Get the free I1099-CAP - irs

Show details

This document provides detailed instructions for completing and filing Form 1099-CAP, which is used for reporting changes in corporate control and capital structure.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign i1099-cap - irs

Edit your i1099-cap - irs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your i1099-cap - irs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing i1099-cap - irs online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit i1099-cap - irs. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

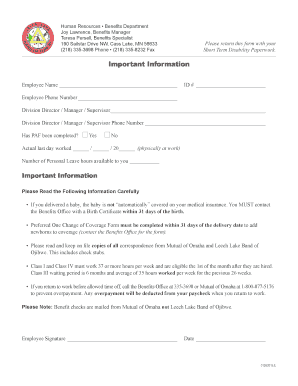

How to fill out i1099-cap - irs

How to fill out I1099-CAP

01

Obtain the Form I-1099-CAP from the IRS website or a tax professional.

02

Fill in your name and address in the appropriate fields at the top of the form.

03

Provide the recipient's information, including their name, address, and taxpayer identification number (TIN).

04

Enter the amount of compensation or cancellation of debt being reported in the designated box.

05

Indicate the type of entity involved (e.g., corporation, partnership, etc.) if applicable.

06

Check the appropriate boxes to show any additional information required, such as backup withholding.

07

Review the completed form for accuracy before submitting.

08

Submit the form to the IRS by the specified deadline, and provide a copy to the recipient.

Who needs I1099-CAP?

01

Businesses or individuals that have canceled a debt of $600 or more must provide Form I-1099-CAP to the IRS.

02

Corporations that experience changes in their capital structure where the cancellation of debt applies.

03

Taxpayers who are involved in debt cancellation transactions must also be aware of this form.

Fill

form

: Try Risk Free

People Also Ask about

Do I need to report a 1099 on taxes?

You must still report it on your tax return. Internal Revenue Service.

How much does a 1099 have to be to report it?

You should receive a Form 1099-NEC if you earned $600 or more in nonemployee compensation from a person or business who isn't typically your employer. You should receive Form 1099-MISC if you earned $600 or more in rent or royalty payments.

Can you fill out a 1099 by hand?

Yes, you can handwrite a 1099 or W2, but be very cautious when doing so. The handwriting must be completely legible using black ink block letters to avoid processing errors. The IRS says, “Although handwritten forms are acceptable, they must be completely legible and accurate to avoid processing errors.

What are the guidelines for a 1099?

The 2024 IRS 1099 rules for Form 1099-MISC (for 2025 filing information returns) require business payers to report payments of $600 or more for specified types of income and other payments, at least $10 in royalty payments, backup withholding of income taxes, and if your business made direct sales of at least $5,000 of

How do I submit a corrected 1099-NEC to the IRS?

Submit the corrected 1099 form to the recipient and prepare the red Copy A to send to the IRS with the Form 1096 transmittal if paper filing. For electronic filing, you do not need to send in a Form 1096, nor should you mail in the originally filed forms with the correction to the IRS.

Do you have to report a 1099-A on your tax return?

Form 1099-A contains several important pieces of information that you'll need to report the foreclosure, repossession, or abandonment of property on your tax return.

Do I have to enter a 1099s on my tax return?

If the property sales price is in excess of $250,000 for an individual or $500,000 for a married couple, regardless of the amount of gain, the IRS requires the sale to be reported on Form 1099-S.

Do I have to claim a 1099 on my taxes?

You should report all taxable income - regardless of whether it is documented on a 1099 or not. The IRS requires you to report all of your earnings, whether they come from traditional employment or other sources. For example, imagine you're a freelancer and did work for a business.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is I1099-CAP?

I1099-CAP is a form used to report changes in the ownership of a corporation, specifically the cancellation of indebtedness that occurs as part of a corporate reorganization or a stock transaction.

Who is required to file I1099-CAP?

Entities that are involved in corporate reorganizations or that take actions resulting in the cancellation of debt that must be reported to the IRS are required to file I1099-CAP.

How to fill out I1099-CAP?

To fill out I1099-CAP, you must provide information such as the corporation's name, address, taxpayer identification number, details of the transaction, and the amount of cancellation of indebtedness.

What is the purpose of I1099-CAP?

The purpose of I1099-CAP is to ensure that the IRS is informed about changes in corporate ownership and related tax implications, allowing for accurate taxation of income from canceled debts.

What information must be reported on I1099-CAP?

I1099-CAP must report the corporation's name, address, taxpayer identification number, the date of the transaction, the amount of debt canceled, and other relevant details about the transaction.

Fill out your i1099-cap - irs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

i1099-Cap - Irs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.