Get the free Form 211(SP)

Show details

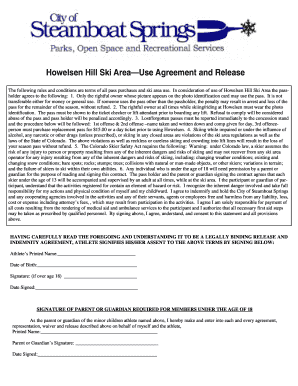

Este formulario permite a los reclamantes solicitar una recompensa por proporcionar información original que conduzca a la detección de violaciones a las leyes de impuestos internos de los Estados

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 211sp

Edit your form 211sp form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 211sp form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 211sp online

To use the professional PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form 211sp. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 211sp

How to fill out Form 211(SP)

01

Obtain Form 211(SP) from the relevant authority or download it from the official website.

02

Fill in your personal information in the designated sections, including your name, address, and contact details.

03

Indicate the specific purpose for which you are requesting the information or assistance.

04

Provide any required identification numbers, such as Social Security Number or Tax Identification Number.

05

Complete any additional sections that pertain to your particular circumstances or needs.

06

Review the form for accuracy and completeness.

07

Sign and date the form at the bottom.

08

Submit the form as directed, either electronically or via mail.

Who needs Form 211(SP)?

01

Individuals or organizations seeking to request specific information or assistance from the relevant agency may need Form 211(SP).

02

Applicants who require verification or documentation for legal or professional purposes may also require this form.

Fill

form

: Try Risk Free

People Also Ask about

What is a W 4 SP form?

A W-4 is the IRS document that you complete for your employer to determine how much should be withheld from your paycheck for federal income taxes.

Who is required to fill out a W9 form?

Who is required to fill out a W-9? Independent contractors, gig workers, freelancers and anyone else who is paid outside an employer/employee relationship might have to fill out a W-9 form.

What is the purpose of the Form 211?

Whistleblowers seeking to claim an award for reporting tax evasion to the U.S. government must use Internal Revenue Service (IRS) Form 211, “Application for Award for Original Information.” If the IRS can recover funds based on a whistleblower's claim, the tax whistleblower will receive a percentage of these funds.

What is a 211 form used for?

Submit a whistleblower claim Individuals must use IRS Form 211, Application for Award for Original Information PDF, and ensure that it contains the following: A description of the alleged tax noncompliance, including a written narrative explaining the issue(s).

What is a 1099 form used for?

A 1099 form reports income from self-employment, freelance work, investment, or other non-employee sources. A W-2 form reports wages, salaries, and taxes withheld for employees by their employer. Learn more about the difference between 1099 and W-2 forms.

What is a W 9 SP form?

Use Form W-9 to provide your correct Taxpayer Identification Number (TIN) to the person who is required to file an information return with the IRS to report, for example: Income paid to you. Real estate transactions.

How long does Form 211 take to process?

Once a company is reporting, it is eligible to have a market maker file a Form 211 with FINRA. The 211 must be approved by FINRA, which normally takes three to six months before the company can trade its stock on the OTC Markets.

Why would someone need a W9?

IRS Form W-9 is used to gather taxpayer information from a vendor, contractor, or other non-employee that a business is working with. Compensation paid to non-employees must be reported to the IRS if it meets four requirements: A payment (or payments) was made to someone who is not an employee.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 211(SP)?

Form 211(SP) is a form used by individuals to report information related to an actionable claim or plea, typically in contexts like financial reporting or compliance.

Who is required to file Form 211(SP)?

Individuals or entities that are involved in certain financial activities or transactions that require reporting due to regulatory requirements must file Form 211(SP).

How to fill out Form 211(SP)?

To fill out Form 211(SP), provide detailed information as required in each section of the form, ensuring all fields are accurately completed and any necessary documentation is attached.

What is the purpose of Form 211(SP)?

The purpose of Form 211(SP) is to gather essential information for regulatory compliance and to facilitate the review and processing of claims or disclosures related to financial activities.

What information must be reported on Form 211(SP)?

Form 211(SP) requires information such as personal identification details, descriptions of the financial activities involved, dates of transactions, and any related documentation supporting the claims.

Fill out your form 211sp online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 211sp is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.