Get the free 8854 - irs

Show details

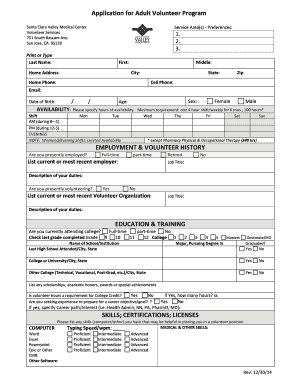

This form is used by U.S. citizens and long-term residents to provide information related to their expatriation and tax obligations under U.S. tax law.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 8854 - irs

Edit your 8854 - irs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 8854 - irs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 8854 - irs online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 8854 - irs. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 8854 - irs

How to fill out 8854

01

Gather your personal information including name, address, and Social Security Number.

02

Collect information on your foreign financial assets, including bank accounts and securities.

03

Fill out Part I of Form 8854 to provide your personal information and the year you're filing for.

04

Complete Part II, which addresses your foreign assets and provides details about their value.

05

Fill out Part III to report any financial accounts and any contributions to foreign trusts.

06

If applicable, fill out Part IV to provide information about your previous year compliance status.

07

Review the entire form for accuracy and ensure you have included all required signatures.

08

Submit Form 8854 along with your annual tax return to the IRS by the tax filing deadline.

Who needs 8854?

01

U.S. citizens who have expatriated and need to report their expatriation to the IRS.

02

Long-term residents of the U.S. who have given up their residency status.

03

Individuals who have met the income or net worth thresholds set by the IRS for reporting.

Fill

form

: Try Risk Free

People Also Ask about

Who needs to file form 8854?

Form 8854, titled “Initial and Annual Expatriation Statement,” is necessary for any U.S. citizen renouncing their citizenship or U.S. resident who lives abroad (known as “expats”).

What is the 8 year exit tax rule?

Green Card holders who have lived lawfully in the US for eight years in the last fifteen years may be subject to the exit tax regardless of their income, net worth, or filing compliance.

Is an expat still a U.S. citizen?

A Certificate of Loss of Nationality is prepared by the diplomatic or consular officer and submitted to the Department of State. Unless and until the Department of State approves the expatriation, the expat will remain a U.S. citizen, and will be subject to U.S. tax on worldwide assets.

What happens if you don't pay taxes for 8 years?

When you don't file taxes for an extended period, the IRS may eventually take notice and initiate a collection process. This process can include sending you notices, assessing penalties and interest, and taking more severe collection actions such as wage garnishment, tax liens, or levies on your property.

What does 8854 mean?

Form 8854 is used by expatriates to certify compliance with tax obligations in the 5 years before expatriation and to comply with their initial and annual information reporting obligations under section 6039G.

How does the US exit tax work?

The US exit tax is a tax on your worldwide assets. The tax applies to all property that you own on the date of renunciation, including personal items such as cars, boats, and jewelry. There are very few exceptions to this, such as foreign pensions you earned before becoming a US taxpayer.

How to avoid exit tax in the US?

With the right tax planning, you may be able to reduce or even avoid the exit tax altogether. If your net worth is close to $2 million, consider strategies to bring it below the threshold like gifting assets or restructuring holdings before giving up your citizenship or green card. Timing matters, too.

What is the 8 year rule IRS?

A lawful permanent resident (green card holder) for at least 8 of the last 15 years who ceases to be a U.S. lawful permanent resident may be subject to special reporting requirements and tax provisions. Refer to expatriation tax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 8854?

Form 8854 is a form used by individuals to certify their compliance with U.S. tax obligations and to report information relevant to expatriation, including those who renounce their U.S. citizenship or terminate their long-term residency.

Who is required to file 8854?

Individuals who have expatriated, meaning they have renounced their U.S. citizenship or terminated their long-term resident status, are required to file Form 8854.

How to fill out 8854?

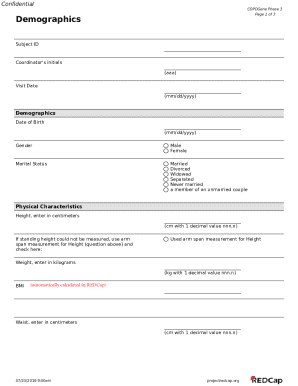

To fill out Form 8854, you will need to provide personal information, including your name, address, and taxpayer identification number, as well as details about your assets and liabilities on the date of expatriation, along with your tax compliance history.

What is the purpose of 8854?

The purpose of Form 8854 is to ensure that individuals who expatriate are compliant with U.S. tax laws and obligations, and to provide the IRS with necessary information regarding their financial situations and tax obligations.

What information must be reported on 8854?

Form 8854 requires reporting of personal details, tax compliance records, a balance sheet of assets and liabilities, and information regarding income and taxes for the final year of U.S. tax residency.

Fill out your 8854 - irs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

8854 - Irs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.