Get the free Form 13981

Show details

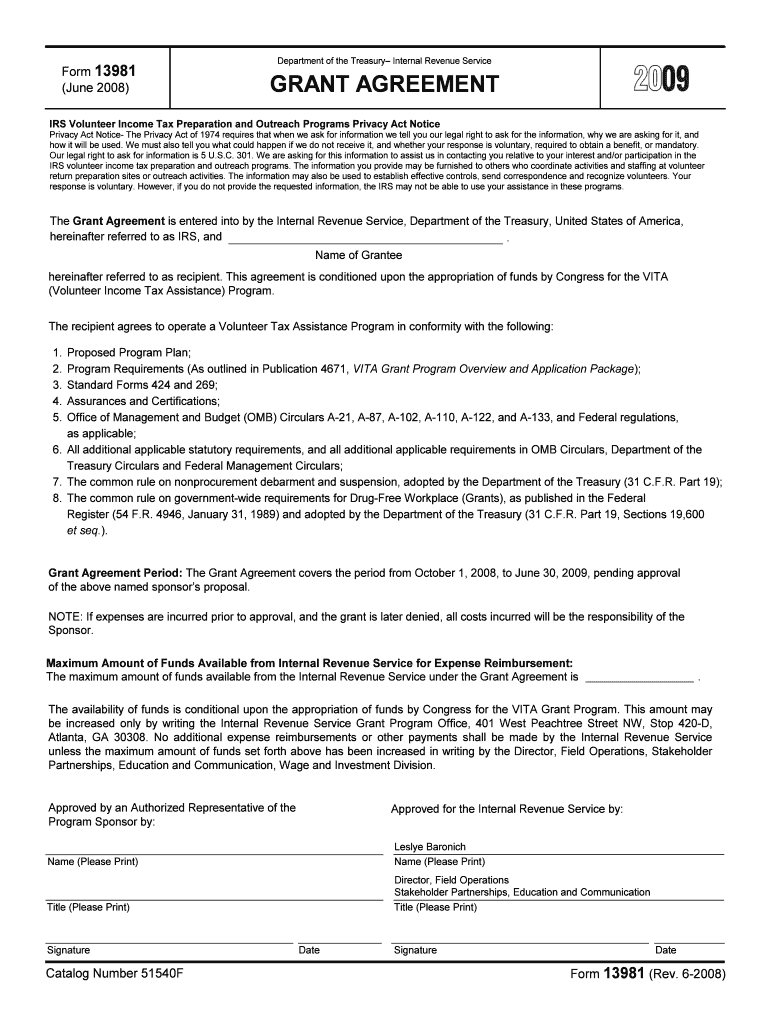

This Grant Agreement is between the IRS and the grantee for operating a Volunteer Tax Assistance Program. It outlines legal rights, program requirements, funding conditions, and compliance regulations

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 13981

Edit your form 13981 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 13981 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 13981 online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form 13981. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 13981

How to fill out Form 13981

01

Obtain Form 13981 from the official IRS website or your local tax office.

02

Read the instructions provided with the form carefully to understand the requirements.

03

Complete the identification section by providing your name, address, and Social Security number.

04

Fill out the relevant sections according to the information you need to report or claim.

05

Review the completed form for accuracy to ensure all information is correct.

06

Sign and date the form at the bottom where indicated.

07

Submit the form either electronically or by mailing it to the appropriate IRS address as specified in the instructions.

Who needs Form 13981?

01

Individuals who are seeking to claim a refund for an overpayment of tax.

02

Taxpayers who need to correct errors in their previous tax returns.

03

Anyone eligible for benefits related to tax credits or deductions.

Fill

form

: Try Risk Free

People Also Ask about

How much is a Vita grant?

The amount of award depends on the applicant's reach and returns expected to be prepared by the program. The expected amounts of individual Federal awards range from $5,000 to $2,000,000.

What is the IRS Vita grant?

The IRS offers the VITA and TCE supporting grants to IRS partner organizations that operate Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs. These grants support free tax preparation service for underserved communities.

What is the purpose of vita?

The Volunteer Income Tax Assistance (VITA) program is an IRS and community-sponsored program designed to assist low to moderate income taxpayers with the preparation of their annual tax returns at no cost.

Who qualifies for the IRS forgiveness program?

The IRS ultimately determines whether you qualify for debt forgiveness. However, the agency generally considers taxpayers who meet these criteria: a total tax debt balance of $50,000 or less, and a total income below $100,000 for individuals (or $200,000 for married couples).

What is the income limit for IRS Vita for seniors?

In-person IRS help for seniors and low-income taxpayers Volunteer Income Tax Assistance – The VITA program is generally for people who make $64,000 or less, people with disabilities and limited English-speaking taxpayers.

What is a cp138 form?

This notice tells you that all or part of the overpayment on a return you filed was applied to other federal taxes you owe.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 13981?

Form 13981 is a tax form used by certain organizations to report information regarding their activities, programs, and financial details to the regulatory authorities.

Who is required to file Form 13981?

Organizations that meet specific criteria, such as certain tax-exempt organizations and non-profits, are required to file Form 13981.

How to fill out Form 13981?

To fill out Form 13981, organizations must provide accurate financial information, details about their operations, and ensure compliance with applicable regulations prior to submission.

What is the purpose of Form 13981?

The purpose of Form 13981 is to ensure transparency and accountability of organizations by requiring them to disclose their operational and financial data.

What information must be reported on Form 13981?

Form 13981 must report details including organizational name, address, purpose, financial statements, and a summary of activities conducted during the reporting period.

Fill out your form 13981 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 13981 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.