Get the free IRS TAX TIP 2001-3 - irs

Show details

This document serves as a reminder from the IRS for newlyweds and recently divorced individuals to ensure that the names on their tax returns match those registered with Social Security to avoid potential

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign irs tax tip 2001-3

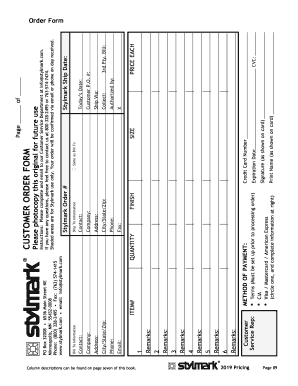

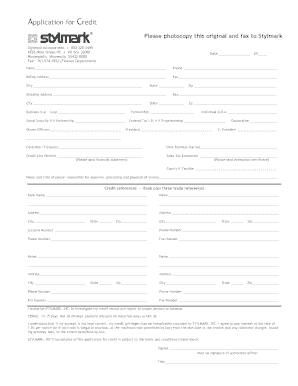

Edit your irs tax tip 2001-3 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs tax tip 2001-3 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing irs tax tip 2001-3 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit irs tax tip 2001-3. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out irs tax tip 2001-3

How to fill out IRS TAX TIP 2001-3

01

Read the IRS TAX TIP 2001-3 document carefully to understand its purpose.

02

Gather all necessary documents and information about your tax situation.

03

Follow the step-by-step instructions provided in the IRS TAX TIP 2001-3.

04

Fill out any required forms and schedules mentioned in the tip.

05

Ensure you provide accurate information; double-check for any errors.

06

If applicable, calculate any credits or deductions as specified.

07

Review your completed forms before submission.

08

File your forms with the IRS by the specified deadline.

Who needs IRS TAX TIP 2001-3?

01

Individuals who are preparing their taxes and want to understand specific IRS guidelines.

02

Taxpayers seeking information about tax credits, deductions, or other tax-related issues.

03

Tax professionals assisting clients with tax preparation and guidance.

Fill

form

: Try Risk Free

People Also Ask about

What is error code 2001 on IRS account?

If there are too many caches and PC junk on your computer, you can encounter the IRS Error Code 2001 too. To fix this, you just need to release your disk space or run disk cleanup. To run disk cleanup, you can do as follows. Press the Windows and S keys at the same time to open the Search window.

Why did I get $1400 from the IRS today?

An eligible taxpayer may receive up to $1,400, ing to the IRS. The stimulus amount is dependent on your adjusted gross income. In order to qualify for the full $1,400, the taxpayers' annual income must not have been more than $75,000 for single filers or $150,000 for married couples filing jointly.

How do I fix my rejected IRS return?

You should receive an explanation of why your return was rejected. If you made a mistake in entering a Social Security number, a payer's identification number, omitted a form, or misspelled a name, you can correct these errors and electronically file your tax return again.

How do I fix IRS reject code ind 517-01?

To correct reject code IND-517-01: Your client will have to file a paper return, with or without the dependent. If filing with the dependent, the dependent will need to file an amended return indicating they are a dependent on someone else's return.

What if the IRS says my SSN has already been used?

However, if your information is already correct and you haven't already e-filed a return this season, contact the IRS at 800-829-1040. The IRS will be able to help you figure out why your tax return was rejected due to an SSN that was already used.

How to fix reject code ind 507 01?

If the Social Security number is correct, you have three options Enter a valid Identity Protection PIN (IP PIN) and e-file. Locate your 2025 IP PIN - if you don't have one, you can visit Get an IP PIN. Remove the dependent from your return and e-file. Keep the dependent on your return and paper file.

What is the IRS tip rule?

The Internal Revenue Code requires employees to report (all cash tips received except for the tips from any month that do not total at least $20) to their employer in a written statement.

How do I fix e-file reject ind 517-01?

How do I fix e-file reject IND-517-01? Go to the Personal profile screen. Under Your household, select your dependent. Compare your dependent's Social Security number to the number on their Social Security card. If it's wrong: Select Edit to fix it.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is IRS TAX TIP 2001-3?

IRS TAX TIP 2001-3 is a publication providing guidance on tax-related issues for taxpayers, specifically focusing on certain deductions, credits, and filing requirements.

Who is required to file IRS TAX TIP 2001-3?

Individuals or entities that meet specific criteria outlined in the publication regarding income, deductions, and credits may be required to file under IRS TAX TIP 2001-3.

How to fill out IRS TAX TIP 2001-3?

To fill out IRS TAX TIP 2001-3, taxpayers need to follow the instructions provided in the document, ensuring they report the necessary information accurately and check for any additional forms that may be required.

What is the purpose of IRS TAX TIP 2001-3?

The purpose of IRS TAX TIP 2001-3 is to inform taxpayers about important tax issues, assist them in understanding their tax obligations, and provide guidance on how to correctly report certain tax information.

What information must be reported on IRS TAX TIP 2001-3?

The information that must be reported typically includes taxpayer identification details, income sources, deductions taken, and any credits claimed, as specified in the publication.

Fill out your irs tax tip 2001-3 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irs Tax Tip 2001-3 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.