About IRS 1120-POL 2010 previous version

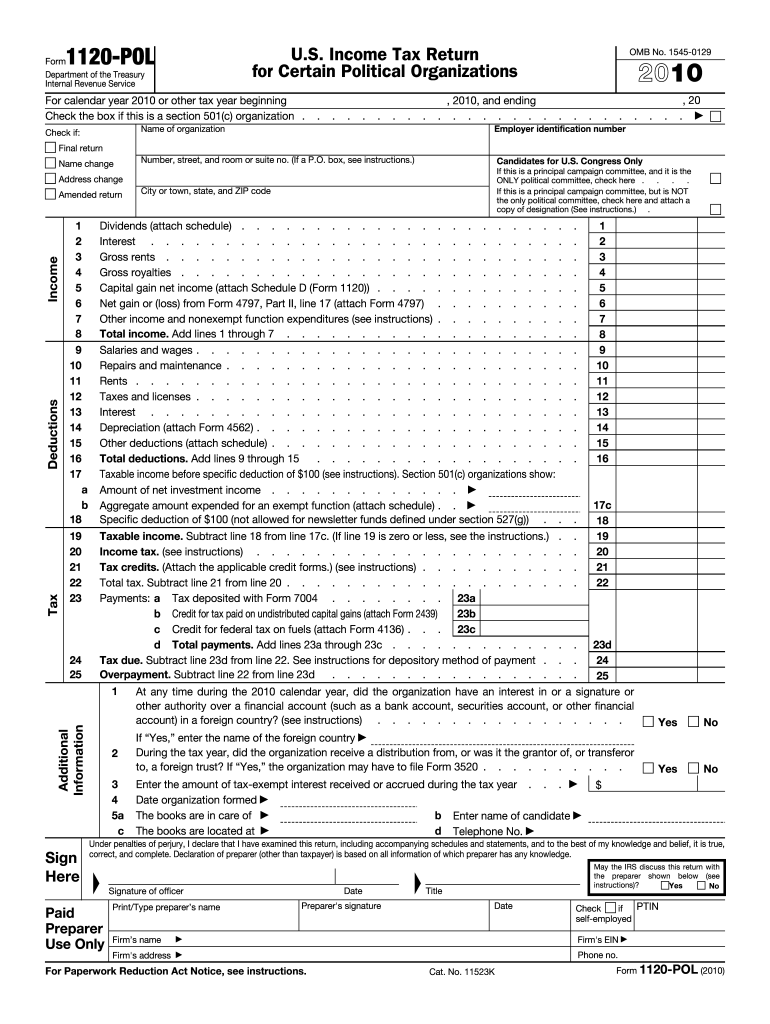

What is IRS 1120-POL?

IRS 1120-POL is the U.S. tax form designed specifically for political organizations. This form is utilized by organizations that are exempt from tax under Section 527 of the Internal Revenue Code. It is used to report income, claim deductions, and calculate tax liabilities for these organizations.

What is the purpose of this form?

The primary purpose of IRS 1120-POL is to report political organization income and tax obligations. It assists organizations in calculating taxes due on their investment income and other taxable items. Proper completion of this form ensures compliance with federal tax regulations for political entities.

Who needs the form?

Political organizations that expect to receive at least $100 of gross income are required to file IRS 1120-POL. This includes groups primarily involved in influencing the election of candidates or the passage or defeat of legislation. Non-profit political organizations and political committees also need this form for reporting purposes.

When am I exempt from filling out this form?

You are exempt from filling out IRS 1120-POL if your organization does not have taxable income. Political organizations with gross receipts of less than $100 for the tax year do not need to file. Additionally, organizations operating exclusively for educational purposes are not required to use this form.

Components of the form

IRS 1120-POL contains several key components, including sections for reporting income, deductions, and the calculation of taxes owed. Essential parts of the form include identifying the organization, detailing sources of income, and lists of expenses incurred during the tax year. It is important to provide accurate and comprehensive information in each component.

Due date

The due date for filing IRS 1120-POL is typically the 15th day of the 5th month after the end of your organization's tax year. For most organizations operating on a calendar year, this means the due date is May 15. However, if the date falls on a weekend or holiday, the due date is extended to the next business day.

What payments and purchases are reported?

IRS 1120-POL requires reporting income from various sources, including contributions, membership fees, and investment income. Expenditures for political activities and administrative costs also need to be documented. It is crucial to categorize these payments accurately for tax compliance.

How many copies of the form should I complete?

You should complete one copy of IRS 1120-POL for each tax filing, which is submitted to the IRS. However, it is advisable to keep a copy for your organization's records. This documentation can be crucial for future reference and compliance verification.

What are the penalties for not issuing the form?

Failing to file IRS 1120-POL can result in significant penalties. Organizations may face a fine calculated as a percentage of the amount of tax owed at the time of the missed filing. Continued failure to comply can lead to further enforcement actions from the IRS, including revocation of tax-exempt status.

What information do you need when you file the form?

When filing IRS 1120-POL, you need comprehensive financial details. This includes all income sources, relevant deductions, and the organization's identifying information. Accurate records of contributions and expenditures will also facilitate the correct filling of this form.

Is the form accompanied by other forms?

In most cases, IRS 1120-POL does not require accompanying forms unless there are specific deductions or credits claimed that necessitate additional documentation. It is important to review IRS guidelines to ensure compliance with any special filing requirements that may apply to your organization.

Where do I send the form?

IRS 1120-POL should be sent to the address specified by the IRS for the corresponding tax year. Generally, this will be a specific processing center depending on the organization's physical location. Ensure you check the IRS website or the form instructions for the latest mailing addresses.