Get the free 2013 Form 1041 (Schedule J). Accumulation Distribution for Certain Complex Trusts - irs

Show details

SCHEDULE J (Form 1041) Department of the Treasury Internal Revenue Service Name of trust Part I Accumulation Distribution for Certain Complex Trusts Attach Information OMB No. 1545-0092 2013 to Form

We are not affiliated with any brand or entity on this form

Instructions and Help about 2013 form 1041 schedule

How to edit 2013 form 1041 schedule

How to fill out 2013 form 1041 schedule

Instructions and Help about 2013 form 1041 schedule

How to edit 2013 form 1041 schedule

To edit the 2013 form 1041 schedule, you can utilize online tools such as pdfFiller. This platform allows you to upload the form, make necessary amendments, and save the updated version securely. Accessing the form through pdfFiller also enables you to leverage features like electronic signatures and cloud storage.

How to fill out 2013 form 1041 schedule

Filling out the 2013 form 1041 schedule involves several key steps. First, review the instructions that come with the form for clarity on what information is needed. Then, gather all relevant financial records associated with the estate or trust. Begin entering the information as required, ensuring accuracy to comply with IRS guidelines.

Latest updates to 2013 form 1041 schedule

Latest updates to 2013 form 1041 schedule

As of the last tax update, there have been no major changes to the 2013 form 1041 schedule. However, it is essential to stay informed about any IRS announcements regarding past forms that may affect filing procedures or compliance. Always refer to the IRS website for the most accurate and up-to-date information.

All You Need to Know About 2013 form 1041 schedule

What is 2013 form 1041 schedule?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About 2013 form 1041 schedule

What is 2013 form 1041 schedule?

2013 form 1041 schedule is an IRS form used to report income, deductions, gains, losses, etc., of estates and trusts. This schedule is specifically designed for fiduciaries who manage these financial entities. Completing the form accurately is crucial for compliance with federal tax regulations.

What is the purpose of this form?

The primary purpose of the 2013 form 1041 schedule is to report the income generated by an estate or a trust to ensure that it meets its tax obligations. This reporting aids the IRS in assessing tax liability and ensures proper taxation of the trust or estate's earnings. Correct completion helps in mitigating issues with the IRS regarding discrepancies in tax filings.

Who needs the form?

Fiduciaries responsible for managing estates or trusts must file the 2013 form 1041 schedule. This includes executors of estates, trustees of trusts, or other individuals tasked with managing these entities' financial affairs. Additionally, if the gross income of the estate or trust meets a specific threshold, filing is necessary.

When am I exempt from filling out this form?

You may be exempt from filling out the 2013 form 1041 schedule if the estate or trust has a gross income below a certain threshold set by the IRS. In addition, if the entire income generated is distributed to beneficiaries within the tax year, the form may not be required. It is important to review IRS guidelines for specific income thresholds for exemptions.

Components of the form

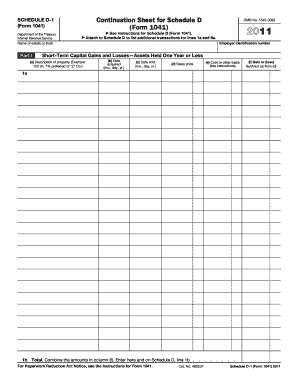

The 2013 form 1041 schedule consists of several components including income reporting sections, deduction entries, and a summary of distributions to beneficiaries. Specific lines on the schedule will require input regarding various income types, such as dividends, interests, and capital gains. Understanding each component is essential for accurate completion.

What are the penalties for not issuing the form?

The penalties for failing to issue the 2013 form 1041 schedule can include significant fines. Typically, the IRS charges a penalty based on the number of days the form is late, with a specific maximum penalty amount applied. It is crucial to file on time to avoid these fees and ensure compliance with tax laws.

What information do you need when you file the form?

When filing the 2013 form 1041 schedule, you will need detailed information regarding the estate or trust's income sources, deductions, and distributions. Essential information includes IRS identification numbers, the total income earned, expenses incurred, and amounts distributed to beneficiaries. Gather this data in advance for a smoother filing process.

Is the form accompanied by other forms?

The 2013 form 1041 schedule may need to be accompanied by other tax forms depending on the financial situation of the estate or trust. Commonly, you will need to attach forms reporting income and deductions, such as schedules for capital gains or rental income. Consulting IRS requirements for additional forms can ensure completeness in your filing.

Where do I send the form?

The submission address for the 2013 form 1041 schedule varies based on the location of the estate or trust. Generally, you should send the completed form to the address specified in the IRS instructions. If you're filing electronically, follow the guidelines provided by e-filing services to ensure proper submission.

See what our users say