Get the free Rental Income and Expenses (If

Show details

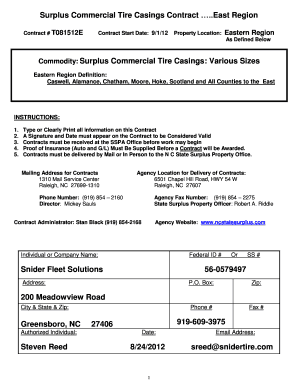

Publication 527 Cat. No. 15052W Department of the Treasury Internal Revenue Service Residential Rental Property (Including Rental of Vacation Homes) For use in preparing 2010 Returns Contents What's

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rental income and expenses

Edit your rental income and expenses form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rental income and expenses form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing rental income and expenses online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit rental income and expenses. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rental income and expenses

How to fill out rental income and expenses:

01

Collect all necessary documentation related to your rental property, including rental agreements, lease agreements, and invoices for expenses.

02

Create a spreadsheet or use accounting software to track your rental income and expenses. Include columns for the property address, tenant information, rental income, and various expense categories such as repairs, maintenance, property management fees, and insurance.

03

Record all rental income received during the specified time period. This includes rent from tenants, late fees, and any other income related to the rental property.

04

Document all expenses incurred during the same period. Categorize them appropriately, including property maintenance and repairs, property taxes, insurance premiums, advertising costs, utilities, and any other relevant expense.

05

Ensure that all income and expenses are accurately recorded. Double-check the calculations and review the documentation to avoid any mistakes.

06

Keep copies of all the supporting documents, such as receipts, invoices, and bank statements, for future reference and potential tax audits.

07

Consult with a tax professional or accountant to understand the tax implications and deductions related to your rental income and expenses.

08

File the rental income and expenses information on your tax return or provide it to your accountant to accurately report your rental activities.

Who needs rental income and expenses:

01

Individuals who own rental properties and receive rental income from tenants.

02

Landlords or property owners who want to track their rental income and expenses for financial management, tax reporting, or investment analysis purposes.

03

Property management companies that handle multiple rental properties and need to keep detailed records of rental income and expenses for clients.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is rental income and expenses?

Rental income refers to the payment received by a property owner for allowing others to use or occupy their property. Rental expenses, on the other hand, refer to the costs incurred by the property owner in maintaining and operating the rental property.

Who is required to file rental income and expenses?

Individuals or businesses who own rental properties and generate rental income are generally required to file rental income and expenses on their tax returns. However, specific requirements may vary depending on the jurisdiction and the amount of rental income obtained.

How to fill out rental income and expenses?

To fill out rental income and expenses, you need to gather records of rental income received and deductible expenses incurred during the tax year. This may include rent payments received, property maintenance expenses, mortgage interest, insurance, and other expenses directly related to the rental property. These records can be used to complete the appropriate sections of your tax return.

What is the purpose of rental income and expenses?

The purpose of reporting rental income and expenses is to accurately determine the taxable income derived from rental activities. By reporting these figures, the tax authorities can ensure that individuals or businesses are paying the appropriate amount of tax on their rental income and receiving any eligible deductions for rental expenses.

What information must be reported on rental income and expenses?

When reporting rental income and expenses, you typically need to provide information such as the total rental income you received, the types of deductible expenses you incurred, and any rental-related deductions you are claiming. It is important to keep accurate records of these transactions to support your reporting.

How do I edit rental income and expenses straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing rental income and expenses.

How do I complete rental income and expenses on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your rental income and expenses, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

How do I complete rental income and expenses on an Android device?

On an Android device, use the pdfFiller mobile app to finish your rental income and expenses. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

Fill out your rental income and expenses online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rental Income And Expenses is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.