Get the free Publicación 596SP - irs

Show details

Esta publicación proporciona información sobre el Crédito por Ingreso del Trabajo (EITC) para ayudar a los contribuyentes elegibles a reclamarlo en sus declaraciones de impuestos. Incluye ejemplos

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign publicacion 596sp - irs

Edit your publicacion 596sp - irs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your publicacion 596sp - irs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit publicacion 596sp - irs online

Follow the guidelines below to use a professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit publicacion 596sp - irs. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out publicacion 596sp - irs

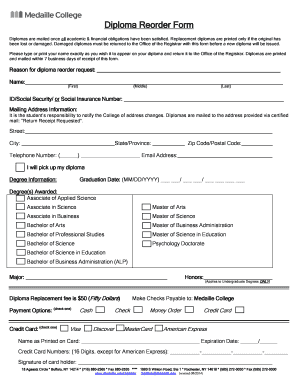

How to fill out Publicación 596SP

01

Begin by downloading the Publicación 596SP form from the official website.

02

Read the instructions provided on the first page to understand the necessary information needed.

03

Fill in your personal details, including your name, address, and taxpayer identification number.

04

Complete the sections that pertain to your income sources and deductions as required.

05

Make sure to check any specific instructions for the year you are filing for, as they may change annually.

06

Review all the information you have entered for accuracy before submission.

07

Print the completed form or save it as a PDF if submitting electronically.

08

Submit the form according to the instructions provided, either by mail or online.

Who needs Publicación 596SP?

01

Individuals or businesses that are required to report specific income types.

02

Taxpayers that have received certain types of payments or income that need to be reported to the IRS.

03

People needing to claim deductions or credits that are relevant to their reported income.

Fill

form

: Try Risk Free

People Also Ask about

How do I know if I received Earned Income Credit?

If you filed a 2022 tax return and received the EIC, it will be listed on IRS Form 1040, line 27.

How much is the refund for earned income credit?

California Qualifying Chart Number of Qualifying ChildrenState EITC Income LimitsState EITC Maximum Credits None $15,008 $223 1 $22,322 $1,495 2 $22,309 $2,467 3 or more $22,302 $2,775

Do you get money from earned income credit?

The Earned Income Tax Credit (EITC) helps low- to moderate-income workers and families get a tax break. If you qualify, you can use the credit to reduce the taxes you owe – and maybe increase your refund.

Why does the IRS hold refunds for earned income credit?

Why we hold your refund. By law, we can't issue EITC or ACTC refunds before mid-February. This includes your entire refund, not just the part that's related to the credit you claimed on your tax return. If you claim the EITC or ACTC, we may need more information from you about your return.

What do the letters in IRS stand for?

Internal Revenue Service (IRS) The Internal Revenue Service (IRS) is part of the U.S. Department of the Treasury and is responsible for enforcing and administering federal tax laws, processing tax returns, performing audits, and offering assistance for American taxpayers.

What does "irs" mean in English?

: abbreviation for Internal Revenue Service: the U.S. government department that is responsible for calculating and collecting taxes: The IRS grants tax exemptions for charities and community organizations.

Is Earned Income Credit refundable?

The credit can decrease or get rid of the taxes you owe. Also, the EIC is a "refundable" credit. This means that if your credit is more than the taxes you owe, the IRS pays you money - rather than you paying them money at tax time.

What does the word "irs" mean?

Internal Revenue Service Internal Revenue Service / Full name

What is the income limit for Earned Income Credit?

Overview. You may be eligible for a California Earned Income Tax Credit (CalEITC) up to $3,644 for tax year 2024 as a working family or individual earning up to $31,950 per year.

Is earned income a refundable credit?

The Earned Income Tax Credit (EITC) is a refundable credit that returns federal, State, and City tax dollars to qualifying families and individuals. Eligible taxpayers may claim the EITC when filing tax returns.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Publicación 596SP?

Publicación 596SP is a tax form used in certain jurisdictions for reporting specific financial information pertaining to individuals or entities.

Who is required to file Publicación 596SP?

Entities or individuals who meet certain criteria related to income, expenditures, or transactions within the reporting period are required to file Publicación 596SP.

How to fill out Publicación 596SP?

To fill out Publicación 596SP, individuals or entities must provide required information accurately, following the guidelines provided by the tax authority, and complete all necessary sections of the form.

What is the purpose of Publicación 596SP?

The purpose of Publicación 596SP is to ensure the accurate reporting of financial activities for tax assessment and compliance purposes.

What information must be reported on Publicación 596SP?

Publicación 596SP requires reporting of income sources, expenditures, any applicable tax deductions, and other relevant financial data.

Fill out your publicacion 596sp - irs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Publicacion 596sp - Irs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.