Get the free 1120-W

Show details

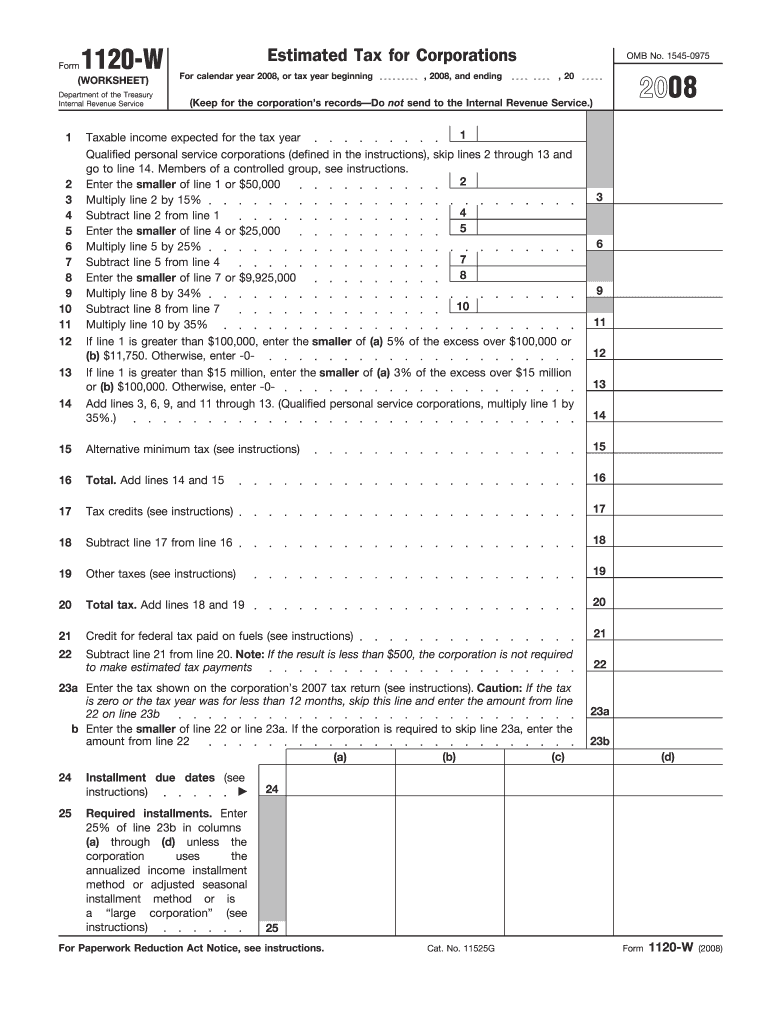

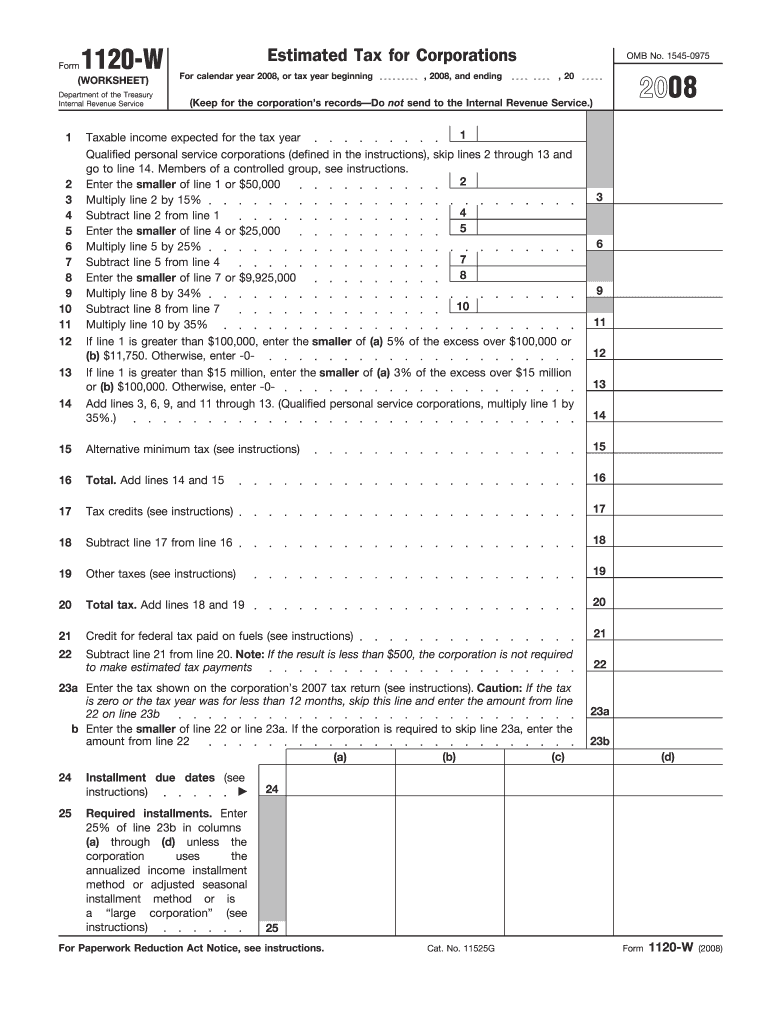

This form is used by corporations to calculate their estimated tax liability for the year. It includes instructions for determining taxable income and required installment payments based on various

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 1120-w

Edit your 1120-w form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 1120-w form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 1120-w online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 1120-w. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 1120-w

How to fill out 1120-W

01

Obtain Form 1120-W from the IRS website or your tax professional.

02

Complete the identification section, providing your corporation's name, address, and Employer Identification Number (EIN).

03

Estimate your taxable income for the year.

04

Calculate your estimated tax liability based on applicable tax rates.

05

Fill out the estimated tax payments section, indicating how much you plan to pay each quarter.

06

Review the form for accuracy and completeness.

07

Submit the form to the IRS along with any required payment by the due date.

Who needs 1120-W?

01

C Corporations that expect to owe tax of $500 or more when filing their return.

02

Corporations that have income from various sources, including investments and operations.

03

Businesses that wish to avoid penalties by making estimated tax payments throughout the year.

Fill

form

: Try Risk Free

People Also Ask about

What is the extended due date for 1120 with June 30 year end?

There's an exception to the normal due date for certain fiscal-year corporate filers, though. A corporation with a fiscal year ending June 30 must file Form 1120 by the 15th day of the third month after the end of its tax year - by September 15.

Is the 1120-W discontinued?

Beginning with tax year 2023, Form 1120-W, Estimated Tax For Corporations, is no longer used to calculate the estimated tax due.

What is form 1120-W used for?

Form 1120-W, "Estimated Tax for Corporations," is a planning tool used by corporations to calculate and pay their estimated tax liability on a quarterly basis. It's used to manage cash flow and ensure compliance with IRS requirements to avoid underpayment penalties.

What are the rules for 1120 estimated tax payments?

The corporation must make installment payments of estimated tax if it expects its total tax for the year (less applicable credits) to be $500 or more. The installments are due by the 15th day of the 4th, 6th, 9th, and 12th months of the tax year.

What does 1120 translate to in English?

We can write the number 1120 in words as One Thousand One Hundred Twenty.

When was 1040EZ discontinued?

Form 1040EZ was a shortened version of Form 1040 for taxpayers with basic tax situations. The form was discontinued as of the 2018 tax year and replaced with the redesigned Form 1040.

What is 1120-W?

Form 1120-W, "Estimated Tax for Corporations," is a planning tool used by corporations to calculate and pay their estimated tax liability on a quarterly basis. It's used to manage cash flow and ensure compliance with IRS requirements to avoid underpayment penalties.

What is a 1120 tax form used for?

Purpose of Form Use Form 1120, U.S. Corporation Income Tax Return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 1120-W?

Form 1120-W is the Estimated Tax for Corporations form used by corporations to estimate their tax liability for the current year.

Who is required to file 1120-W?

Corporations that expect to owe tax of $500 or more when they file their return must file Form 1120-W.

How to fill out 1120-W?

To fill out Form 1120-W, corporations need to estimate their income, deductions, and tax credits for the year, and then calculate their estimated tax liability based on those figures.

What is the purpose of 1120-W?

The purpose of Form 1120-W is to help corporations calculate and pay estimated tax payments throughout the year to avoid penalties at the time of filing their annual tax return.

What information must be reported on 1120-W?

Form 1120-W requires reporting of estimated income, deductions, tax credits, total tax liability, and any prepayments on estimated tax.

Fill out your 1120-w online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

1120-W is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.