Service?

6 Essential Tips for Writing a Letter to the IRS Follow the business letter format. Explain why you qualify for a penalty abatement. Include a copy of the IRS notice you received. Identify additional enclosures. Close the letter on a friendly note. Send your letter as soon as possible.

What is the difference between a 30 day letter and a 90 day letter?

The latter is a notice of deficiency. If you do not respond to the 30-day letter, or if you do not reach an agreement with an Appeals Officer, the IRS will send you a 90-day letter, which is also known as a notice of deficiency.

How do I write an official letter to the IRS?

6 Essential Tips for Writing a Letter to the IRS Follow the business letter format. Explain why you qualify for a penalty abatement. Include a copy of the IRS notice you received. Identify additional enclosures. Close the letter on a friendly note. Send your letter as soon as possible.

How do I contact the IRS about a letter?

If the letter doesn't appear in your search or if it looks suspicious, call 800-829-1040. Follow the IRS representative's instructions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Internal Revenue Service Letter?

An Internal Revenue Service Letter is a written communication from the IRS to taxpayers regarding specific tax-related issues, such as notices about tax returns, balances due, or requests for additional information.

Who is required to file Internal Revenue Service Letter?

Taxpayers who receive a letter from the IRS concerning discrepancies, audits, or requests for information are generally required to respond or file the necessary information specified in the letter.

How to fill out Internal Revenue Service Letter?

To respond to an IRS letter, carefully read the notice for instructions, gather necessary documentation, and provide the requested information in a clear format. Ensure to follow any specific guidelines outlined in the letter.

What is the purpose of Internal Revenue Service Letter?

The purpose of an Internal Revenue Service Letter is to inform taxpayers of important tax matters, such as auditing, outstanding balances, changes to tax filings, or additional information requested by the IRS.

What information must be reported on Internal Revenue Service Letter?

The specific information required on an IRS letter can vary, but it typically includes taxpayer identification details, the reason for the letter, deadlines for responses, and instructions for any required actions.

Fill out your internal revenue service letter online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Internal Revenue Service Letter is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.