IRS 56-F 1991 free printable template

Show details

Form

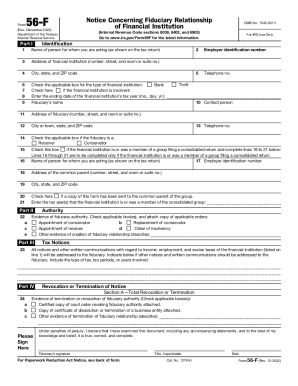

56-F

Identification

(November 1991)

Department of the Treasury Internal Revenue Service

Notice Concerning Fiduciary Relationship of Financial Institution

Part I

1 3 4

Name of financial institution

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 56-F

Edit your IRS 56-F form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 56-F form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 56-F Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 56-F

How to fill out IRS 56-F

01

Obtain IRS Form 56-F from the IRS website or through a local tax office.

02

Fill in your name and contact information at the top of the form.

03

Provide your Social Security Number or Employer Identification Number.

04

Enter the name and address of the person for whom you are filing the form.

05

Specify the type of tax matters for which you are appointing a representative.

06

Identify the individual or entity you are appointing as your representative.

07

Sign and date the form to confirm your appointment.

Who needs IRS 56-F?

01

Individuals who need to appoint a representative for tax matters with the IRS.

02

Taxpayers who are unable to handle their own tax affairs.

Fill

form

: Try Risk Free

People Also Ask about

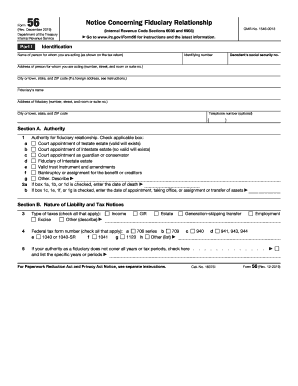

What is the difference between form 56 and form 56f?

Form 56-F should be filed instead of Form 56, Notice Concerning Fiduciary Relationship, by the federal agency acting as a fiduciary (defined below) in order to notify the IRS of the creation, termination, or change in status of a fiduciary relationship with a financial institution. Fiduciary.

Where do I file form 56f?

File Form 56 at Internal Revenue Service Center where the person for whom you are acting is required to file tax returns. If you wish to receive tax notices for more than one form and one of the forms is Form 1040, file Form 56 with the IRS center where the person for whom you are acting is required to file Form 1040.

What is the filing form 56?

File Form 56 at Internal Revenue Service Center where the person for whom you are acting is required to file tax returns. If you wish to receive tax notices for more than one form and one of the forms is Form 1040, file Form 56 with the IRS center where the person for whom you are acting is required to file Form 1040.

What is a 56f form?

Use this form to notify the IRS of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift).

Who needs to file form 56?

An individual or entity that is willing to accept fiduciary responsibility for tax matters must file an IRS Form 56, Notice Concerning Fiduciary Relationship to be able to act as the taxpayer with the IRS.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is IRS 56-F?

IRS 56-F is a form used by the Internal Revenue Service that relates to the filing of information concerning certain tax matters, particularly for foreign entities or individuals.

Who is required to file IRS 56-F?

Entities or individuals who engage in specific transactions or forms of income that require reporting to the IRS must file IRS 56-F.

How to fill out IRS 56-F?

To fill out IRS 56-F, taxpayers must provide their identifying information, details of the transaction or income, and any relevant supporting documentation as outlined in the form instructions.

What is the purpose of IRS 56-F?

The purpose of IRS 56-F is to ensure proper reporting of income or transactions that may affect tax obligations, particularly for foreign entities or individuals.

What information must be reported on IRS 56-F?

IRS 56-F requires the reporting of identifying information, transaction details, nature of the income, and any applicable disclosures related to foreign income or entities.

Fill out your IRS 56-F online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 56-F is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.