Get the free Form 706-GS(T)

Show details

Form 706-GS(T) is used by a trustee to figure and report the tax due from certain trust terminations that are subject to the generation-skipping transfer (GST) tax.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 706-gst

Edit your form 706-gst form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 706-gst form via URL. You can also download, print, or export forms to your preferred cloud storage service.

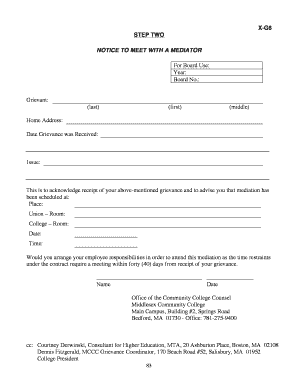

Editing form 706-gst online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 706-gst. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 706-gst

How to fill out Form 706-GS(T)

01

Obtain the Form 706-GS(T) from the IRS website or relevant tax office.

02

Read the form instructions carefully to understand the requirements.

03

Fill out the decedent's name and identifying information in Part 1.

04

Provide details of the property transmitted to heirs or beneficiaries in Part 2.

05

Calculate any applicable deductions or exemptions as outlined in the form.

06

Complete the estate tax computation in Part 3, if necessary.

07

Sign and date the form in the designated area.

08

Submit the completed form to the IRS as instructed.

Who needs Form 706-GS(T)?

01

Form 706-GS(T) is required for estates that consist of Generation-Skipping Transfers (GST).

02

Beneficiaries who receive property from a decedent who has made generation-skipping transfers.

03

Executors or administrators of estates that need to report GSTs.

Fill

form

: Try Risk Free

People Also Ask about

What is reported on form 706?

The executor of a decedent's estate uses Form 706 to figure the estate tax imposed by Chapter 11 of the Internal Revenue Code. Form 706 is also used to compute the generation-skipping transfer (GST) tax imposed by Chapter 13 on direct skips.

What is federal tax form Schedule G?

Schedule G is generally filed by non-profits and exempt organizations to report professional fundraising services, fundraising events, and gaming activities conducted for the tax year.

What is reported on Schedule G?

Schedule G (Form 990) is used by an organization that files Form 990 or Form 990-EZ to report professional fundraising services, fundraising events, and gaming.

When must form 706 GST be filed by a trustee for a trust that has a taxable termination?

In the case of a taxable termination with respect to which an election is made under section 2624(c) to value property in ance with section 2032, a Form 706GS(T) must be filed on or before the 15th day of the 4th month after the close of the calendar year in which the taxable termination occurred, or on or before

What triggers generation-skipping transfer tax?

What Triggers the Generation-Skipping Transfer Tax? The generation-skipping transfer tax is triggered when a person gifts another person an asset but skips a generation in doing so.

What is form 706 GST?

(Rev. November 2021) Generation-Skipping Transfer Tax Return for Terminations. Department of the Treasury.

What goes on schedule G of 706?

Real estate that is included in the gross estate under section 2035, 2036, 2037, or 2038 should be shown on Schedule G. Real estate that is included in the gross estate under section 2041 should be shown on Schedule H. If you elect section 2032A valuation, you must complete Schedule A and Schedule A-1.

What is reported on form 706 schedule G?

The following transfers should be reported on Schedule G: Gift taxes paid on gifts made by the decedent or the decedent's spouse within three years before death. Transfer of life insurance policies made within three years before death.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 706-GS(T)?

Form 706-GS(T) is the United States Estate (and Generation-Skipping Transfer) Tax Return for qualified domestic trusts that receive benefits from a decedent's estate.

Who is required to file Form 706-GS(T)?

Form 706-GS(T) must be filed by the executor of an estate that is subject to estate tax and has qualified domestic trusts as beneficiaries or for those who are handling the distributions from the trust.

How to fill out Form 706-GS(T)?

To fill out Form 706-GS(T), you will need to provide information regarding the decedent, the trust's assets, the beneficiaries, and the calculations for the estate tax as well as any applicable deductions.

What is the purpose of Form 706-GS(T)?

The purpose of Form 706-GS(T) is to report generation-skipping transfers and to calculate the estate and generation-skipping transfer tax when a qualified domestic trust is involved.

What information must be reported on Form 706-GS(T)?

Information that must be reported includes the trust's identifying details, asset valuations, distributions made to beneficiaries, and any relevant deductions or credits related to the estate tax.

Fill out your form 706-gst online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 706-Gst is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.