Get the free W-3c PR

Show details

El Formulario W-3c PR se utiliza para enviar el original de uno o varios Formularios 499R-2c/W-2cPR, Corrección al Comprobante de Retención, a la Administración del Seguro Social (SSA). Proporciona

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign w-3c pr

Edit your w-3c pr form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your w-3c pr form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing w-3c pr online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit w-3c pr. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out w-3c pr

How to fill out W-3c PR

01

Start by obtaining a copy of the W-3c PR form from the IRS website.

02

Enter your name as it appears on your tax return in the 'Employer's Name' field.

03

Fill in your Employer Identification Number (EIN) in the appropriate box.

04

Indicate the tax year for which the corrections are being made.

05

Complete the boxes for the total number of Forms W-2c being submitted.

06

Provide the total amount of wages, tips, and other compensation corrected.

07

Fill in the social security and Medicare tax amounts that have been adjusted.

08

Ensure that all information is accurate and that there are no errors.

09

Sign and date the form, certifying that the information is correct.

10

Submit the completed W-3c PR form to the IRS and provide copies to applicable employees.

Who needs W-3c PR?

01

Employers who have made corrections to previously submitted Forms W-2.

02

Any organization that needs to report changes to wage and tax information due to errors.

Fill

form

: Try Risk Free

People Also Ask about

What is a W 3c form?

File Forms W-2c (Corrected Wage and Tax Statement) and W-3c (Transmittal of Corrected Wage and Tax Statement) as soon as possible after you discover an error. Also, provide a Form W-2c to the employee as soon as possible.

Is there another name for W3?

A W-3 form, also known as the Transmittal of Wage and Tax Statements form, summarizes your organization's wages and employee contributions for the tax year.

What is the meaning of W-3?

Form W-3 is also known as “Transmittal of Wage and Tax Statements.” What employers really need to know: As an employer, your responsibility is to review all W-2s for your workforce, summarize employee wages and tax information, and then combine that data into one W-3 form.

What does W3 mean?

The World Wide Web -- also known as the web, or W3 -- refers to all the public websites or pages that users can access on their local computers and other devices through the internet. These pages and documents are interconnected by means of hyperlinks that users click on for information.

What is another name for W3?

Form W-3 (a.k.a. the Transmittal of Wage and Tax Statementsopens in a new tab) is an Internal Revenue Service (IRS) tax form used by employers to summarize to the Social Security Administration (SSA) a tax year's combined total wages, taxable wages, and withholding amounts for all employees.

Where does the W3 come from?

Much of the information reported on Form W-3 comes straight from the W-2 forms completed for your employees. This generally includes the total amount of: taxable wages, tips, and other compensation paid to employees. wages and tips subject to Social Security and Medicare taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

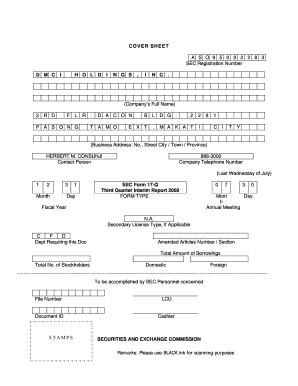

What is W-3c PR?

W-3c PR is a form used to report corrected annual submissions of wage and tax information to the Social Security Administration (SSA) specifically for Puerto Rico.

Who is required to file W-3c PR?

Employers who need to correct previously filed W-2c forms or correct wage and tax information related to employees in Puerto Rico are required to file W-3c PR.

How to fill out W-3c PR?

To fill out W-3c PR, employers must provide corrected information such as employer information, employee details, and specific corrections for wages and taxes. Instructions can be found on the SSA website or the form itself.

What is the purpose of W-3c PR?

The purpose of W-3c PR is to ensure accurate reporting of wages and tax information for employees in Puerto Rico and to correct any discrepancies from prior submissions.

What information must be reported on W-3c PR?

The information that must be reported on W-3c PR includes the employer's and employee's identification details, corrected wages, taxes withheld, and any other relevant corrections to the prior W-2 information.

Fill out your w-3c pr online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

W-3c Pr is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.