Get the free Form 8907

Show details

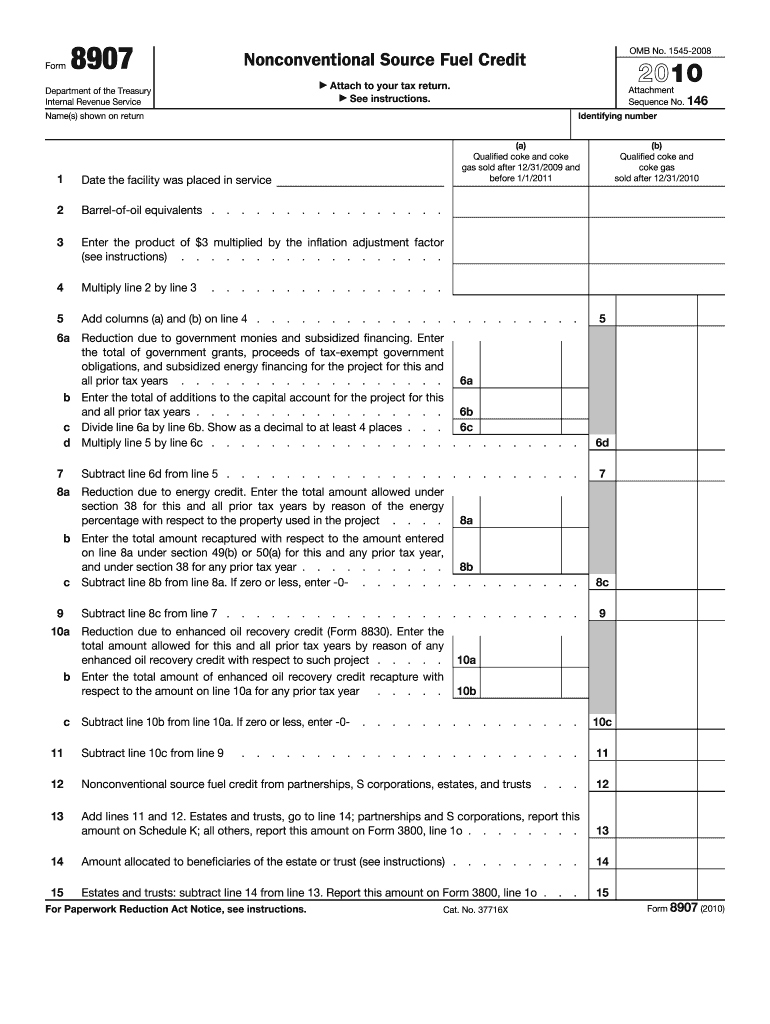

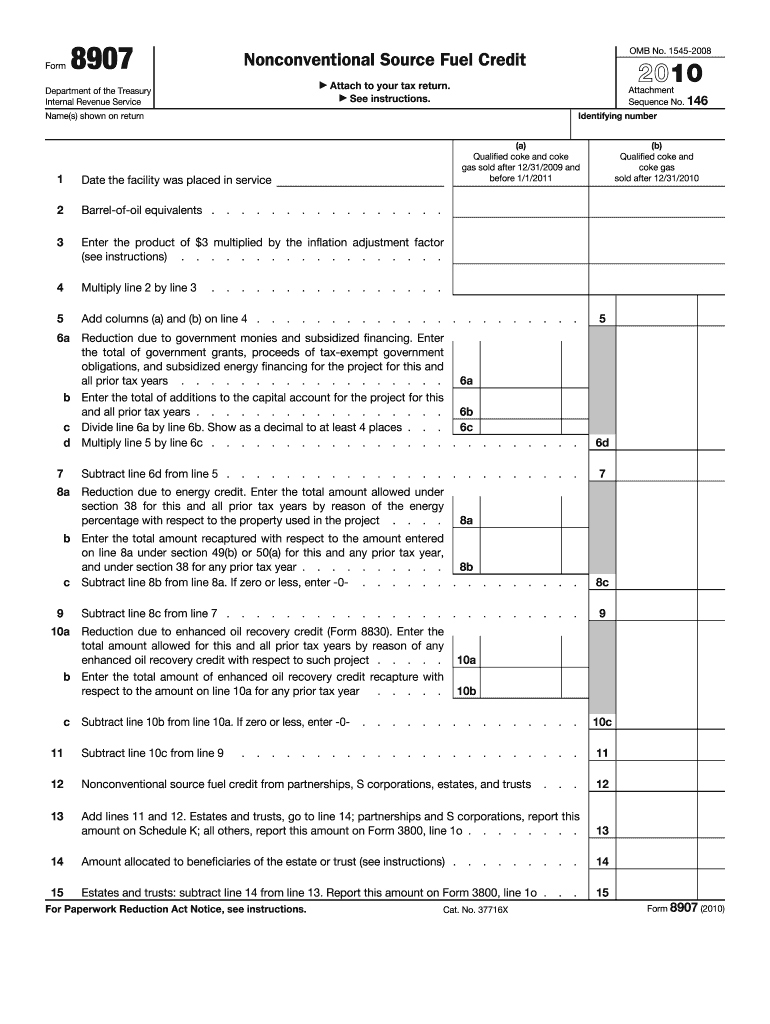

Use Form 8907 to figure the nonconventional source fuel credit, which is allowed for qualified coke or coke gas produced and sold to an unrelated person during the tax year. The credit is part of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 8907

Edit your form 8907 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 8907 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 8907 online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form 8907. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 8907

How to fill out Form 8907

01

Download Form 8907 from the IRS website or obtain a physical copy.

02

Fill in your personal information at the top of the form, including your name, address, and Social Security number.

03

Review the instructions provided with the form to understand the specific tax year and section you're applying for.

04

Complete Part I by providing information on the qualified turf expenses incurred.

05

Move to Part II, where you calculate the credit based on your expenses and any limitations that apply.

06

Review all filled sections for accuracy.

07

Sign and date the form before submitting it to the IRS.

Who needs Form 8907?

01

Form 8907 is typically needed by taxpayers who qualify for the turfgrass industry tax credit, including businesses involved in growing or managing turf.

Fill

form

: Try Risk Free

People Also Ask about

What is the nonconventional source fuel credit?

The Nonconventional Fuels (Section 29) Tax Credit went into effect in 1980, following energy shortages and deep concern about American dependence on imported oil. Congress sought to encourage production of oil and natural gas from “nonconventional” sources, such as Devonian shale, tight formations, and coalbeds.

What is the Federal Alternative Fuel credit?

The amount of the credit is 50 cents per gasoline gallon equivalent of propane, which equates to approximately 37 cents per gallon of propane. Under IRS guidance, whether the seller or the user of propane is eligible for the Alternative Fuel Tax Credit depends on the circumstances.

What is Form 145 in English?

Form 145 is a form used in Spain for workers to communicate to their employer certain personal and family data that affect tax withholdings on their income. These withholdings are applied to earned income, such as wages and salaries, and are used to pay Personal Income Tax (IRPF).

Who qualifies for the fuel tax credit?

For consumers who purchase and qualified alternative fuel vehicle refueling property for their principal residence, including electric vehicle charging equipment, between December 31, 2022, and January 1, 2033, the tax credit equals 30% of the cost with a maximum amount of $1,000 per item (for each charging

What are examples of nonconventional fuels?

The credit is available only for nontaxable uses of gasoline, aviation gasoline, undyed diesel and undyed kerosene. Nontaxable uses are purposes where fuel isn't used for regular driving purposes, such as: On a farm for farming purposes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 8907?

Form 8907 is used to claim the credit for the production of electricity from certain renewable sources for the tax year.

Who is required to file Form 8907?

Taxpayers who produce energy from qualified renewable sources and wish to claim the corresponding tax credit are required to file Form 8907.

How to fill out Form 8907?

To fill out Form 8907, taxpayers need to provide information about their renewable energy production, calculate the credit amount based on their production, and complete the required sections of the form.

What is the purpose of Form 8907?

The purpose of Form 8907 is to allow taxpayers to claim a tax credit for the production of clean, renewable energy, thereby incentivizing investments in renewable energy technologies.

What information must be reported on Form 8907?

Form 8907 requires reporting information such as the type of renewable energy produced, the amount of energy produced, and calculations to determine the eligible credit amount.

Fill out your form 8907 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 8907 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.