Get the free Formulario 2350(SP)

Show details

Este formulario se utiliza para solicitar una prórroga para presentar la declaración del impuesto sobre el ingreso para los ciudadanos estadounidenses y residentes extranjeros que residen en el

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign formulario 2350sp

Edit your formulario 2350sp form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your formulario 2350sp form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit formulario 2350sp online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit formulario 2350sp. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out formulario 2350sp

How to fill out Formulario 2350(SP)

01

Obtain a copy of Formulario 2350(SP) from the relevant authority or website.

02

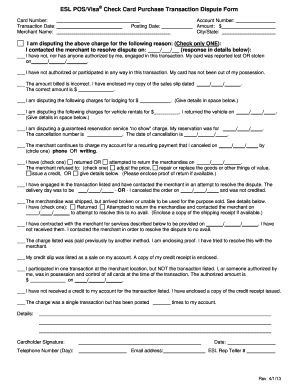

Start by entering your personal identification information, including your full name, address, and identification number at the top of the form.

03

Fill out any boxes that require information about your tax situation, including income sources and deductions.

04

Review the specific sections that apply to your situation, such as those for individuals or businesses.

05

Double-check all entries for accuracy and completeness.

06

Sign and date the form at the designated area.

07

Submit the completed form to the appropriate tax authority by mail or electronically, as instructed.

Who needs Formulario 2350(SP)?

01

Individuals or businesses needing to report specific income or deductions for tax purposes.

02

Taxpayers who are required to submit detailed financial information for compliance with local tax laws.

03

Those who have income from self-employment or other non-traditional sources.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between form 4868 and 2350?

Form 4868 and Form 2350 are both IRS forms used to request a filing extension. However, there are several key distinctions between them. Form 4868 is used to apply for a standard extension to October 15. Form 2350, on the other hand, is intended to help new expatriates qualify for the Foreign Earned Income Exclusion.

How much does the IRS charge for an extension?

There is no penalty for filing a tax extension.

What form is 2350?

About Form 2350, Application for Extension of Time to File U.S. Income Tax Return. Internal Revenue Service.

Who qualifies for the December 15 extension?

Use an Automatic Extension form to make a payment if both of the following apply: You cannot file your tax return by the original due date. You owe taxes for the current tax year.

What is form 2555 used for?

If you qualify, you can use Form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. You cannot exclude or deduct more than your foreign earned income for the year.

What is 2350 form used for?

Use Form 2350 to ask for an extension of time to file your tax return only if you expect to file Form 2555 and you need the time to meet either the bona fide residence test or the physical presence test to qualify for the foreign earned income exclusion and/or the foreign housing exclusion or deduction.

Is form 9325 required?

You're not required to provide Form 9325 along with the rest of the tax return, but some taxpayers may request this form to prove their returns have been e-filed and accepted by the IRS.

What is the paperwork for IRS extension?

You can get an automatic extension of time to file your tax return by filing Form 4868 electronically. You'll receive an electronic acknowledgment once you complete the transaction. Keep it with your records. Don't mail in Form 4868 if you file electronically, unless you're making a payment with a check or money order.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Formulario 2350(SP)?

Formulario 2350(SP) is a tax form used in Spain for the declaration of income and tax obligations of self-employed individuals and businesses.

Who is required to file Formulario 2350(SP)?

Self-employed individuals and businesses that generate income must file Formulario 2350(SP) in order to comply with their tax obligations in Spain.

How to fill out Formulario 2350(SP)?

To fill out Formulario 2350(SP), individuals need to provide their personal information, income details, deductions, and any applicable tax credits. It is important to follow the guidelines provided by the Spanish tax authority.

What is the purpose of Formulario 2350(SP)?

The purpose of Formulario 2350(SP) is to ensure that self-employed individuals and businesses report their income accurately and fulfill their tax obligations towards the Spanish government.

What information must be reported on Formulario 2350(SP)?

The information that must be reported on Formulario 2350(SP) includes personal identification details, total income earned, expenses incurred, applicable deductions, and any tax credits.

Fill out your formulario 2350sp online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Formulario 2350sp is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.