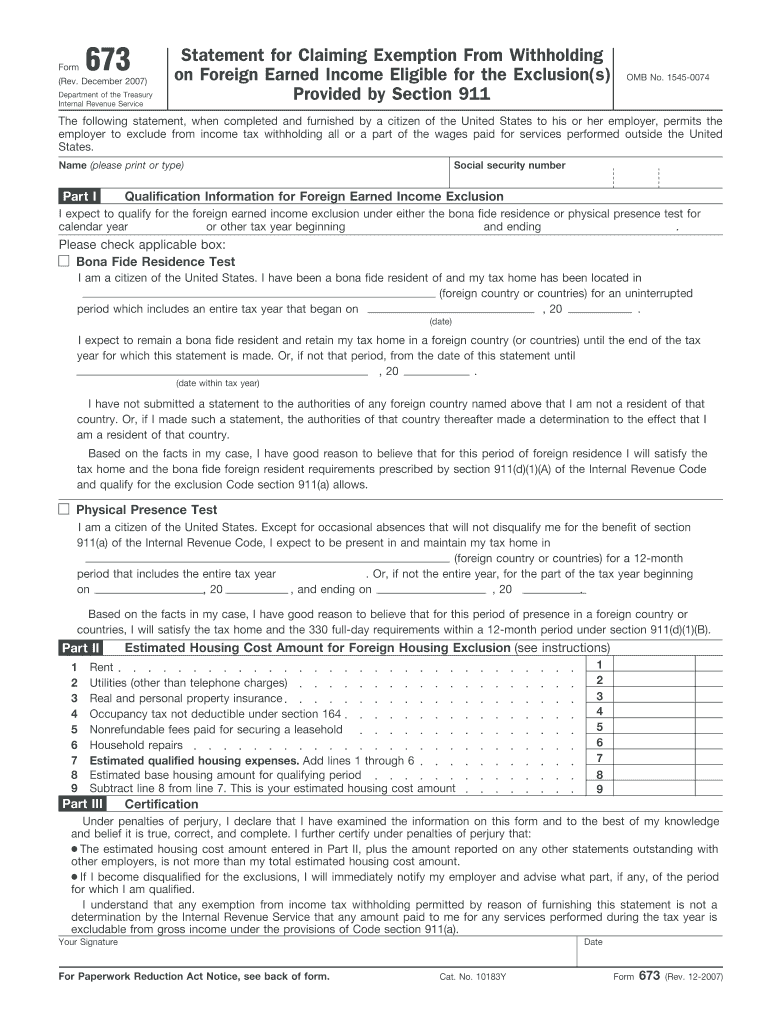

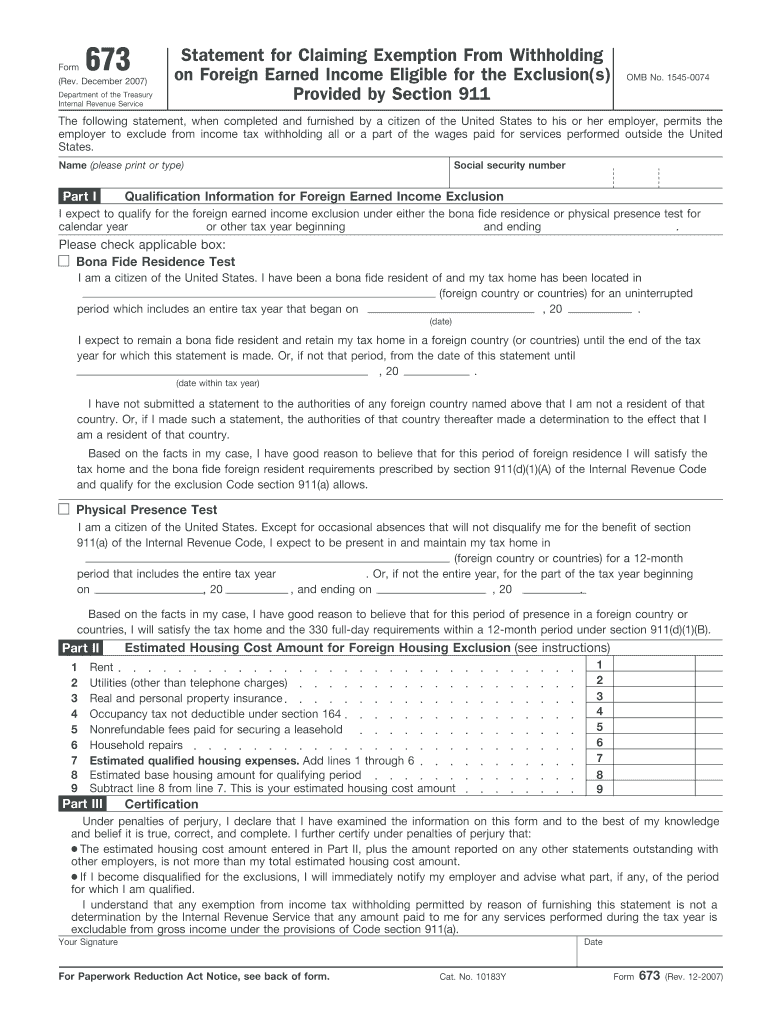

IRS 673 2007 free printable template

Get, Create, Make and Sign form 673 - irs

How to edit form 673 - irs online

Uncompromising security for your PDF editing and eSignature needs

IRS 673 Form Versions

How to fill out form 673 - irs

How to fill out IRS 673

Who needs IRS 673?

Instructions and Help about form 673 - irs

All right for this video I wanted to cover the IRS form 673 this is the form that is the statement for claiming an exemption from withholding on foreign earned income that is otherwise going to be eligible for exclusion under section 911. Section 911 is the foreign earned income exclusion uh part of the tax code, so I've got the form in front of us we'll go through this, and then I've got a slide here where uh we're going to lay out some of the rules who can qualify for this and what this whole form is designed to do right um so the 673 form uh some basics first here when you're a U.S. taxpayer, so you're you're a U.S. citizen you are subject to tax on your worldwide income it doesn't matter where it comes from you're also subject to tax even if you don't live in the United States right so if you're an expat, or you're a dual citizen, and you live and work outside the United States you still need to be filing form 1040s every year reporting your income and paying taxes on those wages' investment income and everything else that...

People Also Ask about

Is form 673 required?

What is a form 673 for payroll?

What is the form for overseas tax exemption?

Who completes form 673?

Who qualifies for form 673?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get form 673 - irs?

How do I edit form 673 - irs in Chrome?

How can I edit form 673 - irs on a smartphone?

What is IRS 673?

Who is required to file IRS 673?

How to fill out IRS 673?

What is the purpose of IRS 673?

What information must be reported on IRS 673?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.