Get the free Form 656-A

Show details

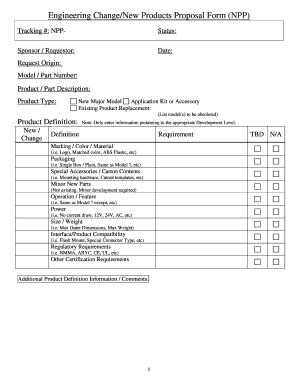

This form is for individual taxpayers who are not required to submit the fee for an offer in compromise based on their income level. It includes sections for personal information, signature certification,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 656-a

Edit your form 656-a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 656-a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 656-a online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form 656-a. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 656-a

How to fill out Form 656-A

01

Obtain Form 656-A from the USCIS website or your local USCIS office.

02

Fill out the applicant's information in the appropriate sections, including name, address, and case number.

03

Indicate the type of request you are making using the checkboxes provided.

04

Review the instructions for any specific eligibility criteria that must be met.

05

Prepare any required supporting documents that need to accompany the form.

06

Sign and date the form where indicated.

07

Submit the completed form and any supporting documents to the appropriate USCIS address.

Who needs Form 656-A?

01

Individuals seeking to apply for a waiver of certain inadmissibility grounds.

02

Those who have received a notice from USCIS indicating they need to submit Form 656-A.

03

Applicants participating in the U.S. immigration process who require consideration for a waiver.

Fill

form

: Try Risk Free

People Also Ask about

What is the 5 year rule for offer in compromise?

You must remain in compliance with filing and payment of all tax returns for a period of five years from the date the offer in compromise is accepted, including any extensions.

How much is the fee for form 656?

Form 656(s) – you must submit individual and business tax debt (Corporation/ LLC/ Partnership) on separate Forms 656. $205 application fee (non-refundable). Initial payment (non-refundable) for each Form 656.

What is the downside of offer in compromise?

The cons include: With this method, you are able to reduce what you owe. However, you also surrender your right to tax credits that you may have access to each year. This could mean your tax return could be lowered each year going forward. OIC does create a public record.

What is a 656 form from the IRS?

Use Form 656 when applying for an offer in compromise (OIC), which is an agreement between you and the IRS that settles your tax liabilities for less than the full amount that you owe.

Does an Offer in Compromise hurt your credit?

An Offer in Compromise (OIC) does not directly impact your credit score, as the IRS does not report OICs to credit bureaus. However, the related processes, such as federal tax liens filed for unpaid taxes, can indirectly affect your credit. Tax liens, which are public records, can significantly lower your score.

Who qualifies for back tax forgiveness?

Qualifications for Tax Relief The IRS ultimately determines whether you qualify for debt forgiveness. However, the agency generally considers taxpayers who meet these criteria: a total tax debt balance of $50,000 or less, and a total income below $100,000 for individuals (or $200,000 for married couples).

What percentage will the IRS accept for offer in compromise?

Lump sum: Submit an initial payment of 20% of the total offer amount with your application. If we accept your offer, you'll receive written confirmation.

How much does the IRS usually settle for?

You want to eliminate the outstanding tax debt as much as possible. Luckily, there are options for you to consider. “How much will the IRS usually settle for?” For a short answer, the IRS usually settles for whatever amount is feasible for a taxpayer to pay back.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 656-A?

Form 656-A is an application used by individuals who seek to request an Offer in Compromise (OIC) with the IRS, allowing them to settle their tax debt for less than the full amount owed.

Who is required to file Form 656-A?

Individuals or entities that owe federal tax liabilities and wish to negotiate a reduced amount for their tax debt are required to file Form 656-A when submitting an Offer in Compromise.

How to fill out Form 656-A?

To fill out Form 656-A, applicants must provide personal information such as their name, Social Security number, and the details of their tax liabilities. Specific sections require information regarding their financial situation, including income, expenses, and assets, in order to evaluate the offer.

What is the purpose of Form 656-A?

The purpose of Form 656-A is to provide a structured request for taxpayers to propose an Offer in Compromise to the IRS, allowing them to resolve their tax debts under more manageable terms.

What information must be reported on Form 656-A?

Form 656-A requires reporting information such as taxpayer identification details, tax liability amounts, financial details including income and expenses, and the offer amount which is the proposed settlement for the tax debt.

Fill out your form 656-a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 656-A is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.