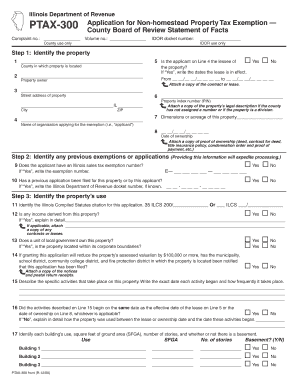

Get the free circular e 2009 form

Show details

The 2008. For wages paid before January 1 2009 see Publication 15 Circular E For Use in 2008. Omnibus Budget Reconciliation Act of 1985 COBRA provides certain former employees retirees spouses former spouses and dependent children the right to temporary continuation of health coverage at group rates. Xml Page 1 of 40 of Publication 15 t Draft Ok to Print Init. date 13 47 - 29-MAY-2009 The type and rule above prints on all proofs including departm...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign circular e 2009 form

Edit your circular e 2009 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your circular e 2009 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing circular e 2009 form online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit circular e 2009 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out circular e 2009 form

How to fill out circular e 2009 form:

01

Gather all necessary information: You will need to know your employer's information, including their name, address, and employer identification number (EIN). You will also need your own personal information, such as your name, social security number, and address.

02

Complete the top section of the form: Provide your name, address, and social security number in the designated fields. Then, enter your employer's information in the corresponding spaces.

03

Fill out the income section: In this section, you will report your total wages, tips, and other compensation received from your employer. You will also need to indicate any federal income tax withheld from your paycheck.

04

Report your income tax withheld: If any federal income tax was withheld from your wages throughout the year, make sure to enter this amount in the appropriate box.

05

Calculate your adjustments: If you have any deductions or adjustments to your income, such as contributions to a retirement plan or health savings account, you can report them on this form.

06

Determine your tax liability: Based on the income and adjustments you have reported, use the provided tax tables or the worksheet to calculate the amount of tax you owe.

07

Claim any credits: If you are eligible for any tax credits, such as the child tax credit or the earned income credit, make sure to include them on the form.

08

Sign and date the form: Once you have completed all the necessary sections, don't forget to sign and date the form. If you are filing jointly with your spouse, they will also need to sign the form.

Who needs circular e 2009 form?

01

Employers: Employers are required to complete and provide circular e 2009 forms to their employees. This form serves as a summary of the employee's income, tax withholdings, and other related information for the tax year.

02

Employees: Employees who receive wages, tips, or other compensation from their employer need circular e 2009 forms to accurately report their income and taxes owed when filing their personal tax returns.

03

Self-employed individuals: Self-employed individuals who have employees and are responsible for withholding and paying federal taxes also need circular e 2009 forms for record-keeping and reporting purposes.

Note: It is important to consult with a tax advisor or refer to the Internal Revenue Service (IRS) website for the most up-to-date information and instructions on filling out the circular e 2009 form, as tax regulations may change over time.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find circular e 2009 form?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the circular e 2009 form in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I edit circular e 2009 form in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing circular e 2009 form and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I fill out circular e 2009 form on an Android device?

Use the pdfFiller app for Android to finish your circular e 2009 form. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is circular e form?

Circular E form is a form used for reporting wage and tax information to the Internal Revenue Service (IRS).

Who is required to file circular e form?

Employers who pay wages to employees and are subject to federal income tax withholding, social security tax, or Medicare tax, are required to file Circular E form.

How to fill out circular e form?

Circular E form can be filled out electronically using tax software or manually by entering the required information in the designated fields.

What is the purpose of circular e form?

The purpose of Circular E form is to report wage and tax information to the IRS, including the amount of wages paid, taxes withheld, and any adjustments or corrections.

What information must be reported on circular e form?

Circular E form requires the reporting of employee names, social security numbers, wages paid, federal income tax withheld, social security tax withheld, Medicare tax withheld, and any other relevant tax information.

Fill out your circular e 2009 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Circular E 2009 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.