IRS W-8 1992-2025 free printable template

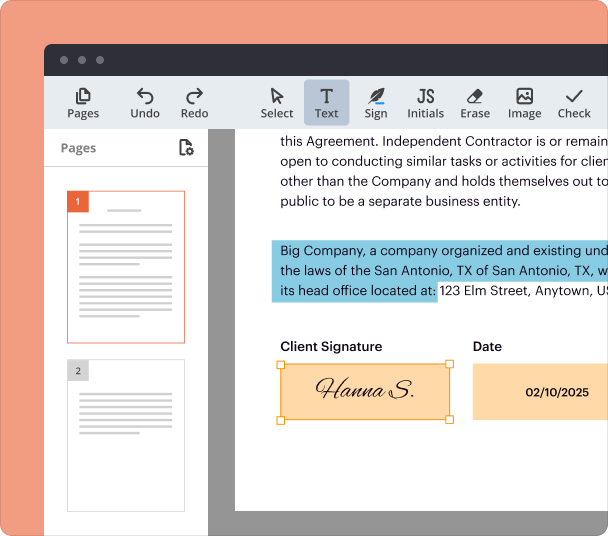

Fill out, sign, and share forms from a single PDF platform

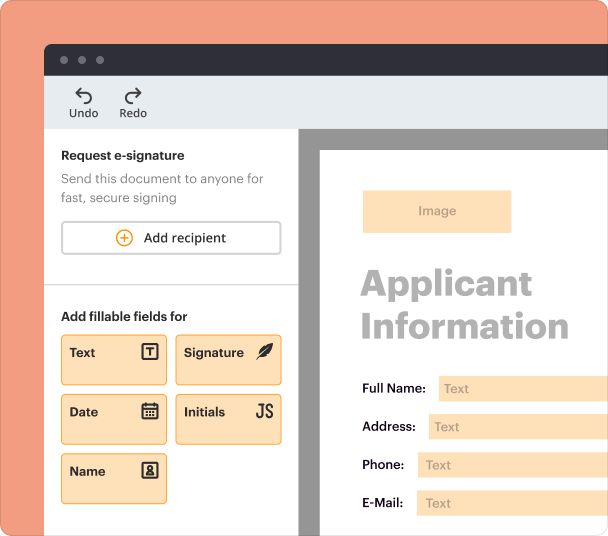

Edit and sign in one place

Create professional forms

Simplify data collection

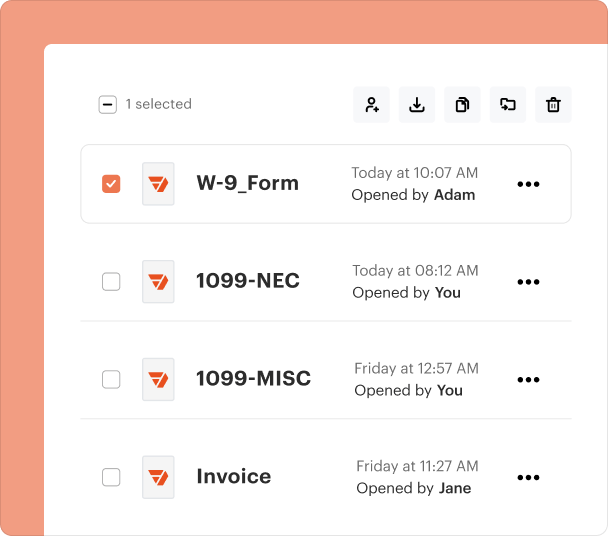

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

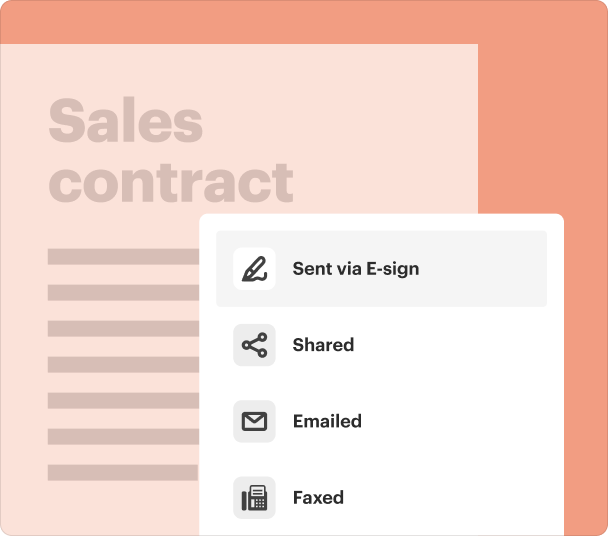

End-to-end document management

Accessible from anywhere

Secure and compliant

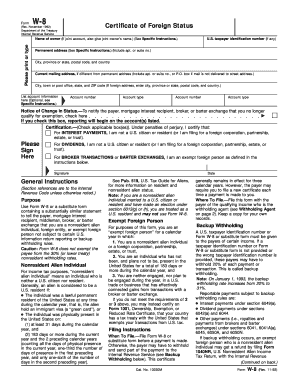

Understanding the IRS W-8 Form for

What is the IRS W-8 Form?

The IRS W-8 form is a tax document designed for non-U.S. persons to certify their foreign status for withholding tax purposes. It is utilized by foreign individuals and entities to inform U.S. payers that they are not subject to U.S. tax withholding on certain types of income. The W-8 form, specifically for the years , requires fill-out for various income types, including dividends, interest, and royalties.

Key Features of the IRS W-8 Form

The W-8 form has several key features:

-

To certify foreign status for withholding exemptions.

-

Contains sections for providing identification and tax information.

-

Requires a signature certifying the accuracy of the provided information.

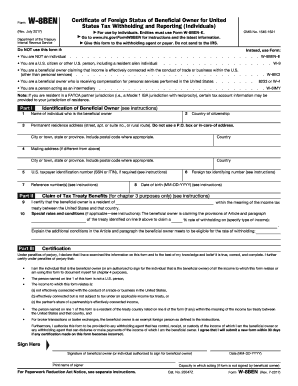

When to Use the IRS W-8 Form

The W-8 form should be used when a foreign entity or individual receives income from U.S. sources and is claiming exemption from U.S. tax withholding. Specific instances include receiving payments for services rendered, dividends, or when engaging in broker transactions. Completing this form accurately is essential for ensuring compliance with tax laws and avoiding unnecessary withholding.

How to Fill the IRS W-8 Form

Filling out the W-8 form involves providing personal and tax information. Key steps include:

-

Fill in your name, address, and tax identification number, if applicable.

-

Indicate the type of income for which you're claiming exemption.

-

Sign and date to certify that the information provided is correct.

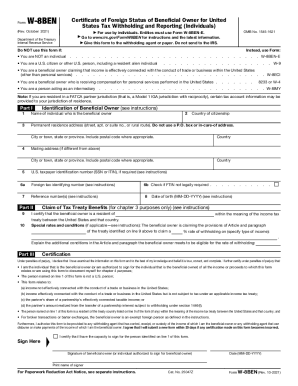

Common Errors to Avoid

When completing the W-8 form, be mindful of common mistakes that could delay processing or result in incorrect tax withholding. These include:

-

Ensure all sections are filled out completely, as missing data can lead to processing issues.

-

Verify that the person signing the form is authorized to do so.

-

Use the correct version of the W-8 form for your specific year of filing.

Frequently Asked Questions about blank w8 form

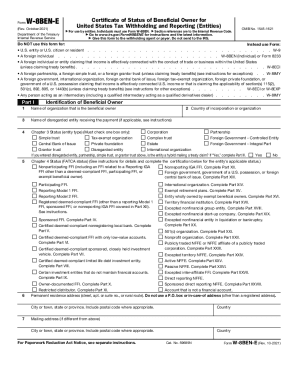

Who needs to fill out the IRS W-8 form?

The IRS W-8 form is required for non-U.S. citizens and entities receiving income from U.S. sources who wish to claim a reduced withholding rate or exempt status.

What documents are required to accompany the W-8?

While the W-8 form itself does not require additional documents at the time of submission, it is advisable to keep supporting documentation, such as proof of foreign status, readily available.

pdfFiller scores top ratings on review platforms