Get the free 8038-R

Show details

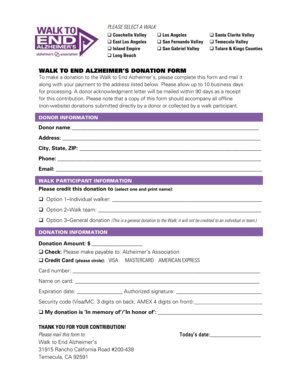

Form 8038-R is used by issuers of state and local bonds to request a refund of amounts paid with Form 8038-T, including yield reduction payments, arbitrage rebates, and related penalties.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 8038-r

Edit your 8038-r form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 8038-r form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 8038-r online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 8038-r. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 8038-r

How to fill out 8038-R

01

Obtain Form 8038-R from the IRS website or appropriate source.

02

Write the Issuer's name, address, and Employer Identification Number (EIN) at the top of the form.

03

Indicate the date of the issue of the bonds in the appropriate section.

04

Detail the type of bonds being issued, typically 'qualified bonds,' and their purpose.

05

Fill out the section regarding the issue price and the total amount of the bonds.

06

Report any applicable redemption details and terms as required.

07

Complete the signatures of the authorized official and the date.

08

Review the form for accuracy and completeness.

09

Submit the completed form to the IRS within the specified deadlines.

Who needs 8038-R?

01

State and local government entities that issue qualified bonds.

02

Organizations that need to report the issuance of tax-exempt bonds.

Fill

form

: Try Risk Free

People Also Ask about

What are the risks of tax-free bonds?

Investing in municipal bonds involves risks such as interest rate risk, credit risk and market risk. The value of the portfolio will fluctuate based on the value of the underlying securities. There are special risks associated with investments in high yield bonds, hedging activities and the potential use of leverage.

What is the tax-exempt bond form?

More In Forms and Instructions Issuers of tax-exempt private activity bonds use Form 8038 to provide the IRS with the information required by Internal Revenue Code section 149 and to monitor the requirements of Internal Revenue Code sections 141 through 150.

What is the purpose of a tax-exempt form?

A sales tax exemption certificate is an official document that allows a business to make purchases without paying the standard sales tax. This certificate is proof that the purchases are not subject to sales tax due to specific exemptions that apply to the business.

What is form 8038 G?

Issuers of tax-exempt governmental obligations use this form to: provide the IRS information required by Internal Revenue Code section 149(e), and. monitor the requirements of Internal Revenue Code sections 141 through 150.

What is the IRS overpayment form?

Use Form 843 to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and additions to tax.

How do I know if my bond interest is tax-exempt?

Interest on a bond that is used to finance government operations generally is not taxable if the bond is issued by a state, the District of Columbia, a U.S. possession, or any of their political subdivisions.

What is a tax-exempt bond form?

(IRS) Form 8038 Form required to establish and maintain the federal income tax-exempt status of the Interest on Tax-Exempt Bonds. Depending upon the type of transaction, Issuers of Tax-Exempt Bonds are required to file one of the forms in the IRS Form 8038 series to report the issuance of Tax-Exempt Bonds to the IRS.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 8038-R?

Form 8038-R is a tax form used by issuers of tax-exempt bonds to report information regarding a redemption of those bonds.

Who is required to file 8038-R?

Any issuer of tax-exempt bonds that redeems bonds and wants to report the redemption to the IRS must file Form 8038-R.

How to fill out 8038-R?

To fill out Form 8038-R, you will need to provide details about the issuer, the bonds being redeemed, including the redemption date, amount, and any relevant financial details. Follow the IRS instructions specific to the form for detailed steps.

What is the purpose of 8038-R?

The purpose of Form 8038-R is to report the redemption of tax-exempt bonds to the IRS and to provide transparency and compliance regarding tax-exempt financing.

What information must be reported on 8038-R?

The information required on Form 8038-R includes the issuer's name and address, the issue date of the bonds, the redemption date, the amount of bonds redeemed, and details related to the tax-exempt status.

Fill out your 8038-r online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

8038-R is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.