Get the free I4684.cvt - irs

Show details

This document provides instructions for reporting gains and losses from casualties and thefts, along with guidelines for deductions and reimbursements related to such losses.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign i4684cvt - irs

Edit your i4684cvt - irs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your i4684cvt - irs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit i4684cvt - irs online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit i4684cvt - irs. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out i4684cvt - irs

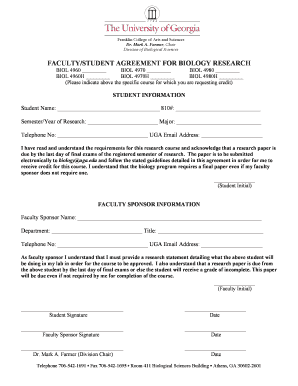

How to fill out I4684.cvt

01

Obtain the I4684.cvt form from the official website or local office.

02

Read the instructions carefully before starting the form.

03

Fill out your personal information in the designated fields.

04

Provide details of the property or event related to your claim.

05

List the damages or losses incurred in the appropriate section.

06

Attach any supporting documentation that may be required.

07

Review the completed form for accuracy and completeness.

08

Sign and date the form before submission.

Who needs I4684.cvt?

01

Individuals or entities that have suffered losses from a specific event.

02

Homeowners seeking compensation for property damage.

03

Businesses looking to claim insurance for lost income or asset damage.

04

Anyone involved in an incident that requires formal reporting for financial remediation.

Fill

form

: Try Risk Free

People Also Ask about

What is the IRS form for casualty loss?

Attach Form 4684 to your tax return to report gains and losses from casualties and thefts.

What is the maximum loss claim?

There's a limit on the total amount of Income Tax reliefs that you may claim for deduction from total income for a tax year. Loss relief is one of the reliefs affected. The limit is the higher of £50,000 and 25% of the adjusted total income of the year.

What qualifies as a theft loss deduction?

Casualty and theft losses are deductible losses that arise from the destruction or loss of a taxpayer's personal property. To be deductible, casualty losses must result from a sudden and unforeseen event. Theft losses generally require proof that the property was actually stolen and not just lost or missing.

Does TurboTax have form 4684?

The Form 4684 is scheduled to be available tomorrow, 02/27/2025, in TurboTax.

What is the maximum casualty loss for IRS?

Your net casualty loss doesn't need to exceed 10% of your adjusted gross income to qualify for the deduction, but you would reduce each casualty loss by $500 after any salvage value and any other reimbursement.

What is the limit for allowable loss?

Under the passive activity rules you can deduct up to $25,000 in passive losses against your ordinary income (W-2 wages) if your modified adjusted gross income (MAGI) is $100,000 or less. This deduction phases out $1 for every $2 of MAGI above $100,000 until $150,000 when it is completely phased out.

What is the IRS form 4684 used for?

Purpose of Form Use Form 4684 to report gains and losses from casualties and thefts. Attach Form 4684 to your tax return.

How much losses can you write off on taxes?

There are, however, limits when deducting a net capital loss from taxable income. This loss deduction is capped at $3,000 per year or $1,500 per year for married filing separately. If your client's losses exceed this amount, they can benefit from carryover losses in subsequent tax years.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is I4684.cvt?

I4684.cvt is a tax form used to report and claim deductions for casualty and theft losses.

Who is required to file I4684.cvt?

Individuals who have experienced casualty or theft losses and wish to claim these deductions on their tax return are required to file I4684.cvt.

How to fill out I4684.cvt?

To fill out I4684.cvt, taxpayers must provide details about the loss, including its type, cause, date, and value, and then calculate the deductible amount.

What is the purpose of I4684.cvt?

The purpose of I4684.cvt is to allow taxpayers to report and claim deductions for losses incurred due to theft or casualty, providing a means to offset taxable income.

What information must be reported on I4684.cvt?

The information that must be reported on I4684.cvt includes the description of the property, date of the loss, amount of loss, and any insurance reimbursements received.

Fill out your i4684cvt - irs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

i4684cvt - Irs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.