Get the free publication 1546

Show details

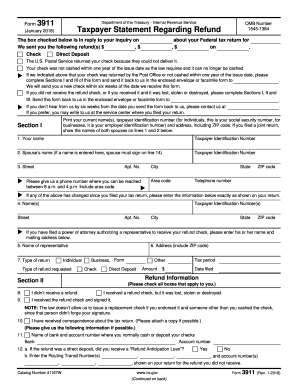

TROUBLESOME TAX ISSUES Can t See the Forest for the Trees IRS Contact TAS It s Free Publication 1546 Rev. 1-2010 Catalog Number 13266S Department of the Treasury Internal Revenue Service www.irs.gov West Virginia 425 Juliana Street Room 2019 Parkersburg WV 26101 Phone 304-420-8695 FAX 304-420-8660 Wisconsin 211 W. Wisconsin Avenue Room 507 Stop 1005 MIL Milwaukee WI 53203 Phone 414-231-2390 FAX 414-231-2383 Wyoming 5353 Yellowstone Road Cheyenne ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign publication 1546 form

Edit your publication 1546 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your publication 1546 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit publication 1546 form online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit publication 1546 form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out publication 1546 form

How to fill out publication 1546:

01

Start by gathering all the necessary information and forms required to complete publication 1546.

02

Read through the instructions provided in publication 1546 carefully to understand the requirements and guidelines for filling it out.

03

Fill in your personal details, such as your name, address, and social security number, as requested on the form.

04

Provide accurate and complete information for each section of the publication, ensuring that all required fields are properly filled in.

05

Remember to attach any supporting documents or additional forms that may be required as specified in publication 1546.

06

Double-check your answers and review the filled-out form to ensure accuracy and completeness before submitting it.

Who needs publication 1546:

01

Individuals who have received income from sources other than their regular employment may need to fill out publication 1546.

02

Taxpayers who have earned income from sources such as rent, royalties, partnerships, or business activities are typically required to complete publication 1546.

03

Additionally, anyone who has received income from foreign sources or has foreign financial accounts may also need to fill out this publication to comply with tax regulations and reporting requirements.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in publication 1546 form without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing publication 1546 form and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I create an electronic signature for signing my publication 1546 form in Gmail?

Create your eSignature using pdfFiller and then eSign your publication 1546 form immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I edit publication 1546 form on an Android device?

You can edit, sign, and distribute publication 1546 form on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is IRS Publication 1546?

IRS Publication 1546 is a document published by the Internal Revenue Service that provides information regarding tax-exempt organizations.

Who is required to file IRS Publication 1546?

Organizations applying for tax-exempt status under section 501(c) of the Internal Revenue Code are required to use IRS Publication 1546.

How to fill out IRS Publication 1546?

To fill out IRS Publication 1546, organizations should carefully follow the instructions provided in the publication, ensuring they include all necessary information regarding their purpose, activities, and governance.

What is the purpose of IRS Publication 1546?

The purpose of IRS Publication 1546 is to guide organizations through the process of applying for tax-exempt status and to explain the responsibilities associated with maintaining that status.

What information must be reported on IRS Publication 1546?

Organizations must report their specific activities, financial information, governance structure, and any relevant operational details on IRS Publication 1546.

Fill out your publication 1546 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Publication 1546 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.