Get the free Instructions for Form 8275-R - irs

Show details

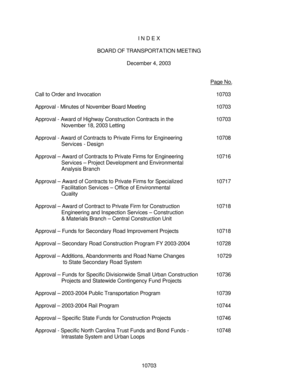

This document provides detailed instructions for taxpayers and tax preparers on how to properly disclose positions taken on a tax return that are contrary to Treasury regulations to avoid penalties.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign instructions for form 8275-r

Edit your instructions for form 8275-r form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your instructions for form 8275-r form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit instructions for form 8275-r online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit instructions for form 8275-r. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out instructions for form 8275-r

How to fill out Instructions for Form 8275-R

01

Obtain Form 8275-R from the IRS website or your tax professional.

02

Read the instructions carefully to ensure you understand the purpose of the form.

03

Begin with Part I: Identify the taxpayer’s name, address, and taxpayer identification number (TIN).

04

In Part II, provide a detailed explanation of the items for which you are making a disclosure.

05

Make sure to include any relevant code sections or regulations related to your disclosure.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form as required.

08

Submit the form along with your tax return to the IRS.

Who needs Instructions for Form 8275-R?

01

Taxpayers who are making a disclosure of items or positions that may be contrary to IRS rules.

02

Individuals or entities that wish to avoid penalties for underreporting tax.

03

Taxpayers claiming a position that is not in accordance with IRS regulations.

Fill

form

: Try Risk Free

People Also Ask about

Does staples have IRS forms?

From W-2 to 1099 forms to envelopes, our expert-curated selection has you covered and next-day delivery gets it all to you fast.

Where can I pick up federal and state tax forms?

By phone. To get federal tax forms, you can also call the IRS at 1-800-829-3676. In person. You can walk in and pick up your forms at an IRS Taxpayer Assistance Center (TAC). Elsewhere. Your local government offices may have federal and state tax forms.

How to use form 8275?

To adequately disclose items reported by a pass-though entity, you must complete and file a separate Form 8275 for items reported by each entity. To adequately disclose a position or positions related to more than one foreign entity, you must complete and file a separate Form 8275 for each foreign entity.

Where can I pick up IRS forms and instructions?

Get the current filing year's forms, instructions, and publications for free from the IRS. You can also find printed versions of many forms, instructions, and publications in your community for free at: Libraries. IRS Taxpayer Assistance Centers.

What are the IRS rules for adequate disclosure?

ing to the regulations, a gift is “adequately disclosed” when the Form 709 includes: (1) a description of the transferred property (including consideration received by the donor); (2) the identity of, and relationship between, the donor and each donee; (3) if a trust is involved , the trust EIN and either a brief

What is the difference between form 8275 and 8275 r?

on a Form 8275-R. represents a good-faith challenge to the validity of the regulation and has a reasonable basis. Instead of Form 8275-R, use Form 8275, Disclosure Statement, for the disclosure of items or positions which are not contrary to regulations but which are not otherwise adequately disclosed.

Where can I get federal tax forms and instructions?

Tax forms and publications Downloading from IRS Forms & Publications page. Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Instructions for Form 8275-R?

Instructions for Form 8275-R provide guidance on how to disclose certain items or positions taken on a tax return to avoid potential penalties. It helps taxpayers identify and report disclosures related to tax positions they believe to be correct but may not be fully addressed by the IRS.

Who is required to file Instructions for Form 8275-R?

Taxpayers who take a position on their tax return that may be contrary to IRS rules and want to disclose that position to avoid penalties are required to file Instructions for Form 8275-R.

How to fill out Instructions for Form 8275-R?

To fill out Instructions for Form 8275-R, taxpayers should provide their name, address, taxpayer identification number, describe the item or position being disclosed, and explain the basis for the position. Additionally, they must reference the relevant IRS sections or legal authority supporting their position.

What is the purpose of Instructions for Form 8275-R?

The purpose of Instructions for Form 8275-R is to allow taxpayers to disclose and explain certain positions taken on their tax returns, thus helping them avoid possible penalties related to undisclosed items that could be considered tax avoidance or evasion.

What information must be reported on Instructions for Form 8275-R?

Information that must be reported on Instructions for Form 8275-R includes a description of the item or position, the legal or factual basis for the position, the relevant IRS guidance, and any applicable facts that support the position taken on the tax return.

Fill out your instructions for form 8275-r online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Instructions For Form 8275-R is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.