Get the free 940 form and instructions 2007

Show details

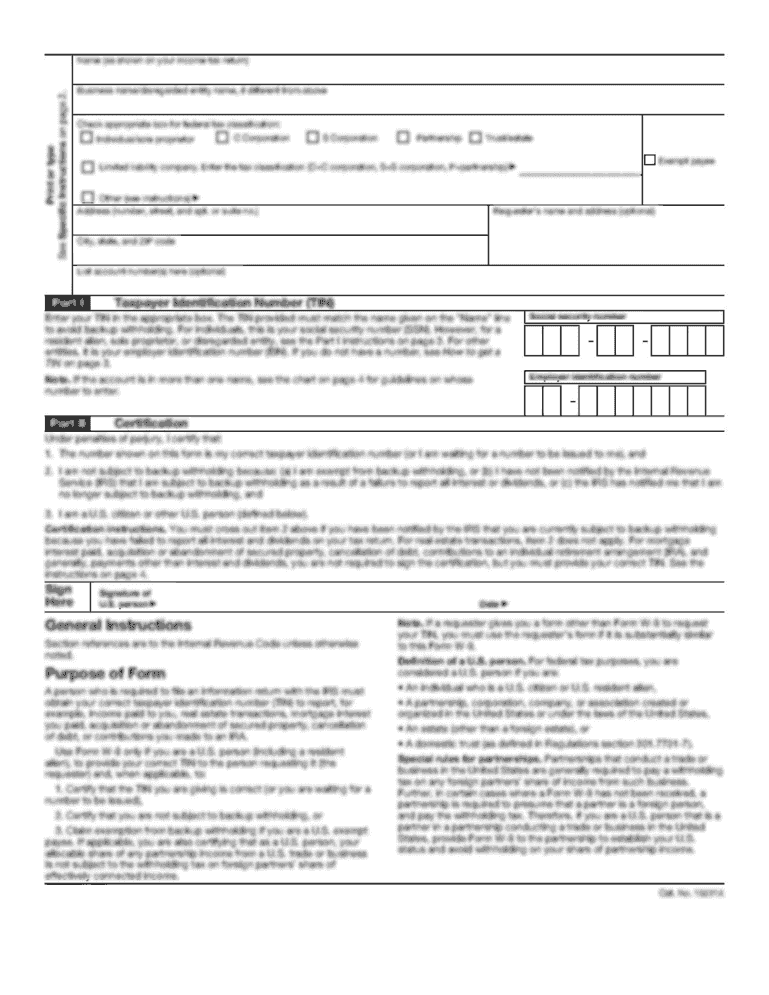

Userid PAGER/SGML Page 1 of 12 Fileid DTD INSTR04 Leadpct 0 Pt. size 9. RS c4jcb documents epicfiles 940 2007 I940 11-21-2007 approval.sgm Instructions for Form 940 Draft Ok to Print Init. What s New General Instructions Understanding Form 940 No credit reduction states. The U.S. Department of Labor DOL has announced that there are no credit reduction states for tax year 2007. Your FUTA tax will be higher if you do not pay the state unemployment...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 940 form and instructions

Edit your 940 form and instructions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 940 form and instructions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 940 form and instructions online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 940 form and instructions. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 940 form and instructions

Point by point instructions on how to fill out 940 form and instructions:

01

Obtain the necessary forms: You can download Form 940 from the official website of the Internal Revenue Service (IRS) or request a copy by calling their helpline.

02

Fill in your employer and business details: Provide your employer identification number (EIN), business name, address, and other relevant information as requested on the form.

03

Report your taxable wages: Enter the total amount of wages paid to employees during the year that are subject to federal unemployment tax (FUTA).

04

Determine your FUTA tax liability: Calculate the FUTA tax owed by multiplying the taxable wages by the current FUTA tax rate, which is subject to change.

05

Deduct any state unemployment taxes paid: If you have paid state unemployment taxes during the year, you can deduct this amount from your FUTA tax liability.

06

Determine if you qualify for any credits: Check if you qualify for any FUTA tax credits, such as the credit for amounts paid into a state unemployment fund.

07

Calculate your final FUTA tax liability: Subtract any applicable credits from your FUTA tax liability to determine the amount you owe.

08

Complete payment and filing information: Fill in the payment amount and indicate whether you are making an electronic payment or will send a check. Provide your contact information and sign the form.

09

Retain a copy for your records: Make a copy of the completed Form 940 and keep it with your tax records for future reference.

Who needs 940 form and instructions?

01

Employers subject to FUTA tax: The Form 940 is required to be filed by employers who paid wages of $1,500 or more to employees during any calendar quarter in the current or preceding year. It helps determine the amount of federal unemployment tax owed.

02

Employers of household employees: If you employed household workers and paid cash wages of $1,000 or more to a single employee in any calendar quarter of the current or preceding year, you may also need to file Form 940.

03

Agricultural employers: Agricultural employers should file Form 940 if they paid cash wages of $20,000 or more to farmworkers during the year or employed at least 10 farmworkers for some portion of a day in each of 20 or more different weeks during the year.

Note: It is advisable to consult the official instructions specific to your circumstances and seek professional advice if necessary.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 940 form and instructions to be eSigned by others?

940 form and instructions is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I make changes in 940 form and instructions?

With pdfFiller, the editing process is straightforward. Open your 940 form and instructions in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I fill out 940 form and instructions on an Android device?

Use the pdfFiller mobile app to complete your 940 form and instructions on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

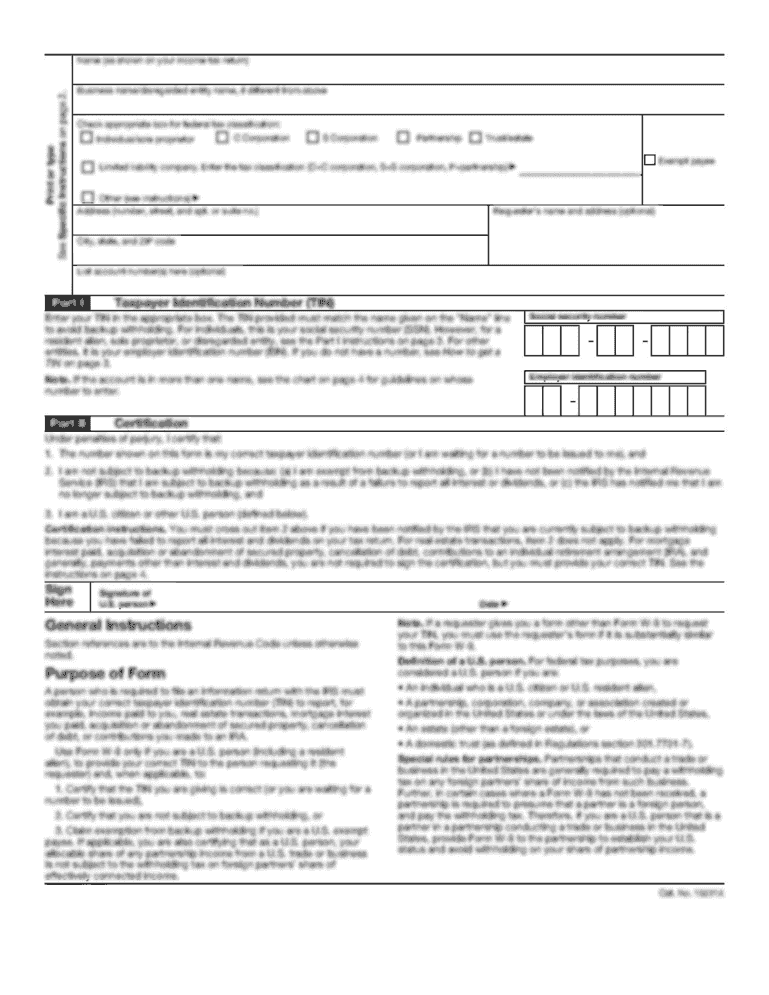

What is 940 form and instructions?

The 940 form, also known as the Employer's Annual Federal Unemployment (FUTA) Tax Return, is used by employers to report and pay their federal unemployment tax. The instructions provide detailed guidance on how to complete the form correctly.

Who is required to file 940 form and instructions?

Any employer who paid wages of $1,500 or more to employees during any quarter in the previous calendar year, or who had at least one employee working for a portion of a day in any 20 or more different weeks in the previous calendar year, must file Form 940.

How to fill out 940 form and instructions?

To fill out Form 940, employers must provide information such as their business name, address, and Employer Identification Number (EIN), along with details about their employees, wages paid, and any unemployment tax credits claimed. The instructions provide step-by-step guidance on how to complete each section of the form.

What is the purpose of 940 form and instructions?

The purpose of Form 940 is to report and pay the federal unemployment tax owed by the employer. The form helps ensure that employers contribute funds to the federal unemployment insurance program, which provides benefits to eligible unemployed workers.

What information must be reported on 940 form and instructions?

The 940 form requires employers to report their total payroll for the year, unemployment tax owed, tax credits claimed, and any payments made to state unemployment programs. Additionally, employers must provide details about their workforce, such as the number of employees and wages paid.

Fill out your 940 form and instructions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

940 Form And Instructions is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.