Get the free Form 1099-Q

Show details

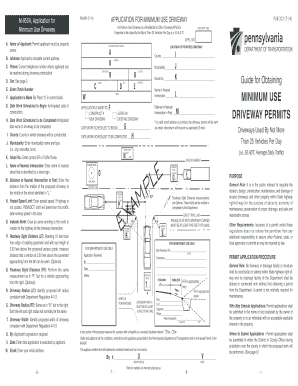

This document provides specific instructions for completing Form 1099-Q used for reporting payments from Qualified Education Programs under Sections 529 and 530. It outlines filing requirements, recipient

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 1099-q

Edit your form 1099-q form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 1099-q form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 1099-q online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 1099-q. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 1099-q

How to fill out Form 1099-Q

01

Obtain Form 1099-Q from the IRS website or your tax professional.

02

Gather the necessary information about the account holder and the beneficiary of the funds.

03

Fill in the payer’s information, including name, address, and taxpayer identification number (TIN).

04

Enter the recipient’s information, including name, address, and TIN.

05

Complete Box 1 with the total gross distribution amount.

06

Complete Box 2 with the earnings portion of the distribution.

07

Complete Box 3 with the basis or return of contributions.

08

If applicable, provide the account number in Box 4.

09

Check all information for accuracy before submission.

10

Provide copies to the recipient and file with the IRS.

Who needs Form 1099-Q?

01

Any educational institution that received distributions from a qualified tuition program (QTP).

02

Individuals who withdraw funds from a 529 plan or Coverdell Education Savings Account (ESA).

03

Financial institutions managing QTPs that must report distributions made during the tax year.

Fill

form

: Try Risk Free

People Also Ask about

What are qualified expenses for 1099-Q distributions?

Qualified expenses include tuition, fees, books, supplies, and equipment required for enrollment at an eligible school; expenses for room and board if the student is enrolled at least half-time; expenses for special needs services; and qualified elementary and secondary expenses (for ESA distributions only).

What is the penalty for a 1099-Q?

Form 1099-Q penalty Days latePenalty per return Up to 30 days $60 31 days late through August 1 $130 After August 1 or not filed $330 Intentional disregard $660

Is the 1099-Q the parent or student?

The person who reports the form depends on who received the distribution. If the funds were sent directly to the beneficiary, school, or student loan provider for the student's benefit, the student reports it. If the distribution was made to the parent (i.e., the account owner), then the parent reports it.

Who claims 1099Q, parent or student?

The person who reports the form depends on who received the distribution. If the funds were sent directly to the beneficiary, school, or student loan provider for the student's benefit, the student reports it. If the distribution was made to the parent (i.e., the account owner), then the parent reports it.

Do I have to report a 1099-Q on my tax return?

IRS Form 1099-Q is issued when you withdraw funds from a 529 plan or Coverdell ESA, detailing your total withdrawals, including earnings and basis. When you receive IRS Form 1099-Q, you'll need to report this information on your tax return if the distribution is used for non-qualifying expenses.

Do I have to report a 1099-Q on my tax return?

IRS Form 1099-Q is issued when you withdraw funds from a 529 plan or Coverdell ESA, detailing your total withdrawals, including earnings and basis. When you receive IRS Form 1099-Q, you'll need to report this information on your tax return if the distribution is used for non-qualifying expenses.

What is the penalty for not paying quarterly taxes?

If you don't pay your estimated taxes on time (or if you don't pay enough), the IRS can charge you a penalty. The amount you owe increases the longer you go without payment. The failure to pay penalty is 0.5% of the unpaid taxes for each month or part of a month you don't pay, up to 25% of your unpaid taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 1099-Q?

Form 1099-Q is a U.S. tax form used to report distributions from qualified education programs, such as 529 plans and Coverdell Education Savings Accounts (ESAs).

Who is required to file Form 1099-Q?

Financial institutions or entities that make distributions from qualified education programs are required to file Form 1099-Q. This includes universities, colleges, and plan administrators.

How to fill out Form 1099-Q?

To fill out Form 1099-Q, provide the payer's information, recipient's information, and details of the distributions made, including the total amount distributed and the earnings portion.

What is the purpose of Form 1099-Q?

The purpose of Form 1099-Q is to inform the IRS and the recipient about the amount of money withdrawn from qualified education accounts, which may affect the recipient's tax liability.

What information must be reported on Form 1099-Q?

Form 1099-Q must report the name, address, and taxpayer identification number (TIN) of both the payer and recipient, the account number, the total distributions for the calendar year, and the earnings portion of the distributions.

Fill out your form 1099-q online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 1099-Q is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.