About IRS 1120S 2010 previous version

What is IRS 1120S?

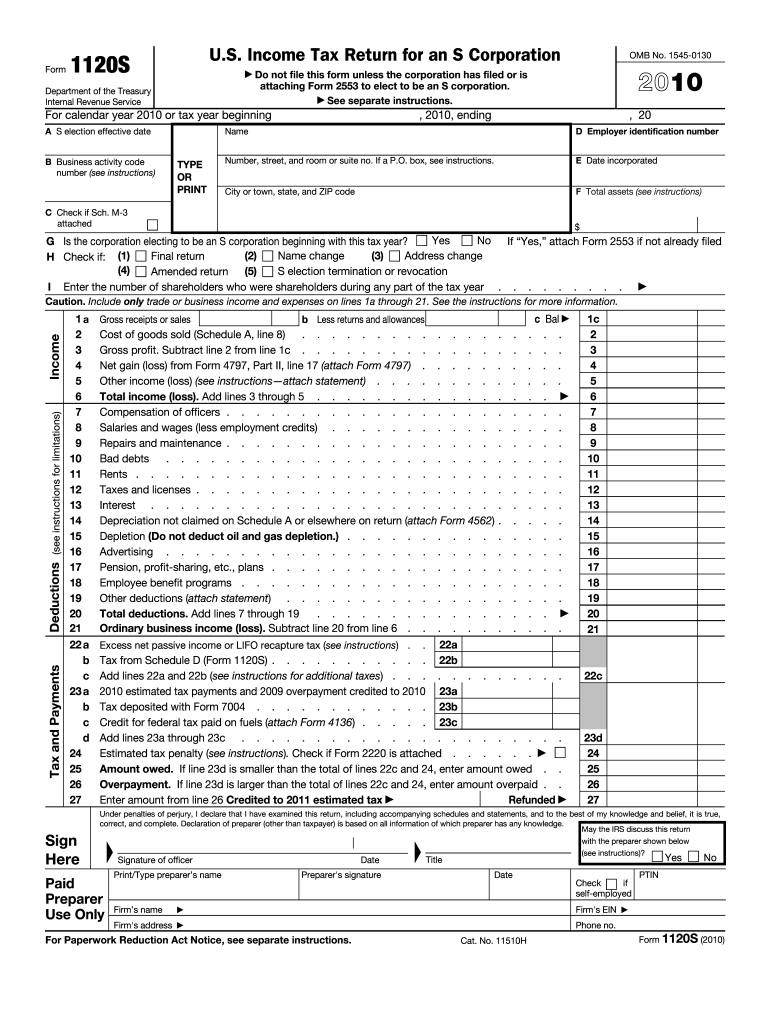

IRS Form 1120S is the tax return form that S corporations use for reporting income, gains, losses, and deductions. The form also allows S corporations to pass income directly to shareholders, avoiding double taxation commonly found in C corporations. By filing this form, S corporations convey their financial results to the IRS for a specific tax year.

What is the purpose of this form?

The purpose of IRS Form 1120S is to report the financial performance of an S corporation. This includes reporting income, deductions, credits, and other necessary tax information. Through this form, the IRS can assess the tax obligations of the S corporation and ensure compliance with federal regulations.

Who needs the form?

IRS Form 1120S must be filed by S corporations, which are corporations that have elected to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. Only eligible corporations that meet IRS criteria for S corporation status are required to use this form.

When am I exempt from filling out this form?

An S corporation may be exempt from filing IRS Form 1120S if it meets certain criteria, such as having no income, losses, or business transactions for the tax year. Furthermore, S corporations that have dissolved or have been terminated may not need to file if they do not engage in business activity.

Components of the form

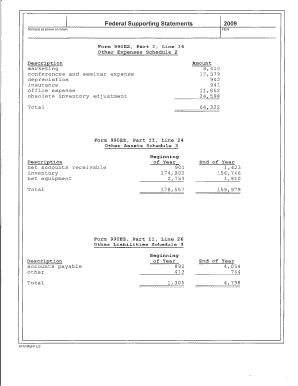

IRS Form 1120S consists of multiple sections, including a basic information section where the corporation's details are recorded, an income section for reporting revenues, a deductions section for expenses, and a tax credits section. Additionally, the form includes various schedules that provide supplementary information about specific expenses, shareholder details, and other financial activities.

Due date

The due date for filing IRS Form 1120S is typically the 15th day of the third month after the end of the tax year. For corporations operating on a calendar year, this means the form is due on March 15th. If the due date falls on a weekend or holiday, the deadline is extended to the next business day.

What payments and purchases are reported?

IRS Form 1120S requires S corporations to report all income received from sales, services, or investment activities. Additionally, the form captures expenses related to the ordinary course of business, such as salaries, rent, and utilities. These reported amounts are crucial for determining the corporation's tax liabilities.

How many copies of the form should I complete?

Typically, an S corporation should prepare one copy of IRS Form 1120S for submission to the IRS. However, it is advisable to keep a copy for the corporation's records and possibly provide one to each shareholder for their records, depending on individual tax needs and requirements.

What are the penalties for not issuing the form?

Failure to file IRS Form 1120S can result in penalties imposed by the IRS. If the form is filed late, the corporation may incur a penalty of $210 per month or part of the month for each month the return is late, multiplied by the number of shareholders in the corporation. Additionally, failure to report income accurately can result in further penalties and interest on owed taxes.

What information do you need when you file the form?

To file IRS Form 1120S, you need essential information such as the corporation's legal name, address, Employer Identification Number (EIN), total income, total assets, and detailed financial statements. Accurate records of shareholder distributions and any other relevant financial documents are also required for proper completion.

Is the form accompanied by other forms?

IRS Form 1120S is typically accompanied by several schedules that provide further detail on specific items reported on the form. This may include Schedule K-1, which details each shareholder's share of the income and deductions, as well as any other relevant schedules that pertain to credits, deductions, or special elections made by the corporation.

Where do I send the form?

IRS Form 1120S should be mailed to the address specified in the form's instructions, which varies based on the corporation's location and whether or not payment is included. It is crucial to ensure the form is sent to the correct address to avoid processing delays. For electronic filers, the submission can be completed through authorized e-file services.