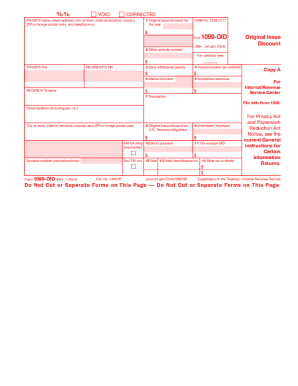

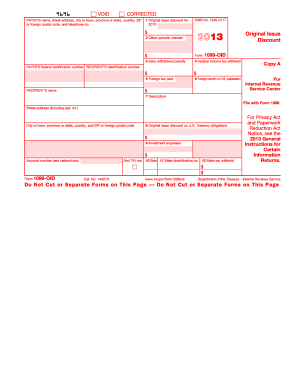

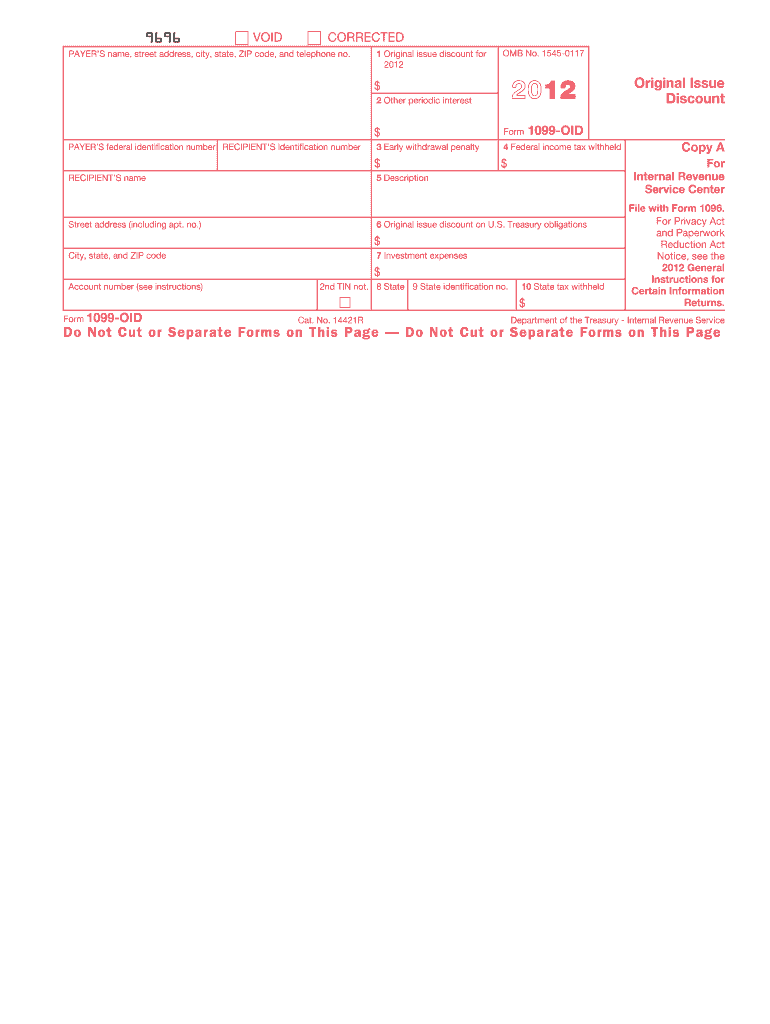

IRS 1099-OID 2012 free printable template

Instructions and Help about IRS 1099-OID

How to edit IRS 1099-OID

How to fill out IRS 1099-OID

About IRS 1099-OID 2012 previous version

What is IRS 1099-OID?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

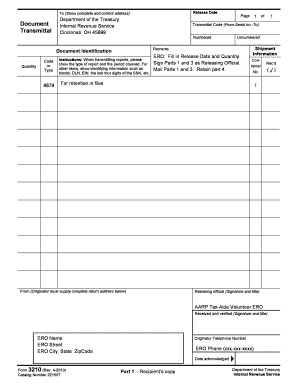

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1099-OID

What should I do if I need to correct a mistake on my 1099 OID 2012 form?

To correct an error on a 1099 OID 2012 form, you must file a corrected version of the form, indicating that it is a correction on the top of the form. Make sure to include the correct information and submit it to the IRS and recipients. It's crucial to address mistakes promptly to avoid any potential penalties.

How can I verify the receipt of my submitted 1099 OID 2012 form?

You can verify the receipt of your submitted 1099 OID 2012 form by checking the IRS e-file status, if you submitted electronically. The IRS typically sends an acknowledgment of receipt within 48 hours. Keep a copy of your submission and any confirmation for your records.

What should I do if my e-filed 1099 OID 2012 form gets rejected?

If your e-filed 1099 OID 2012 form is rejected, review the error codes provided by the IRS to understand the reasons for rejection. Correct any issues based on the feedback and resubmit as soon as possible. Make sure to track your resubmission to ensure it is accepted.

Are e-signatures acceptable for the 1099 OID 2012 form?

Yes, e-signatures are generally acceptable for the 1099 OID 2012 form as long as they meet the IRS's e-signature requirements, ensuring authenticity and integrity. Ensure that your e-signature solution complies with IRS regulations to facilitate smooth processing of the form.

What documentation should I prepare if I receive an IRS notice regarding my 1099 OID 2012 form?

If you receive an IRS notice concerning your 1099 OID 2012 form, prepare relevant documentation such as copies of the submitted forms, any correspondence from the IRS, and supporting records that validate the entries made on the form. Respond promptly to the notice with all requested documents to resolve any issues.