Get the free Forma 13844

Show details

Este formulario se utiliza para solicitar una reducción del cargo administrativo para entrar en un acuerdo de plan de pago a plazos. La reducción está disponible para individuos cuyo ingreso cae

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign forma 13844

Edit your forma 13844 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your forma 13844 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing forma 13844 online

To use the services of a skilled PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit forma 13844. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

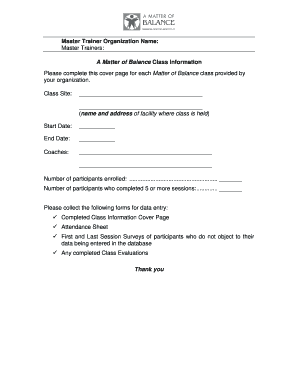

How to fill out forma 13844

How to fill out Forma 13844

01

Obtain Forma 13844 from the official website or designated local office.

02

Read the instructions carefully before starting to fill out the form.

03

Provide your personal information including name, address, and contact information in the specified sections.

04

Fill out the details regarding your income and tax information accurately.

05

Review the eligibility requirements and ensure you meet them before completing the form.

06

Sign and date the form at the end, confirming that the information is correct.

07

Submit the completed form to the designated authority either online or by mail as instructed.

Who needs Forma 13844?

01

Individuals who are eligible for tax credits or deductions.

02

Taxpayers seeking to report specific financial information to the tax authorities.

03

People applying for financial assistance programs that require tax documentation.

Fill

form

: Try Risk Free

People Also Ask about

What is form 13844?

Form 13844, Application For Reduced User Fee For Installment Agreements, is a formal document created by the IRS to reduce user fees for taxpayers who are not already classified as low-income and are applying for a tax resolution plan.

Do I need form 8453?

A signed Form 8453 U.S. Individual Income Tax Transmittal for an IRS e-file Return must be attached to a federal partnership or corporation return whenever a taxpayer electronically files a business return without the assistance of a Paid Preparer.

What is IRS form 13844?

If you believe that you meet the requirements for low-income taxpayer status, but the IRS did not identify you as a low-income taxpayer, please review Form 13844: Application for Reduced User Fee for Installment Agreements PDF for guidance.

What disqualifies you from an IRS payment plan?

The IRS might deny a payment plan if you have incomplete tax filings, owe for multiple periods, or lack consistent compliance with tax laws.

What is pro forma to English?

The term pro forma (Latin for "as a matter of form" or "for the sake of form") is most often used to describe a practice or document that is provided as a courtesy or satisfies minimum requirements, conforms to a norm or doctrine and tends to be performed perfunctorily or is considered a formality.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Forma 13844?

Forma 13844 is a tax form used in certain jurisdictions for reporting specific financial information to tax authorities. It may be related to income reporting, deductions, or credits.

Who is required to file Forma 13844?

Typically, individuals or entities that meet specific income thresholds or engage in particular financial activities as defined by the tax authority are required to file Forma 13844.

How to fill out Forma 13844?

To fill out Forma 13844, gather all necessary financial documents and information. Follow the instructions provided with the form carefully, ensuring all sections are filled out accurately and completely before submission.

What is the purpose of Forma 13844?

The purpose of Forma 13844 is to ensure compliance with tax regulations by providing the tax authority with detailed information regarding an individual's or entity's financial activities during a specific tax year.

What information must be reported on Forma 13844?

Typically, Forma 13844 requires reporting of income, deductions, credits, and other pertinent financial information relevant to the taxpayer's financial status for the reporting period.

Fill out your forma 13844 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Forma 13844 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.